Last week, as Bitcoin reached its all-time high (ATH), Ethereum also tried to break the $4,000 level but experienced a price drop due to a pullback in spot exchanges. As of this writing, Ethereum (ETH) is trading at $3,866 after a 2% decrease, with a market value of $464 billion. Ahead of the new week in the market, all eyes are on the historical increase, namely the Ethereum Dencun, despite the prevailing uncertainty in the market, which is attributed to the decreasing optimism around a spot Ethereum ETF.

Is a Spot Ethereum ETF Approval Unlikely?

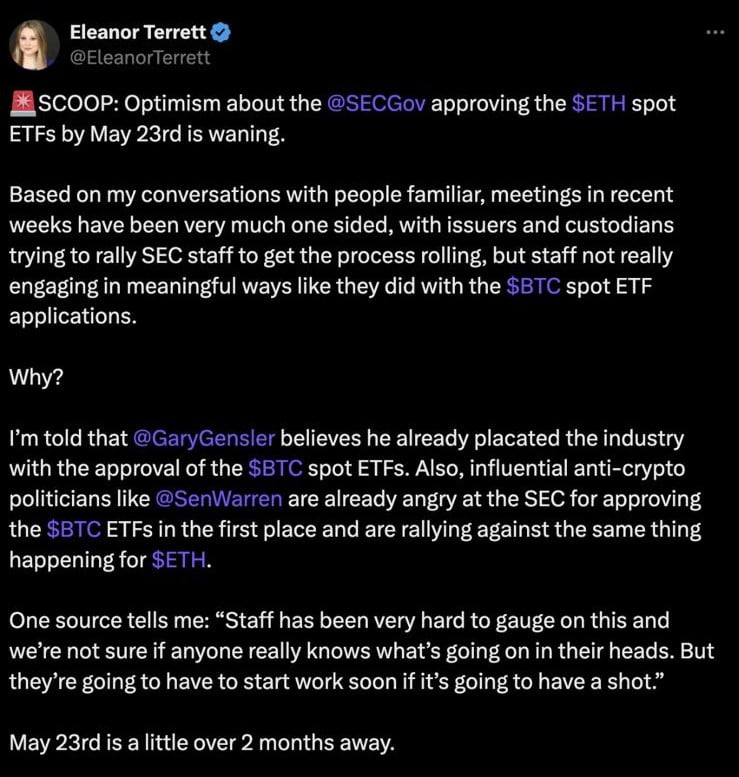

Fox Business’s prominent reporter during the Bitcoin ETF era, Eleanor Terret, published a statement indicating that optimism for the approval of spot Ethereum ETFs by the U.S. Securities and Exchange Commission (SEC) is fading before May 23rd.

According to conversations with people believed to be knowledgeable on the subject, recent meetings have been largely one-sided, showing issuers actively pushing SEC staff to expedite the process.

Moreover, it was noted that the SEC official representing the agency’s side displayed a different attitude compared to the sensitive approach the institution had for spot Bitcoin ETF applications, engaging in no meaningful discussions.

Terret also highlighted another point, mentioning that SEC Chairman Gary Gensler’s approval of spot Bitcoin ETFs had addressed the existing demand in the industry.

The information provided by sources was as follows:

It has been very difficult to gauge the staff on this matter, and we are not really sure what is going on in their minds. However, if they are to have a chance, they will need to start working soon.

Correlation Between ETH Spot and Futures

Bloomberg analyst Eric Balchunas, a significant figure in the Bitcoin ETF process, revealed that the SEC representative did not provide any feedback to the institutions and organizations that have already applied for an Ethereum spot ETF, following the evaluation process for the Bitcoin spot ETF.

This attitude of the SEC representative is considered negative, especially considering the notable parallel between Bitcoin spot and future ETF approvals.

Despite all these developments, it was indicated that the correlation between Ethereum spot and future ETFs is not as strong as believed, and optimism for an Ethereum ETF approval is lower.

Türkçe

Türkçe Español

Español