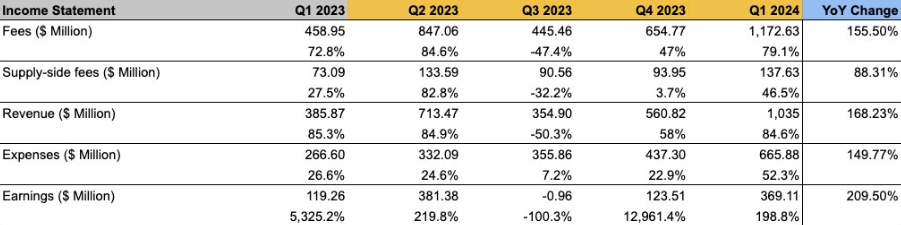

The largest blockchain network by transaction volume, Ethereum, recorded significant growth in the first quarter of 2024, witnessing positive developments in most of its income statement data. According to data from Coin98 Analytics, Ethereum‘s earnings in the first quarter of 2024 tripled to $369 million compared to the previous quarter. This amount represents a 210% increase from the $119 million recorded in the first quarter of 2023.

Intense Interest in Ethereum

In the first quarter of 2024, Ethereum saw fees and revenues increase by 79% and 85%, respectively, compared to the previous quarter. According to the data, Ethereum earned $1.2 billion in transaction fees in the first quarter of 2024, which is 155% more than the same period last year. The total Ethereum revenue reached $1 billion in the first quarter of 2024, marking a 186% increase from the previous year’s $385 million.

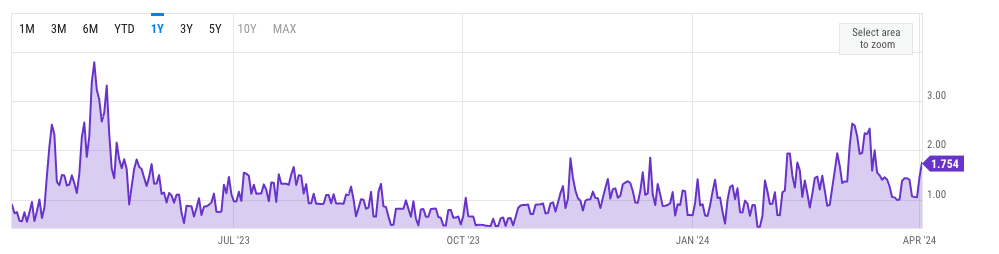

Ethereum’s success in the first quarter of 2024 came during a period when the cryptocurrency approached its all-time high prices in March, triggering a significant increase in network transaction costs. While Ethereum’s price rose above $3,000 at the end of February, some users reported paying over $100 in transaction fees during peak times.

As of March 1st, the average gas fee for a swap transaction was reported to be around $79, while some users reported estimated ETH transaction fees rising to $400 towards the end of February.

What’s Happening on the Ethereum Front?

Despite facing high transaction fees, Ethereum network users saw significant growth in network usage in the first quarter of 2024. According to Coin98, the total number of Ethereum transactions increased in the first quarter of 2024, with total transactions up by 8.4% from the previous quarter, exceeding 107 million transactions.

Furthermore, the total value locked in the Ethereum decentralized finance ecosystem increased by 86% from the previous quarter, reaching $55.9 billion. Tether remained the largest Ethereum-based or ERC-20 stablecoin by market value in the first quarter of 2024, adding 14% to its market value since the previous quarter. Its biggest competitor, USDC, increased its ERC-20 market value by 23% from the previous quarter.

Türkçe

Türkçe Español

Español