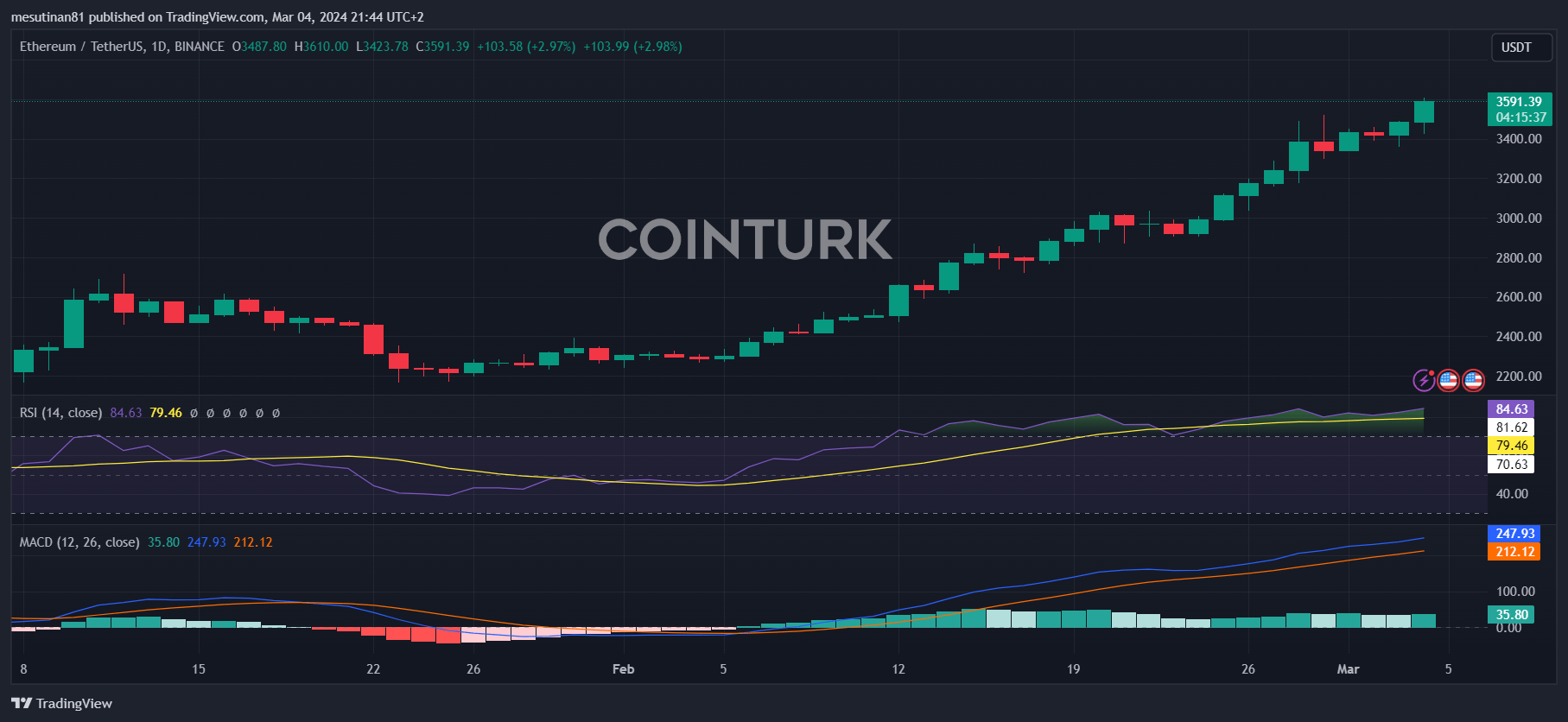

Today, we continue to see the peaks of the year 2024 in the Bitcoin and cryptocurrency market. The latest development is related to Ethereum. The altcoin king Ethereum has surpassed $3,600 today. This level was last seen in January 2022. It seems we are about to start discussing new levels for Ethereum. So, what can be expected for ETH?

Ethereum Breaks Past $3,600

As I write this article, Ethereum has spiked to a level of $3,610. The next phase could change depending on the direction of Bitcoin’s price. If Bitcoin moves sideways, this could allow altcoins to gain some strength.

For Ethereum, facing rejection at the $3,610 price level indicates that this is now a resistance level for ETH. If this level is breached, the next significant level for ETH will be $3,650.

Significant Inflows into Crypto Investment Funds

In the last four hours, there has been an increase in buying activities in the cryptocurrency market, causing the Bitcoin price to exceed $67,000, approaching an all-time high by 3.4%. This increase follows the significant investment flow into spot Bitcoin ETFs last week.

Coinshares reported a substantial weekly inflow of $1.84 billion into crypto asset investment products. Additionally, trading volumes have exceeded $30 billion, representing half of Bitcoin’s global trading volume on leading exchanges.

What’s Next for Ethereum?

Ethereum encountered selling pressure around $3,610. However, the lack of a significant pullback indicates that investors are inclined to buy on minor dips. This suggests a strong buying dominance near resistance zones for ETH. Currently, ETH’s price is trading around $3,600, showing an increase of over 3% from yesterday’s close.

Bulls are in an environment where the market is attempting to break the strong resistance at $3,610 again. If successful, the ETH/USDT pair could initiate a new upward movement and potentially move towards the $4,000 levels, followed by consolidation around $4,200.

The bullish trend of moving averages indicates that market momentum is in favor of the bulls. However, the Relative Strength Index’s (RSI) prolonged stay in the overbought region could increase the risk of a temporary pullback. Support levels are at $3,370 and then the critical $3,000 level.

Türkçe

Türkçe Español

Español