The cryptocurrency market often experiences fluctuations that trigger unexpected developments affecting the entire sector and leading to significant events. Recently, one such incident did not go unnoticed. An Ethereum whale made a surprising move by choosing to sell all their ETH investments, ending their transactions with a massive loss of $6.5 million. This whale’s action has increased opinions within the cryptocurrency world, especially among the Ethereum community, about the potential for a price decline.

How Much is Ethereum in Turkish Lira?

According to statements, a significant cryptocurrency whale opted to sell all 6,714 of their ETH at a price level of $2,903. This move by the whale resulted in a significant loss of $6.45 million.

Moreover, key indicators such as the Relative Strength Index (RSI) continue to remain below the neutral zone, while there is a decrease in investor interest in altcoins. On the other hand, basic averages continue to reflect a downward curve, potentially signaling pessimistic price movements in the near future.

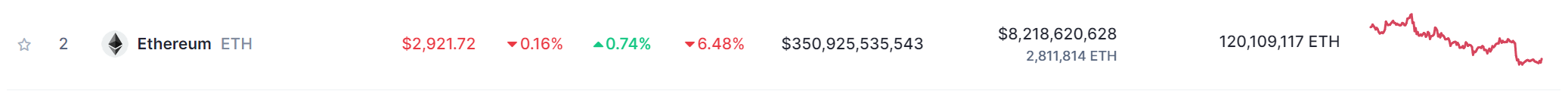

As of the time of writing, Ethereum (ETH) is trading at $2,921 after a 1% increase over 24 hours. The cryptocurrency’s market cap is at $351 billion, while the 24-hour trading volume has decreased by 30% to $8.2 billion.

According to market analysts, if the price successfully exceeds the critical resistance level of $3,017, the upward momentum on the ETH side could continue, and the price could potentially break the descending channel pattern. Conversely, if bears maintain their strength, a price movement towards this month’s lowest level of $2,650 could occur.

Why is Ethereum Falling?

Ethereum, a leading altcoin, seemed to enter a descending channel formation after a rise in mid-March, indicating a decrease in investor enthusiasm following the rise.

On the other hand, the fact that the Spot Ethereum ETF has not yet been approved by the Securities and Exchange Commission (SEC) contributes to the downward price movement in the altcoin.

Additionally, the Dencun hard fork, conducted on March 13, 2024, aimed to reduce rising transaction fees and optimize platform scalability. Although there was a decrease in transaction fees and an increase in scalability, the upgrade did not seem to provide support to the Ethereum price.

On the contrary, after Dencun, the cryptocurrency continued to face rejections at the resistance level, triggering an ongoing steep decline.

Türkçe

Türkçe Español

Español