Stellar (XLM) has been enjoying a partial victory of about 60% since Ripple‘s court decision on July 13 against the U.S. Securities and Exchange Commission (SEC). So what kind of price movement can we expect in the coming days?

XLM Movement!

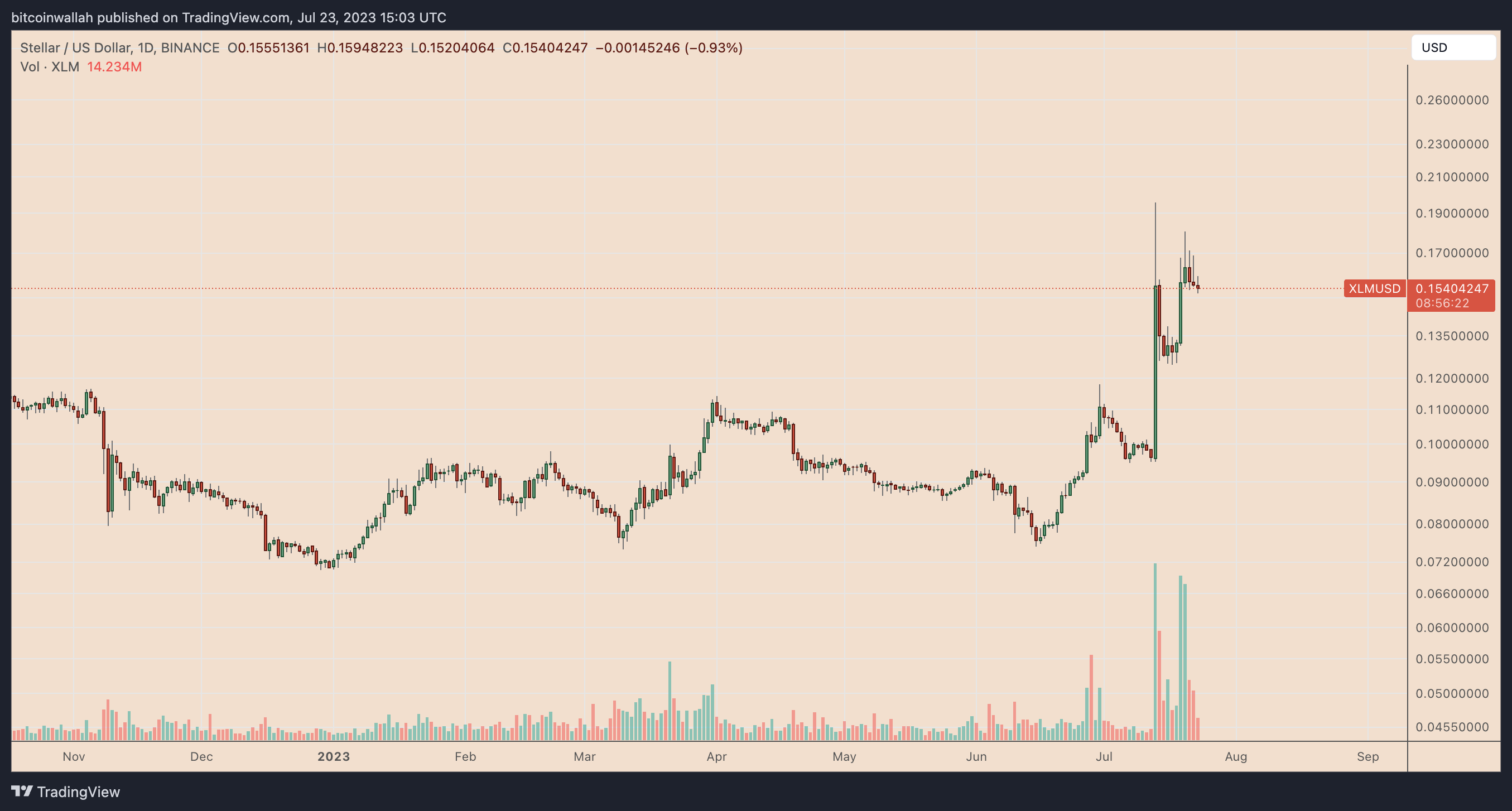

Since July 13, when a federal judge ruled that public sales of XRP on public exchanges did not violate U.S. securities laws, the XLM price has increased by over 60%. However, the token experienced a drop of about 20% from its local peak of $0.195 and was trading at around $0.154 on July 23. The period of price increase for XLM occurred alongside the increasing positive correlation with XRP on a daily time frame.

As of July 23, the correlation coefficient between the two tokens was 0.95, indicating that they were moving in a similar direction. Considering that Stellar is a blockchain payment project founded by Jed McCaleb, a co-founder of Ripple, the price trends in the XLM and XRP markets can often mirror each other. For example, since Ripple’s win, the price of XRP has also increased by about 60%. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

However, the price of XRP carries a risk of dropping by about 40% until September, which could potentially cause XLM to undergo a similar downward pressure. From a technical perspective, the latest XLM price rally pushed the market’s weekly relative strength index (RSI) to its most overbought levels since April 2021. As of July 23, XLM’s weekly RSI value was around 72.5.

Token Data!

In addition, the token is trading at a point where the 200-week exponential moving average (200-week EMA; blue wave) intersects with a strong resistance line near $0.164. Indicators suggest that XLM may undergo a sharp price correction in the coming weeks.

In this bearish scenario, the XLM price could drop to the 50-week EMA by September and experience a 30% decline from current price levels. This level could also align with the support seen during the May-November 2022 session for XLM. On the other hand, a decisive close above the point of intersection of resistance could cause the XLM/USD pair to rise to $0.22 with a 45% increase from current price levels by September. This level served as support and resistance from June 2021 to April 2022.

Türkçe

Türkçe Español

Español