Ethereum (ETH) experienced a sharp decline in fee revenue this week, indicating a decrease in network traffic and user participation. According to the on-chain analysis firm IntoTheBlock, Ethereum validators collected a total of $116 million in fees over the week, representing a significant decrease of 41.2%.

Investor Interest in Meme Tokens Wanes

The collapse in cryptocurrency occurred following a decrease in meme token transactions on the network, a domain historically dominated by Ethereum. Transaction volumes for leading Ethereum-based cryptocurrencies such as Pepe (PEPE), Shiba Inu (SHIB), and Floki Inu (FLOKI) decreased significantly throughout the week.

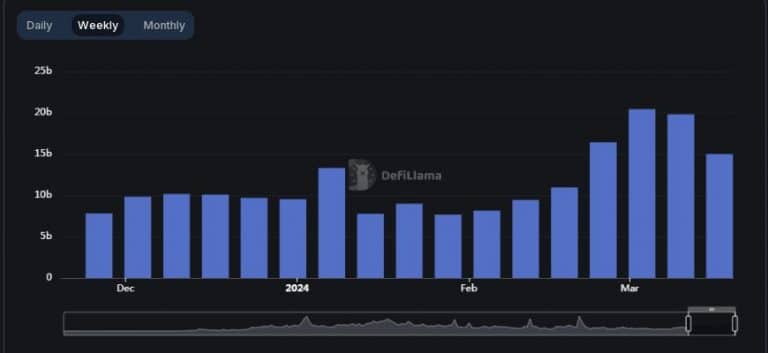

According to data from analytics firm Santiment, this happened after a period of high demand in the first half of the month. The ongoing meme token frenzy, which excited the markets, also reflected in the decreased trading volumes on Ethereum-based decentralized exchanges (DEX), commonly used by cryptocurrency entities for token trading. An analysis related to DeFiLlama data suggests that Ethereum DEXs achieved just over $15 billion in volumes during the week, which could indicate a 25% decrease compared to the previous week. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Transaction Fees on Solana

The decline occurred as investors shifted their meme token enthusiasm towards the Solana (SOL) blockchain. Solana’s total DEX volume increased by 3% over the week. The creation of new meme tokens on the network throughout the week attracted more users and, consequently, more revenue. Solana offered a faster and cheaper alternative compared to Ethereum.

The average transaction fee paid by Solana users in the last 24 hours was $0.027, based on SOL’s market value at the time of writing. On the other hand, Ethereum charged an average of $1.19 to validate a transaction. The decrease in on-chain traffic could mean fewer native ETH tokens being moved and, therefore, a decrease in demand. According to the website 21milyon.com, this partially contributed to a 5% decrease in its value over the week.

Türkçe

Türkçe Español

Español