It is well known how much dominance Ethereum has established over other altcoins. Despite this, some teams continue their efforts to compete with ETH or at least to be an alternative. In this context, NEAR positions itself in such a place. With its positioning, NEAR is closely followed by investors, and some analysts have pointed out important aspects.

Analyst’s Commentary on NEAR

Jamie Coutts, a crypto analyst from the Real Vision team, mentioned that NEAR, positioned as a competitor to Ethereum (ETH), shows a bullish outlook in fundamental indicators.

The analyst, who previously worked at Bloomberg, stated on the social media platform X that NEAR Protocol (NEAR) could potentially rise over 47% from its current value.

Absolute price momentum: It has been consolidating since March. If it breaks the resistance around $7.60, where a volume cluster was traded in recent months, the technical formation looks extremely bullish. Breaking the neckline of the formation would create a target above $10.50 (+30%), generating high confidence.

The analyst, pointing to the chart he prepared, mentioned that NEAR displays an inverse head and shoulders formation (I-HNS). I-HNS is described as a bullish technical formation with a right shoulder, indicating the presence of investors willing to buy the cryptocurrency before the price falls back to previous low levels.

The analyst also mentioned that NEAR could potentially move in a bullish trend against Bitcoin (BTC) and Solana (SOL).

Relative price momentum: NEAR is positive and ready to rise against SOL and BTC.

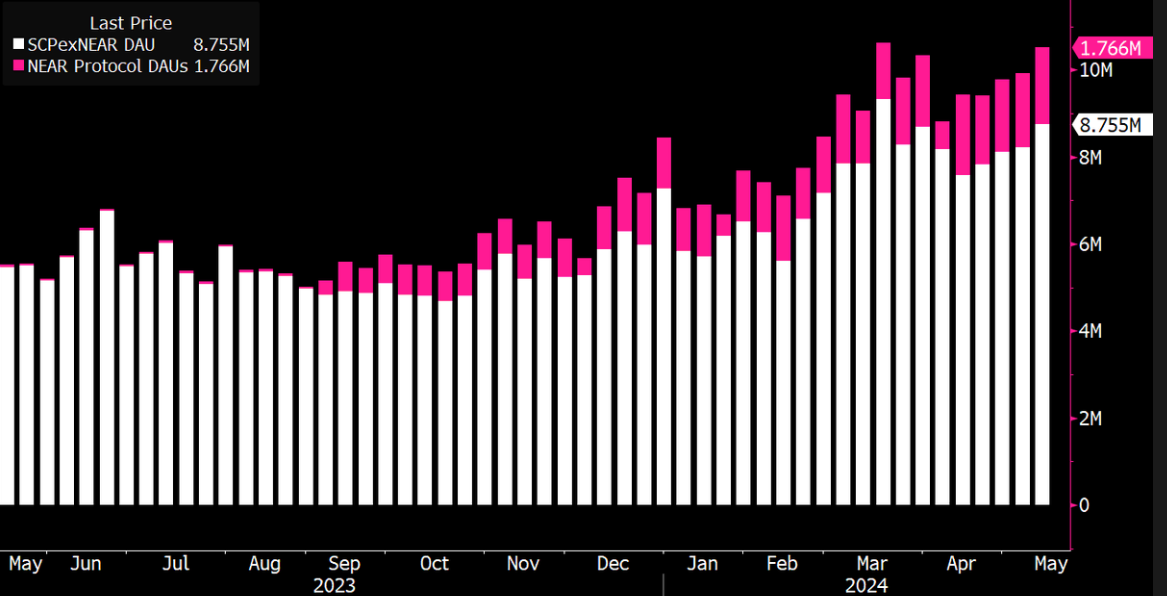

According to another analysis by the analyst, there is a significant increase in the number of daily active users (DAU) on NEAR compared to other smart contract platforms, which can be considered another bullish signal.

Absolute active user momentum: NEAR’s daily active user count rose from 50,000 last year to 1.76 million. Outside of NEAR, this number increased from 5.4 million to 8.75 million.

The analyst also notes that the growth rate in user numbers is much higher than the total growth rate of other layer-1 and layer-2 projects.

Relative active user momentum: this means a 33-fold growth against 0.6 times for the rest of the L1/L2 ecosystem.

What is the Price of NEAR?

NEAR is currently trading at $7.12, following a 2.51% decrease over the last 24 hours. During this time, its market cap has fallen to $7.6 billion, while the 24-hour trading volume has also decreased by 35% to $312 million.

The decrease in trading volume could indicate a lack of investor interest. Additionally, the situation could be linked to investors not wanting to sell their NEAR holdings at the current level.

Considering all these factors, it’s important not to forget that potential Bitcoin price movements or positive news from around the world, especially from the USA, could have positive effects on the market and NEAR.

Türkçe

Türkçe Español

Español