Cryptocurrency investors are facing challenging days in determining their direction as Bitcoin hovers above a critical support level of $70,000. Bitcoin‘s fluctuating movement within a certain range inevitably leads to questions of whether its price will rise or fall. An analyst provides critical information to investors at this juncture.

Vital Warnings from a Popular Analyst to Bitcoin Investors

Popular analyst Stockmoney Lizards points out in his statement that there is an attempt to create a lot of FUD (fear, uncertainty, and doubt) around Bitcoin, drawing attention to some bears still calling for a crash. The analyst questions the accuracy of these crash predictions.

According to the analyst, if Bitcoin’s price were to crash as predicted, it would fundamentally contradict clear cycle dynamics. At this point, the analyst presents four important findings.

The Four Important Findings Presented by the Analyst

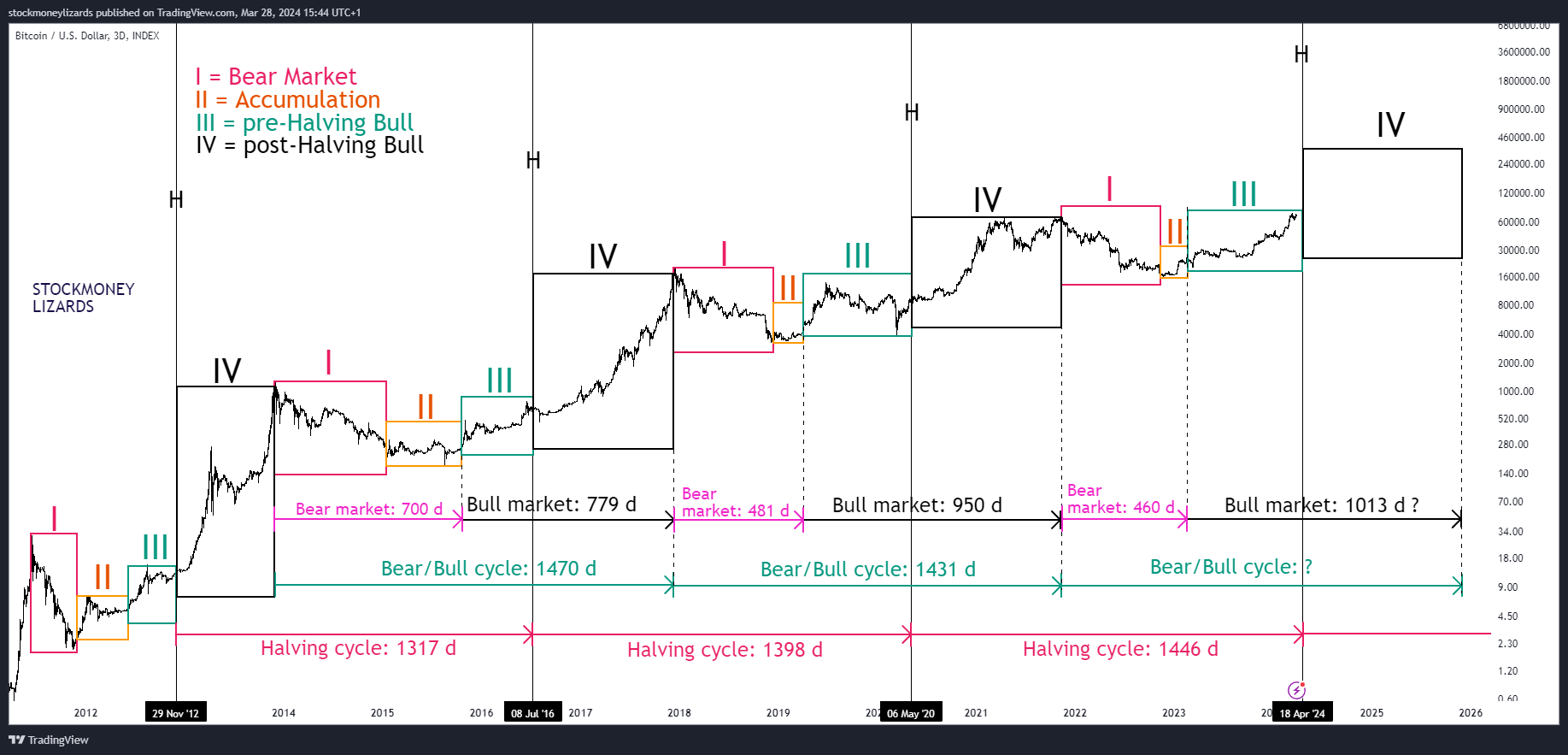

Firstly, the analyst believes it is necessary to distinguish between halving events and bear/bull cycles. The durations of both bear and bull cycles remain the same, with the analyst noting that they last approximately 1,300 or 1,400 days.

The analyst explains the second finding with the concept of bull and calf phases. According to the analyst, we need to look at different stages, which are the bear market (I), accumulation (II), pre-calf bull (III), and post-calf bull (IV). The analyst states, “It is clear that there is a gradual shift towards shortened phases I & II, while phases III and IV are extended.”

What Are the Other Bitcoin Cycle Findings?

As a third point, the analyst draws attention to the likelihood of similar events occurring, supported by strong reasons. These include the ETF narrative (billions of dollars of fresh money inflow), an all-time high before the first halving, and a generally matured market with a strong investor base as reasons emphasized by the analyst.

The analyst considers the fourth finding in terms of a matured market. In the past, we have seen up to 50% declines in bull markets, but now these have been replaced by softer landings, with corrections occurring at around 20%. The analyst attributes this to a shift in the supply/demand ratio increasingly favoring demand.

In conclusion, according to the analyst, there is very little evidence to suggest an imminent crash. On the contrary, the analyst believes that the upcoming halving will trigger another strong surge.

Türkçe

Türkçe Español

Español