Ethereum, saw an increase of over 2% in the last 24 hours, reaching $3,865 on June 6. The rise in the altcoin market reflects the broader crypto market, which increased by approximately 1.50% in the same period. Today, the main factors driving Ethereum’s price up include the depletion of Ethereum reserves on all crypto exchanges and the increase in institutional inflows into Ethereum-focused investment funds.

Why is Ethereum Rising?

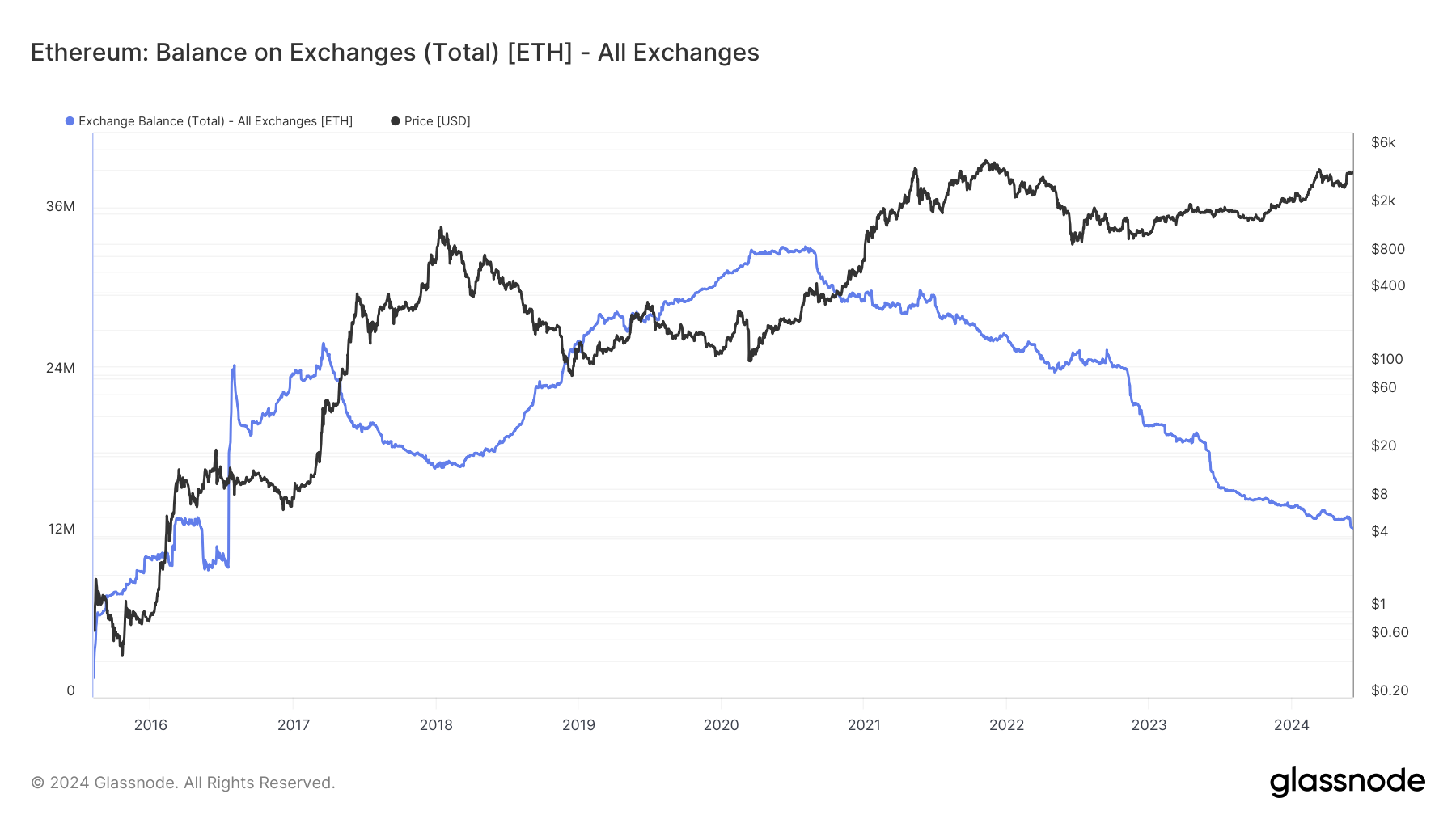

A significant trend among Ethereum investors is the increasing withdrawal of Ethereum from exchanges, indicating growing investor sentiment.

Glassnode’s data shows that as of June 5, Ethereum reserves on all exchanges were just over 12.59 million Ethereum, the lowest level since July 2016. Historical data reveals a direct correlation between declining exchange balances and rising Ethereum prices.

This indicates that investors are holding or staking their assets for longer periods, reducing the circulating supply and increasing the price potential. As of June 6, Ethereum’s annual supply growth rate has been -0.71% since the introduction of the transaction fee burning feature in 2021.

Additionally, the Ethereum ecosystem has seen nearly ninefold growth in daily active users over the past four years. This data shows that Ethereum, Arbitrum, and Polygon had more than 250,000 daily active users on average in the first quarter of 2020, highlighting strong adoption and further supportive price potential.

Notable Data for Ethereum

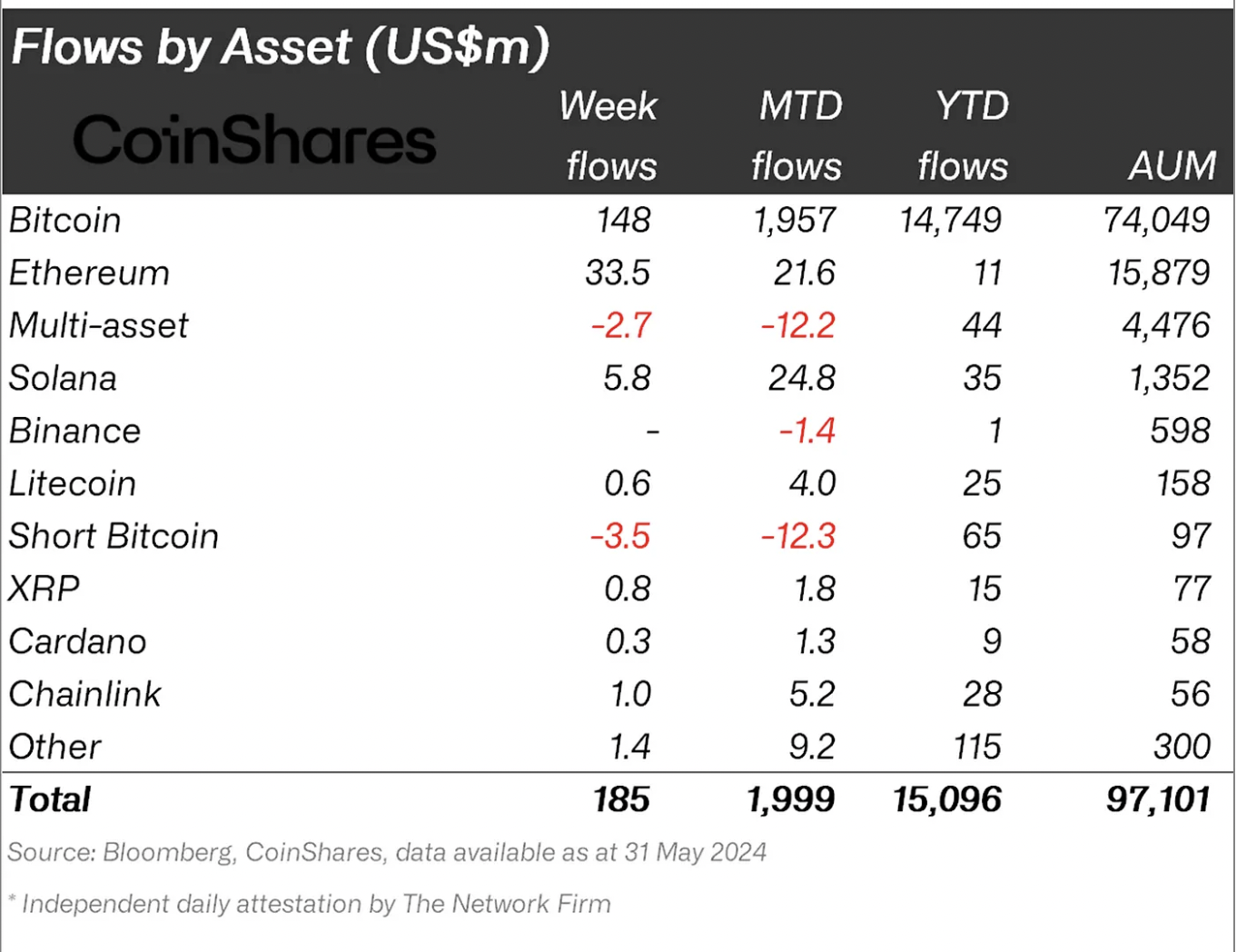

Ethereum experienced inflows for the second consecutive week following the approval of spot-based Ethereum ETF applications by the U.S. Securities and Exchange Commission (SEC). According to CoinShares’ latest weekly report, these Ethereum funds attracted $33.5 million in the week ending May 31.

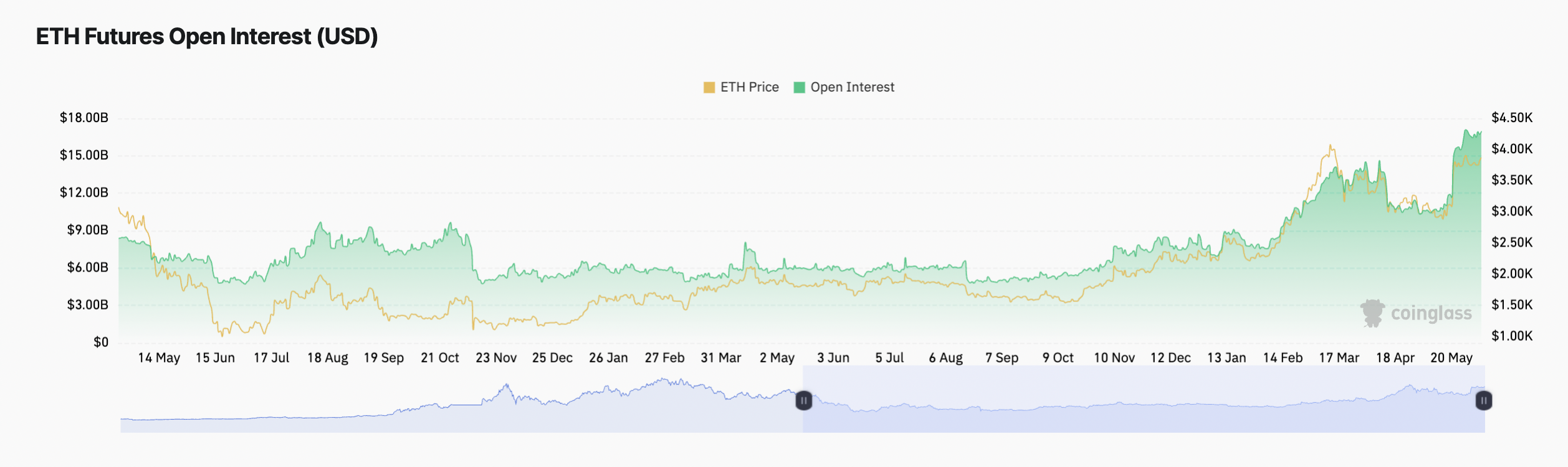

This marks a significant shift in investor sentiment, reversing a 10-week total outflow of $200 million and increasing Ethereum’s upward expectations in the days leading up to the potential Ethereum ETF launch. Today’s price increases on the Ethereum front coincide with high open interest and funding rates.

Notably, the SEC’s approval of spot Ethereum ETF applications followed a sharp increase in the number of pending futures contracts, rising from $14.68 billion on May 21 to $16.97 billion on June 6. During this period, the best-performing Ethereum OI was around $17.09 billion.

Türkçe

Türkçe Español

Español