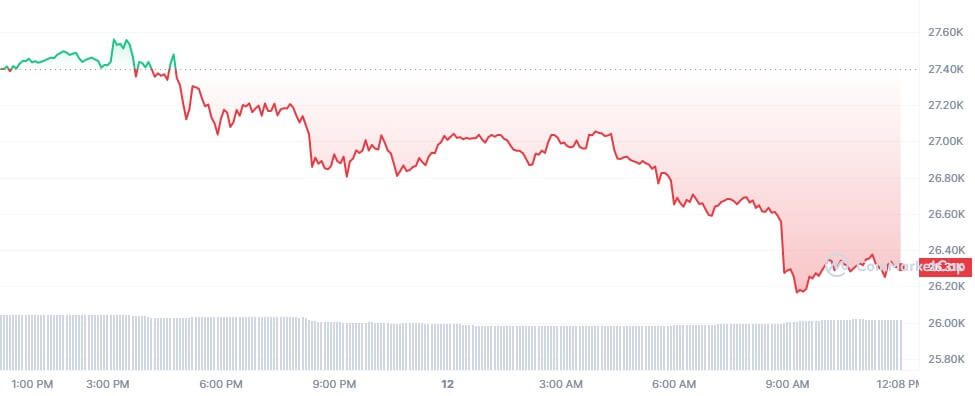

Bitcoin price falling for the second day in a row and hitting its lowest level in more than six weeks could signal a bearish short-term trend. The token may have lost some of the gains from the 2023 rebound and the sentiment in the market may be triggering greater caution and fear.

Given the mixed signals and indicators coming from the market, one question comes to mind. Will Bitcoin cross $30,000 or head towards $25,000?

BTC Market Analysis

At the time of writing, the Bitcoin price is trading at $26,350. The 24-hour decline was 3.21% and the 7-day decline was 1.77%. The foreign exchange reserve continues to fall, suggesting that selling pressure is easing. More investors in Bitcoin appear to be selling at a loss, which could signal a market crash for Bitcoin and the altcoins that follow it in the middle of the bear market.

According to CryptoQuant, 51.03% of long positions have been liquidated in the last 24 hours. The RSI indicates an oversold condition and a staggering 75.00% of the price action over the last 2 weeks has been to the downside, potentially leading to a trend reversal, which could be the beginning of more pain for traders.

Regulatory uncertainty coupled with technical issues on the network, such as reduced liquidity, has led to reduced demand for Bitcoin, which has been a major reason for the recent price drop. It remains to be seen whether the market will rebound in the short term or whether the downtrend will continue.

BTC Trends to Know

Buying pressure from US investors on Coinbase is strong relative to the rest of the market, potentially paving the way for higher prices. Crypto Tony, an analyst, tweeted about the declines, hinting at possible price spikes in the third quarter:

Really hoping that these dips we’re seeing in #Bitcoin/#Altcoins will hold major support zones, leading to absolutely massive price spikes for June/July.

Finally, the correlation between Bitcoin and the stock market has weakened, which could mean that macroeconomic factors have less influence on the crypto asset market.