In the last four days, Ethereum (ETH) has achieved significant double-digit gains, leading to a substantial impact on the liquidation volume. Ethereum’s daily time frame analysis indicated a significant increase, marking the second major rise of the year on February 12th.

Ethereum’s Rising Trends

Despite experiencing minor declines, Ethereum witnessed its third highest surge of the year on February 14th, exceeding a 5% increase and climbing above $2,776. The short moving average is also acting as a support level around $2,400. The Relative Strength Index (RSI) showed a strong uptrend. The RSI line positioned above 75 could indicate that ETH has entered the overbought zone.

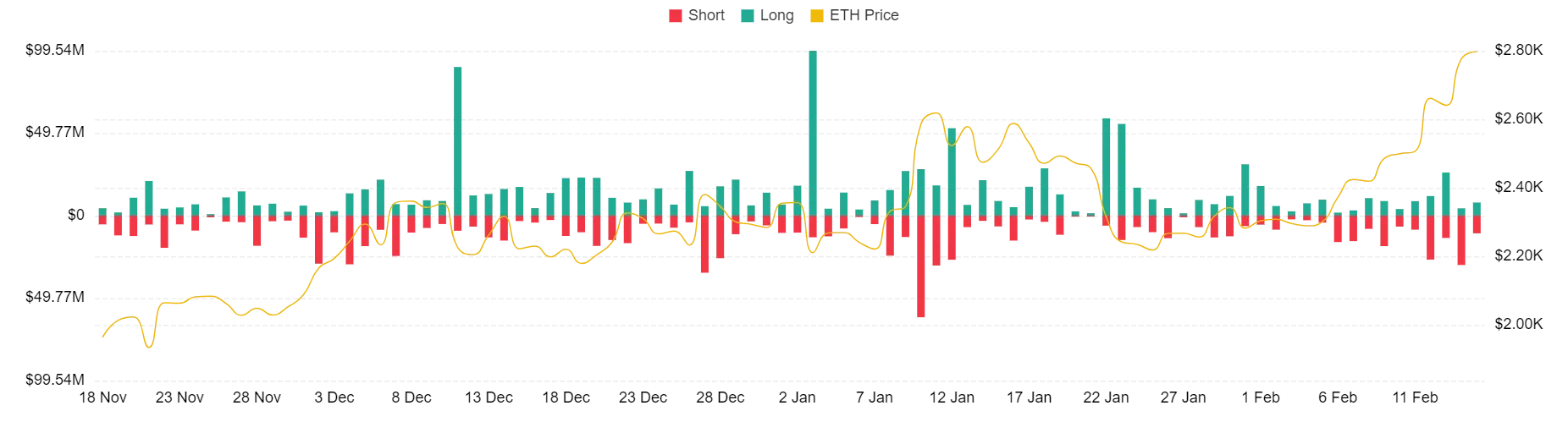

The strength of the ongoing trend can also be confirmed by the Moving Average Convergence Divergence (MACD). Moreover, the MACD lines were above zero, which may confirm the bullish trend indicated by the RSI. Following Ethereum’s price surge of over 6% on February 12th, an examination of the liquidation table on Coinglass revealed a significant liquidation of short positions.

Leveraged Trades in ETH

The chart showed a total liquidation of $26.5 million in short positions and $11.8 million in long positions. However, a minor price drop the next day led to a more significant liquidation volume, especially for long positions. The charts also indicate over $26 million in long position liquidations. On February 14th, there was a noticeable increase in short position liquidation volume over the last four days. The cryptocurrency’s charts show over $29 million in short position liquidations and approximately $4.4 million in short position liquidation volume.

Coinglass‘s analysis of the funding rate in recent days indicates an increase in buyer dominance, with the rate consistently remaining positive. The chart shows that during the price rise on February 13th, the funding rate rose to around 0.02%. However, there was a slight decrease at the time of writing, with the funding rate currently at around 0.01%.