After a strong comeback to the $1,750 levels, the price of the largest altcoin, Ethereum (ETH), has come under selling pressure. At the time of writing, ETH is trading at $1,558 with a market capitalization of $187.37 billion and a 1.76% decrease. Despite the selling pressure on the altcoin king, data shows that the top 10 Ethereum whales have accumulated millions of ETH in recent days.

Ethereum Whales Show Their Strength

According to on-chain data, Ethereum whales continue to show their strength despite strong selling pressure. Data shows that the top 10 Ethereum whales have accumulated a surprising 40 million ETH in recent days.

On-chain data provider Santiment reported that while Ethereum’s price remains slightly above $1,570, the richest Ethereum wallet addresses, both on and off exchanges, continue to accumulate more ETH. Currently, approximately 8.51% of the ETH supply is held on exchanges, while the top 10 off-exchange wallet addresses collectively hold an impressive 39.22 million ETH.

However, amidst the current selling pressure, Ethereum is losing ground against Bitcoin (BTC). Ethereum’s percentage of the $1 trillion cryptocurrency market cap has decreased from approximately 18.4% to 17.8% at the beginning of the year. As Ethereum’s market share continues to decline, Bitcoin’s market share has surpassed 50%.

On the other hand, on the first day of the week, the Ethereum Foundation converted approximately $2.7 million worth of ETH to USDC through direct sales. This caused some selling pressure on the largest altcoin.

Ethereum (ETH) Price Analysis

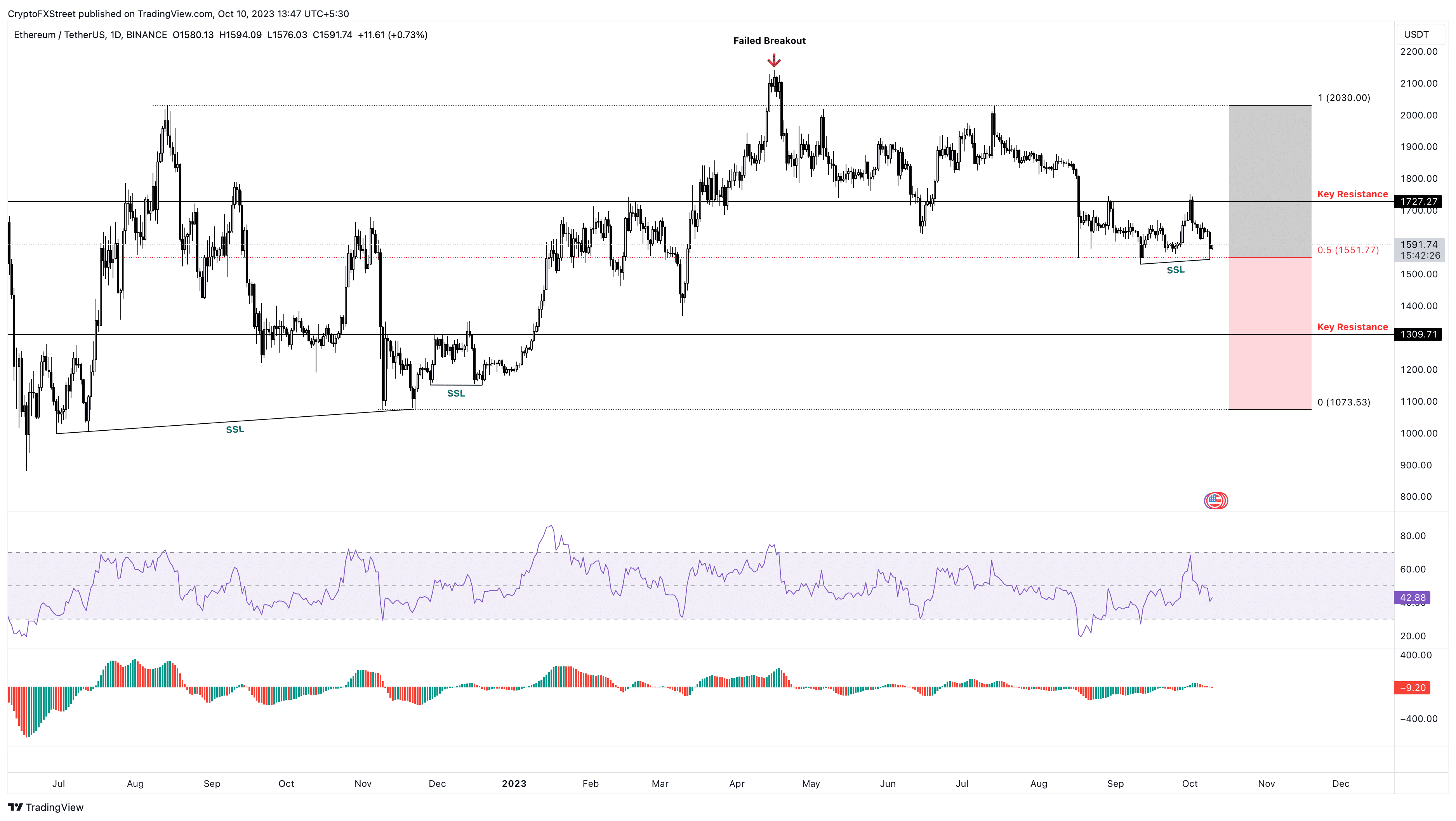

At the time of writing, ETH is trading just above the significant support level of $1,550. However, both the Relative Strength Index (RSI) and the Awesome Oscillator (AO) indicators have dropped below their respective average levels of 50 and 0. Looking ahead, investors may expect the price of the altcoin king to retest the next support level at $1,309. Experienced cryptocurrency analyst Ali Martinez noted that a drop below $1,530 could keep the price under strong selling pressure.

Despite the signs of a decline, the direction can quickly change if external factors such as news flow or macro developments create a strong upward wave. In such a case, if Ethereum turns the $1,727 resistance into support, the bearish outlook will become invalid. Such a move could push ETH to retest the $2,030 resistance.

Last week, the launch of six futures-based ETFs in the US was a significant indicator for Ethereum investors. However, these new ETFs underperformed expectations by raising just under $10 million in their first weeks.

Türkçe

Türkçe Español

Español