After a lengthy hiatus, Ethereum (ETH) has once again climbed above the $2,830 level, and the price increase is ongoing. Alongside the rise of BTC, there are several factors supporting the price increase of Ether. We had previously written independent assessments on why the ETH price potential is high for the year 2024, but now let’s take a look at the outlook for February and March.

Ethereum February Predictions

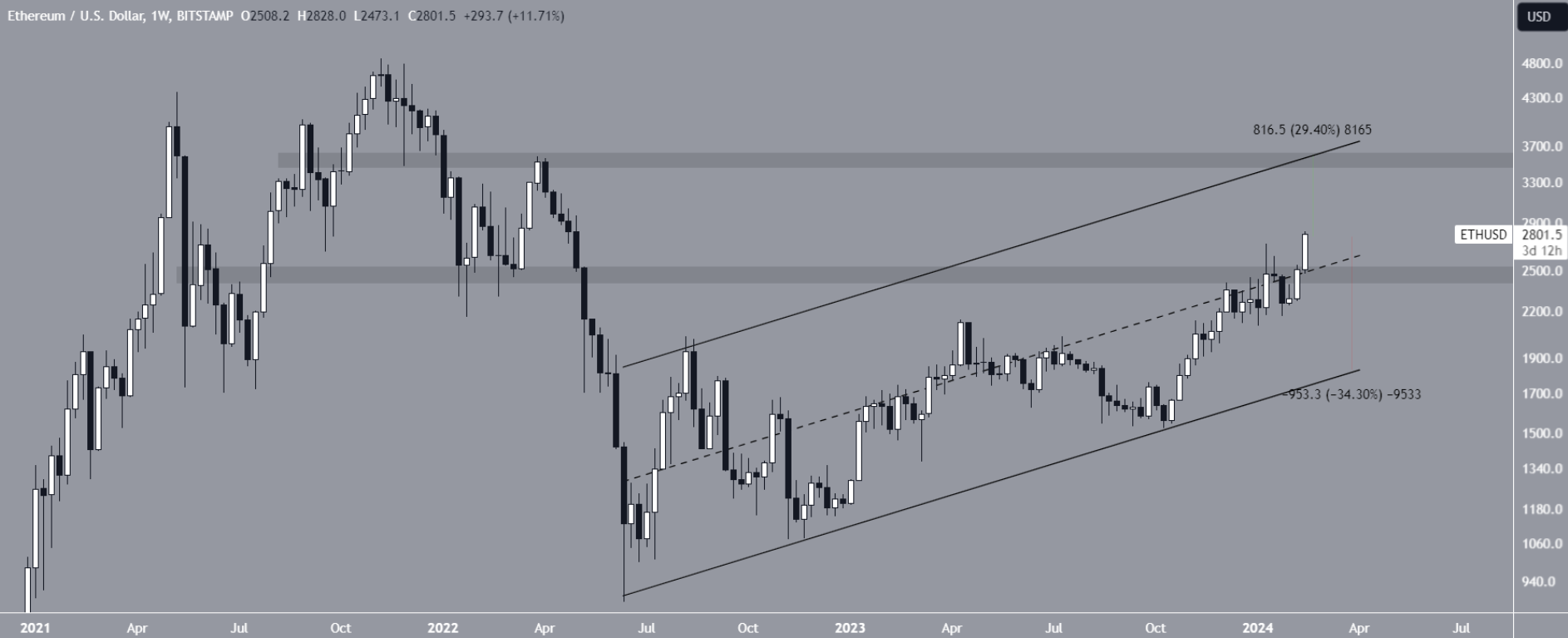

The price of Ether, the largest altcoin by market value, has been experiencing a gradual increase since June 2022. On the weekly chart, the price has moved significantly away from the bottom region of the range since the March 2023 low. In January 2024, ETH climbed to a peak of $2,717 but then retreated due to subsequent profit-taking.

Now it has set a new peak for the year 2024 at $2,867. The price has formed three large upward candles in the last four days. The RSI is significantly above the neutral zone, and the demand increase is strong along with the price. This suggests that the rise could lead to an even larger peak.

The cryptocurrency analyst known by the pseudonym Zsuirad Nezrok recently stated that the ETH price could reach $3,000 before the end of the month. Indeed, the current outlook suggests that this is more possible than it was yesterday.

Noblecoins is also hoping for a satisfactory recovery in altcoins along with the ETH price.

“ETH just passed $2,800, it’s time to see some of your favorite tangible things. We may be heading to a place where altcoins experience parabolic rises. Hope you are prepared.”

Vella Crypto‘s target is $3,400.

How Much Will ETH Be Worth?

ETH price has once again surpassed a key region that has been a strong resistance since May 2021. This breakout, considered with the current price, is likely to be confirmed with the weekly close. If we want to see a parabolic rise, the price needs to close at high levels close to its current price.

Having surpassed the middle line of the parallel channel that started in June 2022, if ETH price is to target the resistance level (which is a reasonable scenario given the momentum), it needs to test $3,600.

However, if we see closes below $2,500, a sharp correction could bring the price down to $1,800.

As a bonus, the above ETHBTC chart suggests that if the $0.054 region is maintained, it could target levels of $0.0559 and between $0.058 and $0.06 again. It reached the last target in January, and if it does the same again (with BTC at $52,000), ETH price would need to exceed $3,100.

Türkçe

Türkçe Español

Español