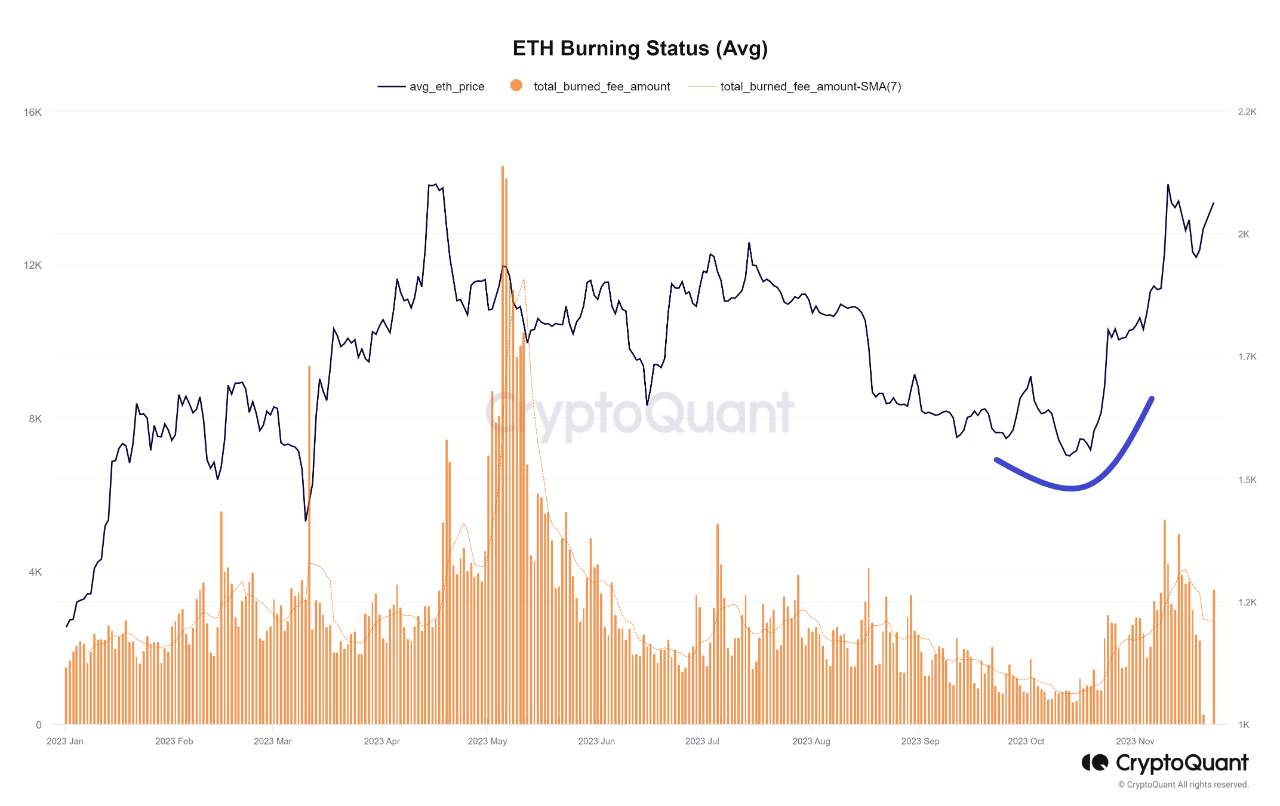

The king of altcoins, Ethereum, has experienced a significant revival in its burning rate throughout October 2023. This increase in burning rate, coinciding with a simultaneous price surge, has sparked debates within the crypto community about the driving forces behind this important development. The development has also brought the possibility of a rally for Ethereum.

Network Activity and Market Sensitivity Support Ethereum’s Burning Rate Increase

Crypto analysis platform CryptoQuant reported a significant increase in Ethereum’s burning rate, reflecting the amount of ETH permanently removed from circulation. According to CryptoQuant, this increase is a result of numerous factors that strengthen Ethereum’s fundamentals and change market perception.

One of the main catalysts for this increase is the growing activity on the Ethereum network. Increased transactions, the usage of decentralized applications (dApps), and an expanding ecosystem have collectively contributed to the increase in the burning rate. More transactions have led to higher gas fees paid in ETH, resulting in the burning of numerous tokens, a decrease in overall supply, and potentially an increase in scarcity.

The noticeable change in market sensitivity has shed a positive light on Ethereum. Positive perceptions of its true value and utility have increased investor confidence, leading to an increase in demand. Ethereum is recognized not only as a digital currency but also as a robust platform for decentralized finance (DeFi), NFTs, and smart contracts, fueling this shift in sentiment.

Expectations of Updates and External Factors Boost Ethereum’s Appeal

Expectations surrounding upcoming technical updates, such as the implementation of Ethereum 2.0, have played a significant role in this increase. Investors anticipate that these updates will enhance Ethereum’s scalability, security, and sustainability, further increasing its appeal.

Externally, economic factors influencing the cryptocurrency market have also played a role. Ethereum’s flexibility and potential to serve as a store of value during uncertain times have garnered attention. This has led to an increase in demand and burning rate.

The cumulative effect of these factors has created an empowering cycle. Increased network activity leads to rising burning rates, long-term value for Ethereum, increased investor confidence, and subsequently, a price surge.

This positive feedback loop not only reflects short-term speculation but also deep belief in Ethereum’s applicability within the evolving landscape of decentralized technologies.

The increase in the burning rate indicates a potential price surge by signaling a decrease in ETH token supply. These developments highlight Ethereum’s utility, relevance, and sustainable value proposition.

Türkçe

Türkçe Español

Español