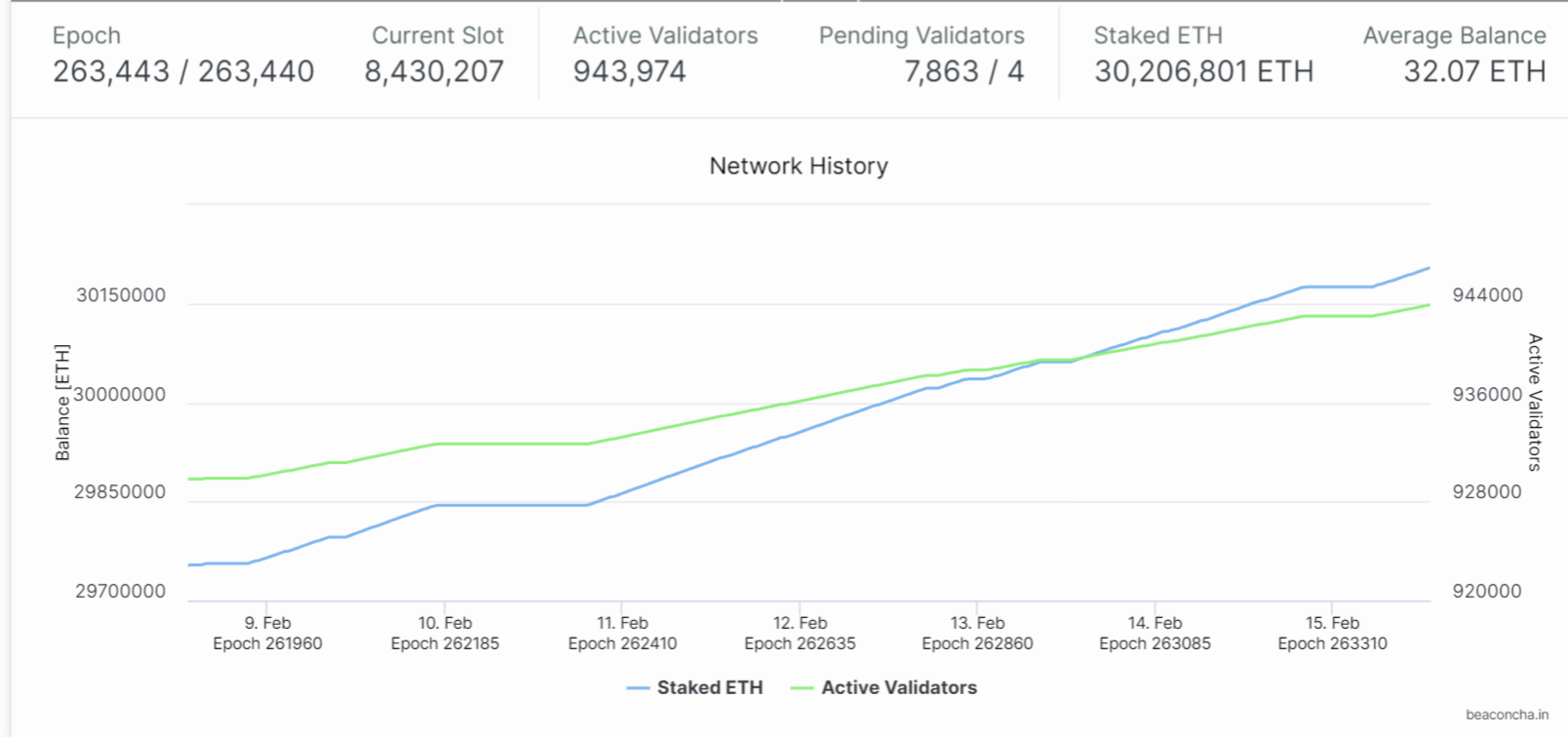

Ethereum (ETH) network’s Beacon Chain has reached a significant milestone by surpassing 30.2 million ETH, which has a value exceeding 85 billion dollars. This milestone corresponds to approximately 25% of the total circulating ETH supply, with the current number of active validators contributing to the Beacon Chain being 943,974.

Staked ETH Amount on Beacon Chain Increases Alongside Price

February proved to be a month of ascent for Ethereum, marked by a rise in investor confidence and activity. In the first half of the month, investors deposited an astonishing amount of 600,000 ETH into the Ethereum 2.0 staking contract. During this period, there was also a notable price increase for the altcoin king, with ETH’s price surpassing $2,800, reaching its highest level of the year. As of the writing of this article, ETH is trading at $2,774.

The high amount of ETH locked in Proof of Stake (PoS) contracts is seen as a bullish indicator for the Ethereum network. This increase in staked ETH enhances the network’s security and efficiency, while also reducing the available ETH supply for trading on cryptocurrency exchanges. The reduction in supply on exchanges, combined with increasing demand, creates a favorable environment for further price increases.

The integration of PoS mechanisms into the Ethereum ecosystem through the Beacon Chain has been a significant development. Since Ethereum’s network transition from Proof of Work (PoW) in September 2022, validators have been able to stake ETH and earn a reward rate of 4% annually.

The Ethereum PoS network operates through a decentralized group of validators, each required to deposit at least 32 ETH. Although the Beacon Chain initially started with 21,063 validators, it has since seen exponential growth and now boasts over 900,000 validators contributing to the security of the network.

Following the Shanghai update in April 2023, concerns arose about the potential withdrawal of staked ETH by validators. However, data revealed that the influx of newly staked ETH exceeded withdrawal transactions in the week following the update. This trend indicates that validators are willing to continue staking their ETH for passive income.

Investors Eye SEC’s Decision on Spot Ethereum ETFs

As ETH’s price continues to climb, nearing the $3,000 mark, attention is now shifting towards the potential approval of spot Ethereum exchange-traded funds (ETFs) by the U.S. Securities and Exchange Commission (SEC). With increasing institutional demand for ETH, the market supply is expected to decrease further, potentially driving prices up, and the launch of spot Ether ETFs is anticipated to have a significant impact on Ethereum.

At this point, the SEC is expected to approve at least one spot Ethereum ETF by May and to have the spot ETF listed and available for trading on the exchange.

Türkçe

Türkçe Español

Español