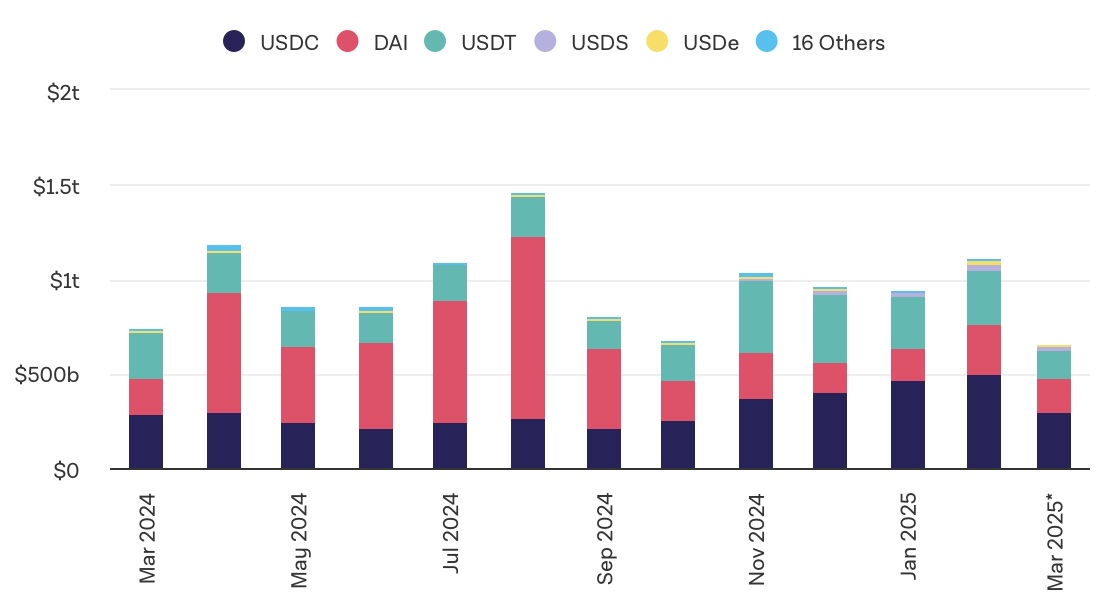

As the cryptocurrency market continues to experience significant price fluctuations, the stablecoin activity circulating on the Ethereum (ETH)  $2,484 network maintains steady growth. Over the past four months, the on-chain volume of stablecoins has averaged around $800 billion per month. USD Coin (USDC) and Tether (USDT) accounted for $740 billion of the $850 billion stablecoin volume reported in February. Recent data indicates that there is $35 billion worth of USDC and $67 billion worth of USDT on the Ethereum network, reinforcing Ethereum’s position as the primary platform for stablecoin transfers.

$2,484 network maintains steady growth. Over the past four months, the on-chain volume of stablecoins has averaged around $800 billion per month. USD Coin (USDC) and Tether (USDT) accounted for $740 billion of the $850 billion stablecoin volume reported in February. Recent data indicates that there is $35 billion worth of USDC and $67 billion worth of USDT on the Ethereum network, reinforcing Ethereum’s position as the primary platform for stablecoin transfers.

Why Are Stablecoins So Popular?

Stablecoins hold a significant place in the cryptocurrency market due to their clear use cases. They are favored for the solutions they provide in everyday life and financial systems. By enabling transfers around the clock, they facilitate transactions independent of bank hours. Cross-border money transfers using stablecoins are also much cheaper compared to traditional methods. Additionally, their integration into smart contracts allows for programmable payments, increasing financial inclusivity for unbanked populations.

These advantages make stablecoins an indispensable element of the cryptocurrency ecosystem. Ethereum’s leading position can be attributed to its advanced infrastructure and widespread acceptance.

The U.S. Takes Action on the Stablecoin Market

Despite facing regulatory uncertainties, the stablecoin ecosystem in the U.S. is moving toward clarity. The U.S. government is advancing a new legislative proposal to establish a framework for stablecoin issuers.

These regulations could provide a more secure legal framework for U.S.-based stablecoin projects like Circle (USDC), Paxos (USDP), and PayPal (PYUSD). If passed, the proposed legislation is expected to lead to greater adoption of the stablecoin market by institutional investors.

All these developments are among the factors further enhancing the long-term potential of stablecoins in the cryptocurrency market.

What is a Stablecoin?

A stablecoin is a cryptocurrency pegged to a specific asset’s value. They are typically backed by reserves like the U.S. dollar, Euro, or gold. Due to their ability to provide financial stability, they are widely used in the cryptocurrency market, with USDT and USDC being the most popular stablecoins.

Türkçe

Türkçe Español

Español