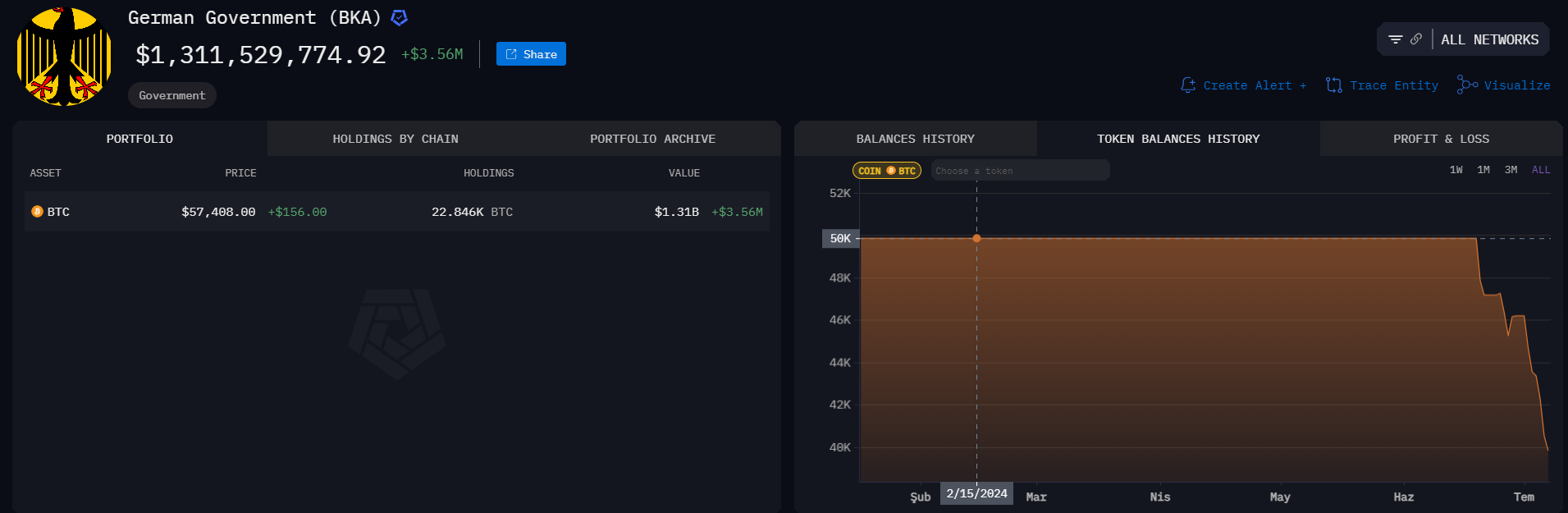

Bitcoin price was hovering at $57,400 during the preparation of this article, showing a gradual, albeit weak, recovery. After the US markets opened yesterday, Germany triggered a rapid decline by making new BTC transfers. However, this situation did not last long, and after weakening the open positions in futures a bit more, BTC returned to its previous level. So, what do market experts think?

Comments from Cryptocurrency Market Experts

The BKA, affiliated with the German government, quickly consumed more than half of its BTC holdings, reducing its reserves. Over 25,000 BTC were liquidated through transfers to market makers and direct exchanges. This indicates that most of the path has been taken, and the remaining transfers can be troublesome at most to the same extent.

QCP Capital analysts focused on the current situation in their market note published during the preparation of this article.

“After the German Police transferred $900 million worth of BTC to exchanges, there was a drop to $55,200 and below on Monday. Although the market was scared, it quickly recovered.

We still believe that the rise will start, and we have several reasons for this.

$200 million worth of BTC was later returned from exchanges to the German Police, indicating that these assets did not enter the market.

The strong demand shown by rapid dip buying supported by the $295 million ETF inflow on July 8, the highest level in the last 21 days.

Despite weak liquidity, BTC and ETH saw higher dip levels this week, and the dip levels were aggressively bought.

The market is very responsive to supply movements, indicating speculative selling pressure rather than real spot demand. This may suggest that the market is overly positioned to the downside. A catalyst is needed. The ETH spot ETF will start trading around July 15. The inflows here could increase liquidity and initiate an upward movement in the market.”

Is the Decline Over?

Many metrics indicate that oversold conditions have formed. Especially in the middle of an uptrend, when we see such oversold conditions, we expect the rise to start based on historical data. The good news is that the markets are still in an uptrend, and we have seen a decline for a sufficiently long time.

In the coming weeks, it would not be surprising to see BTC making attempts around $70,000, and seeing strong demands in the ETF channel again (due to elections and the upcoming interest rate cut). And of course, we cannot see the future, especially in a high-risk, highly volatile environment like crypto, predicting what will happen is even more impossible.

Türkçe

Türkçe Español

Español