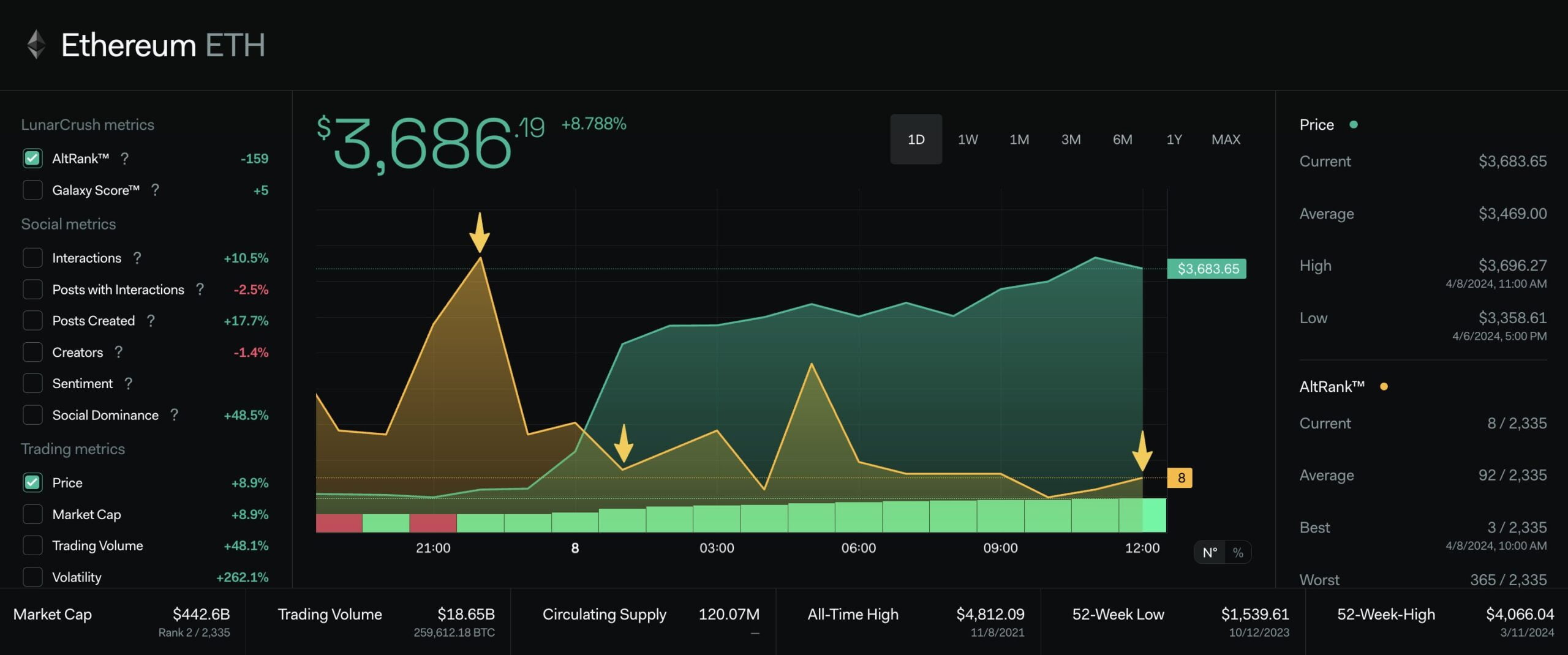

Ethereum (ETH) kicked off the week with an 8% increase, buoyed by growing social awareness and optimism among investors, marking a significant rally. According to data from the crypto data and price platform CoinGecko, ETH’s price has seen a notable increase in the last 24 hours, reaching an intraday high of $3,722. With this surge, ETH has outperformed Bitcoin (BTC) and many other major altcoins.

High Investor Interest

The recent price movement brings ETH to its highest level since March 16, about three weeks ago. Despite this latest fluctuation, ETH is trading approximately 9% below its 2024 peak of $4,070 and 24% below its all-time high of $4,878 recorded in 2021. In contrast, Bitcoin‘s price saw a smaller 3% increase during the same period and is trading at $70,753 at the time of writing.

The momentum behind the price increase of the altcoin king is based on various factors, including strong social and market activity, as highlighted by the social intelligence firm Lunar Crush. According to the company’s analysis, social activity surrounding Ethereum continues to trend significantly upward, along with strong price movement and high trading volume.

Furthermore, ETH shows signs of a bullish trend for the remainder of the month, supported by signals from derivative markets. Data from the futures exchange Deribit indicates high open interest (OI) at significant strike prices, including $4,000, $3,700, and $5,000, suggesting optimism among investors regarding ETH’s price outlook.

The on-chain analysis firm Santiment recently reported a notable increase in the performance of ERC-20 altcoins, with these assets outperforming the average of the broader crypto market. According to the data, there has been an 8.1% growth in ERC-20 altcoins over the last 7 days, indicating rising investor interest in Ethereum-based altcoins.

Famous Figure Issues Downturn Warning

However, not all market participants are on the bullish side. Figures like crypto writer and educator Vijay Boyapati warn against excessive optimism fueled by expectations of spot ETF approvals in the US for Ethereum.

Boyapati emphasizes that if the anticipated ETFs are not approved as expected and are rejected, the capital flow to the altcoin king could reverse back to Bitcoin.

Türkçe

Türkçe Español

Español