Cryptocurrency analytics platform Ultrasound.money reports that approximately $53.17 million worth of 18,109 Ethereum (ETH) has been withdrawn from circulation in the last 30 days, reducing the circulating supply to a new low following the increase. Information from the data provider indicates that the circulating supply of the leading altcoin is 120.16 million ETH.

Ethereum Transaction Volume Increases by 100%

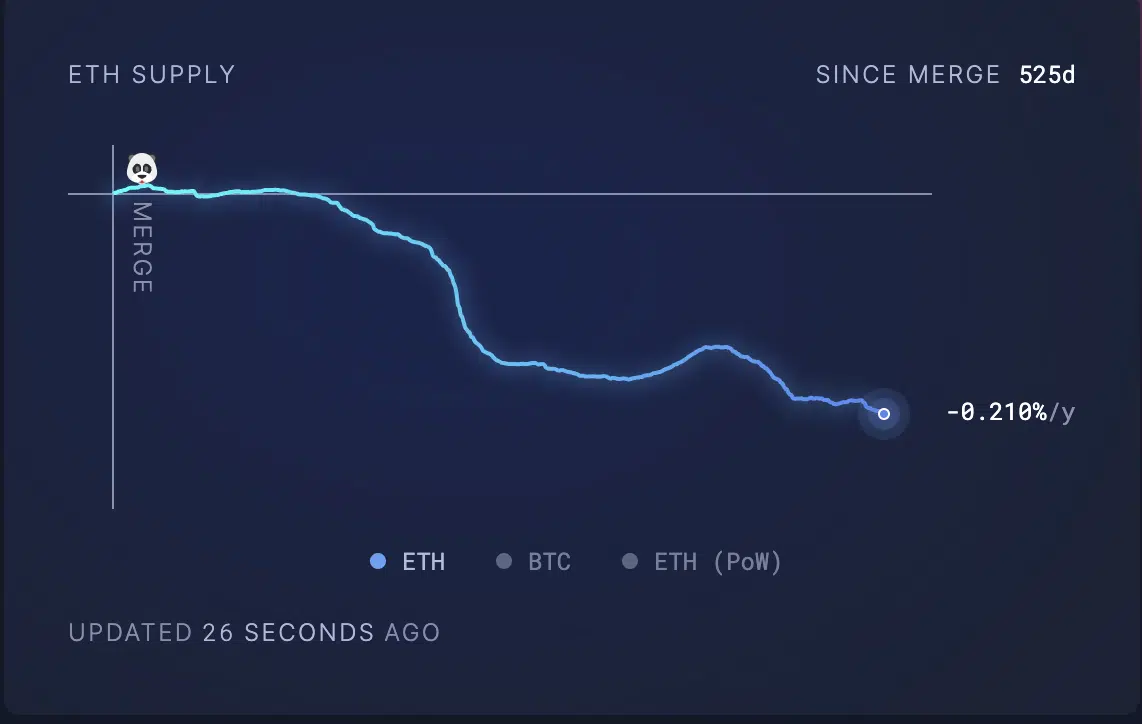

This situation coincides with the network’s lowest level in 524 days since the popular event known as “The Merge,” when the crypto network transitioned to the Proof-of-Stake (PoS) consensus mechanism. When there is growth in demand and usage of the Ethereum network, the burn rate increases, and more ETH tokens are permanently removed from circulation. This increase in network activity is often accompanied by a rise in transaction fees. According to Messari data, the average transaction fees on the Ethereum network have seen an increase of about 100% since February 17th.

An assessment of Ethereum’s non-fungible tokens (NFTs) and decentralized finance (DeFi) verticals confirms the increase in network demand. According to CryptoSlam data, the NFT sales volume on the Ethereum network has reached $395 million so far this month. With a few days left in the month, this figure represents the highest monthly NFT sales volume for Ethereum since April 2023.

NFT Sales Transactions

Additionally, data obtained from CryptoSlam shows that in the last 21 days, 619,000 NFT sales transactions were completed by 91,000 individual sellers and 108,000 individual buyers. Regarding the DeFi sector, a significant indicator of growth on the Ethereum network is the increase in Total Value Locked (TVL) recorded in the last 30 days. According to DefiLlama’s data, Ethereum’s TVL was $46 billion at the time of writing, showing a 45% increase from the previous month.

During the mentioned period, the chain’s leading protocol, the liquid staking platform Lido Finance, recorded a 39% increase in TVL. Furthermore, Ethereum has witnessed an increase in decentralized exchange (DEX) transaction volumes amidst the current rise in cryptocurrency values. According to data from Artemis, the total volume of daily transactions conducted on DEXs on Ethereum has increased by 118% since February 17th.