The world’s second-largest cryptocurrency, Ethereum (ETH), has regained much of the ground it lost since dropping to a monthly low of $3,000 in March. The price of Ethereum (ETH) is trading at $3,615, up 2.5%, with a market capitalization of $433 billion.

Ethereum Address Numbers

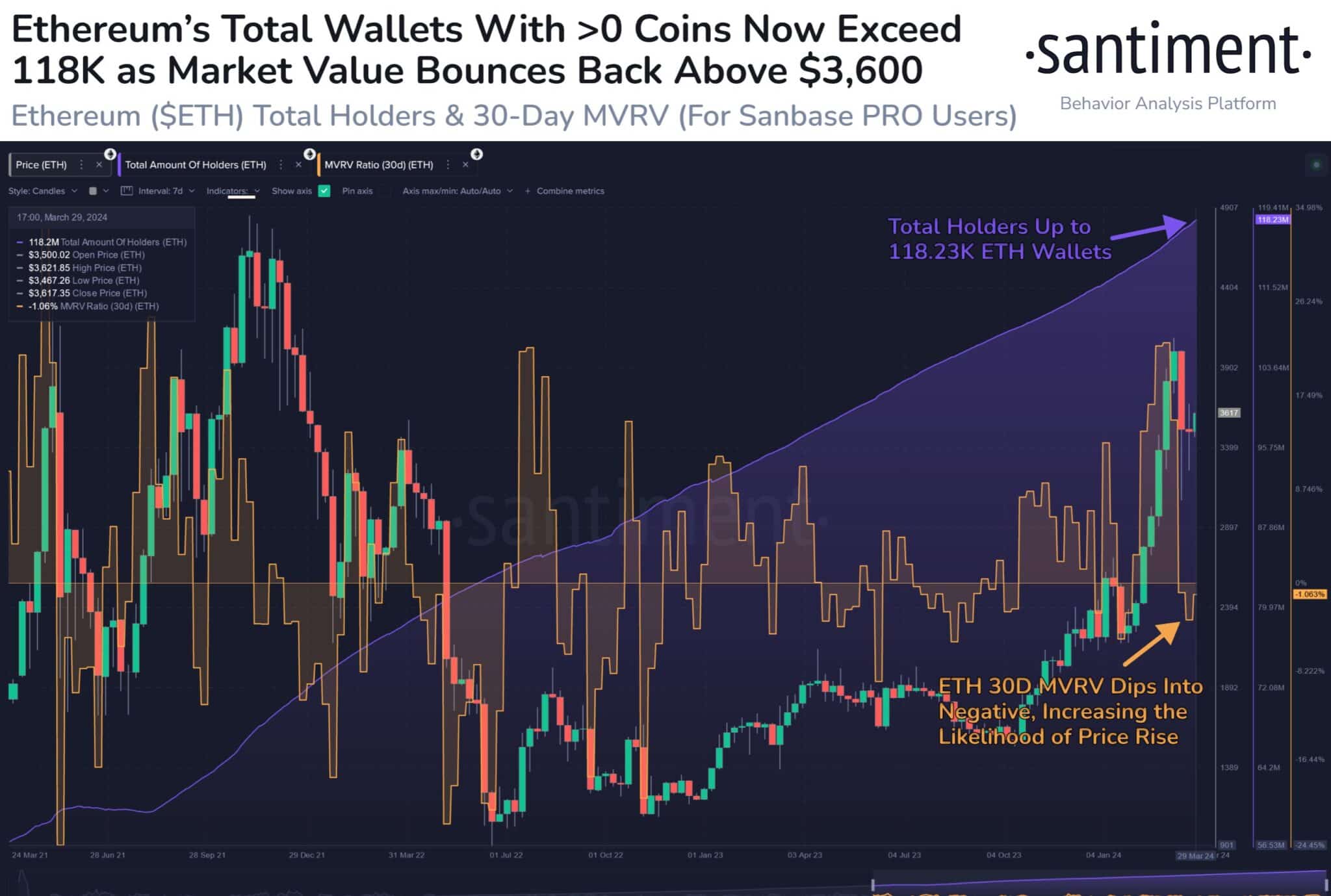

Cryptocurrency analytics firm Santiment highlighted the significant recovery in Ethereum’s price over the past weekend. This recovery followed a notable 25% drop between March 11 and 19. Notably, the number of Ethereum addresses holding the cryptocurrency reached an all-time high of 118,230, indicating increased investor participation.

Additionally, the mid-term market value to realized value (MVRV) ratio shows a slight uptick, signaling potential positive market sentiment. Ethereum whale transactions have also increased over the past week, further suggesting a continuation of the upward price movement. Another bullish indicator is the large portion of Ethereum supply leaving exchanges, with ETH exchange reserves reaching new lows.

ETH Trend Line

Ethereum continues to maintain its position above the $3,550 level, supported by the 100-hour simple moving average. A significant bullish trend line is also forming on the ETH/USD hourly chart around a support level of $3,550. This trend line closely aligns with the 61.8% Fibonacci retracement level calculated from the recent rise between the lowest level of $3,491 and the highest level of $3,654.

However, resistance near the $3,630 level is expected, followed by a more significant barrier around $3,650. Further upward momentum could push Ethereum towards a crucial level at $3,680, where it may encounter resistance. If this resistance is breached, Ethereum could target the $3,880 resistance level. A sustainable upward trend could even drive the price towards the significant milestone of $4,000.