Ethereum, the largest altcoin by market value, has once again exceeded the $1,850 level. Meanwhile, BTC has surpassed $35,000. The cumulative value of cryptocurrencies is aiming for $1.5 trillion after a long hiatus. With increased optimism in the macro landscape and positive news specific to the crypto market, ETH may experience a new breakout.

Ethereum Whale Movements

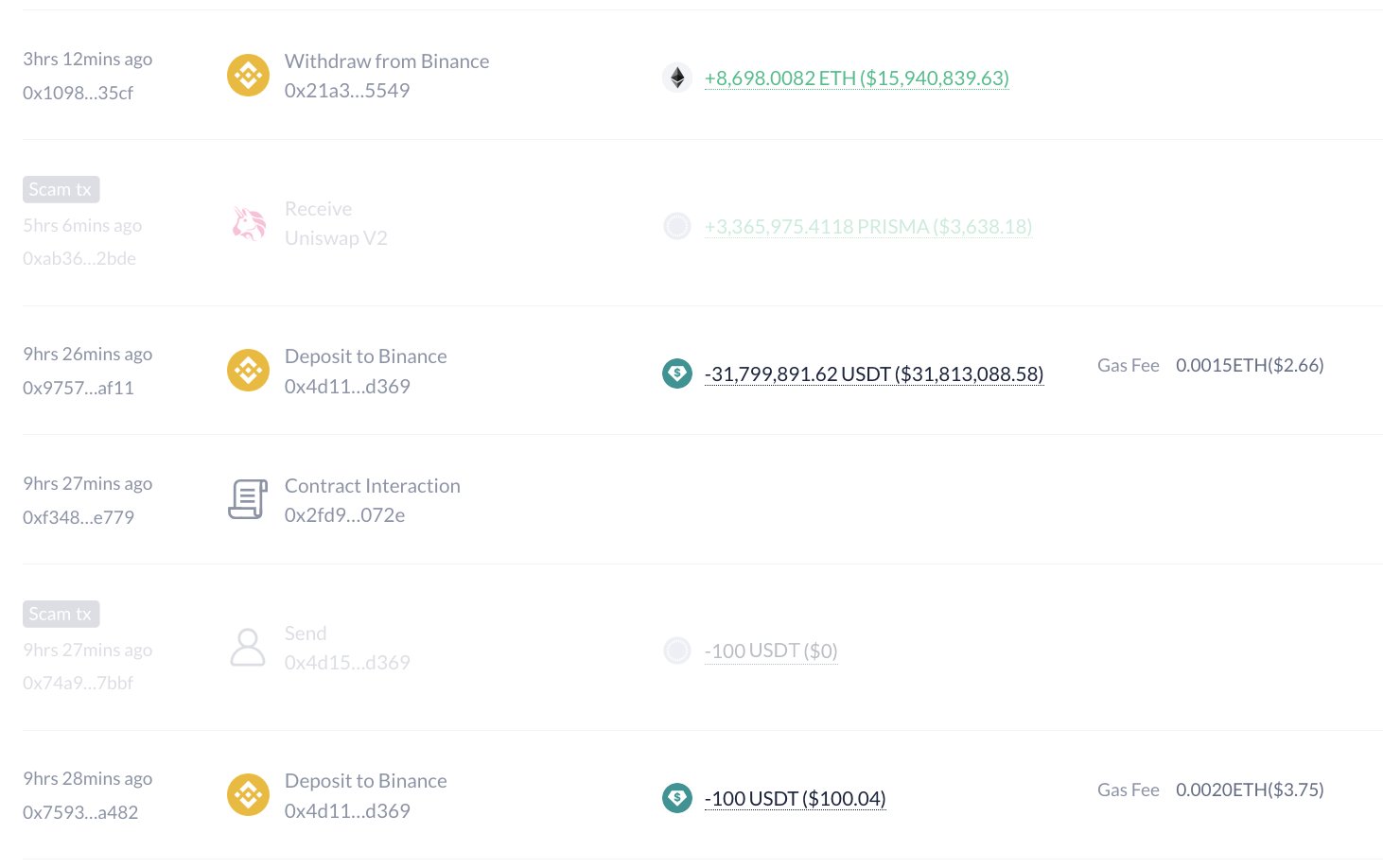

Crypto whales are investors who have spent a longer time in the industry and achieved success. They earn the title “whale” because their capital exceeds a certain amount. On November 4th, a crypto whale deposited $31.8 million into the Binance exchange and withdrew 8,698 ETH a few hours later. This indicates that they made a strategic purchase at a high level.

Just two days ago, on November 2nd, the same crypto whale deposited $45 million worth of ETH into the Binance exchange and made a profit of $5.4 million after the price of Ethereum rose. According to LookOnChain, the mysterious whale’s trading performance is quite good. Since February 12th, the whale has executed eight transactions, seven of which have been profitable. This cumulative profit exceeding $13 million makes them remarkable.

Believing that this mysterious whale may anticipate a new breakout as they made their latest purchase at a higher level.

Will Ethereum (ETH) Price Rise?

The fact that the altcoin king makes short-term closures above $1,880 and has notable weekly gains is noteworthy. On the other hand, the recovery of BTC after the last resistance test is promising for investors. Ali Martinez shared the current outlook for ETH’s price with the latest whale movement:

“You may need to wait for ETH to surpass the massive supply wall at $1,960 for it to start rising.”

According to on-chain data, 33 million ETH was purchased around this average, indicating that resistance could strengthen with those looking to sell their profits. If the famous whale is buying near a critical level, it could indicate an upcoming breakout.

If the Ether price can surpass the $1,960 resistance, it could solidify the $2,000 level as support and embark on a journey towards the $5,000 target once again.