Bitcoin price was at $68,700 at the time of writing, and recent macro data was positive. Cryptocurrency investors are concerned about the risk of further tightening by the Fed, while macroeconomic data highlights the danger of more tightening. What are experts’ predictions for the markets?

Current State of Cryptocurrencies

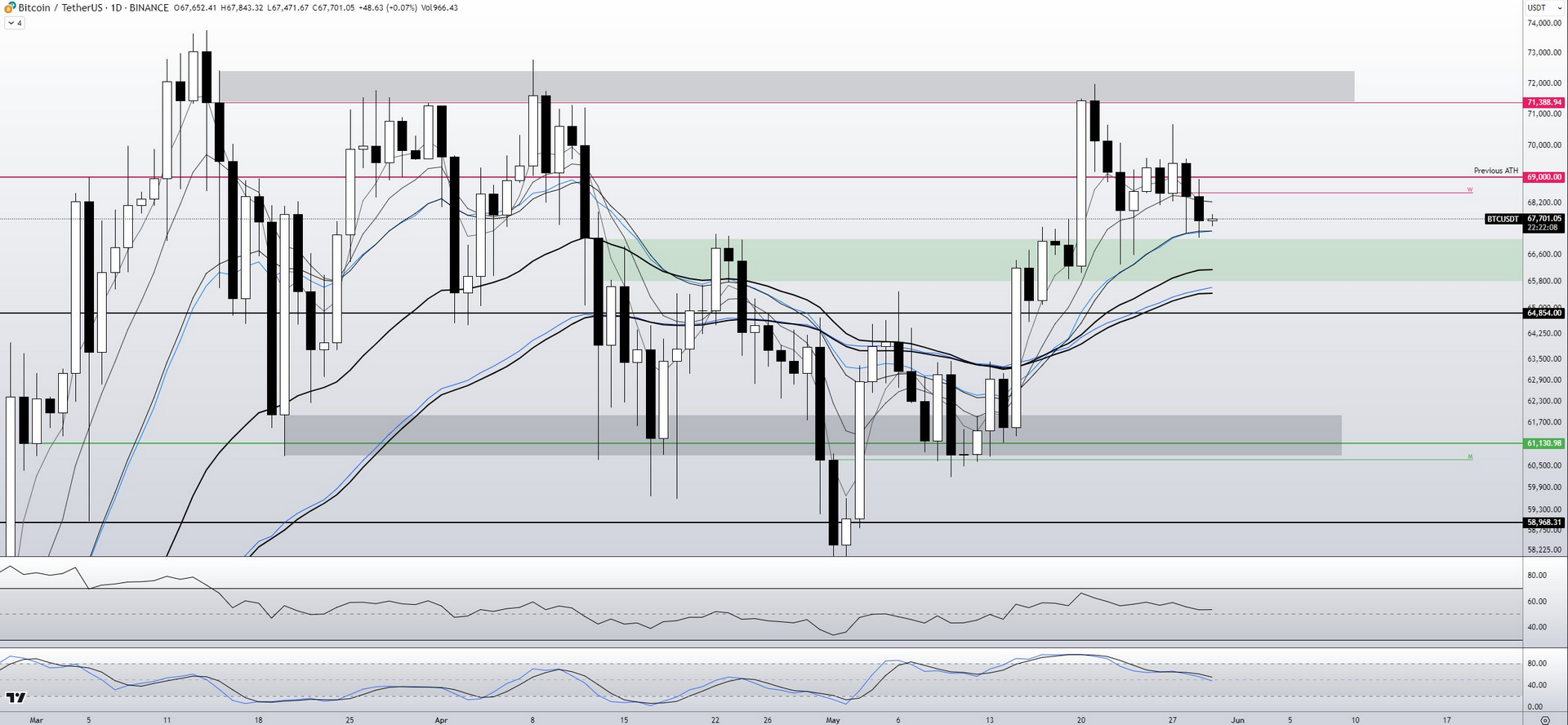

Recently, the number of wicks towards $67,000 has started to increase. This is an important level for bulls to maintain, but frequent testing is negative. On the other hand, continuous sales above $70,000 indicate a lack of momentum here. Crypto commentator Skew wrote in his latest evaluation:

“After entering the $72,000 peak and market supply range, bulls lacked sustainable momentum above $70,000.”

At the time of writing, Skew mentioned that before the ongoing $69,000 attempt, the RSI signaled a new dip test at $65,000.

“Buyers sold on the rise, supply is a bit weak with limit spot bids defending the low level ($67,000).”

Analyst Comments

Bitcoin analyst Roman points out the decrease in volume during repeated visits to the lower end of the short-term range. The weakening of volumes during declines indicates that fewer investors are selling. Massive volumes are essential for sharp declines. Therefore, from this perspective, these pullbacks may not result in disastrous outcomes.

“Low volume + low price = an uncertain downtrend. Again, we are taking short-term reversals in this area to make long-term purchases.”

The Producer Price Index (PCE), the Federal Reserve’s preferred inflation indicator, will be announced on May 31, that is, tomorrow. Today’s data indicates that economic growth is below expectations. This means the Fed’s tightening measures are working. Moreover, the Beige Book details mentioned a weakening in personal spending in favor of inflation. Unemployment figures are positive, and if PCE meets expectations, investors can breathe a sigh of relief.

Of course, the unpredictable nature of cryptocurrencies should not be forgotten, and investors should always be prepared for any possibility. The latest example of this was seen last week with the SEC’s 180-degree turn.

Türkçe

Türkçe Español

Español