Bitcoin’s price hovers around the $108,000 mark, with significant U.S. comments on negotiations yet to create an impact. Amid these developments, Eric Trump has expressed positive sentiments about Bitcoin  $91,081. The upcoming inflation data, set to be released on Friday, stands as this month’s critical macroeconomic checkpoint before the Federal Reserve’s interest rate decision. The crucial question now is what the current forecasts hold for Aster, Solana

$91,081. The upcoming inflation data, set to be released on Friday, stands as this month’s critical macroeconomic checkpoint before the Federal Reserve’s interest rate decision. The crucial question now is what the current forecasts hold for Aster, Solana  $139, HYPE, and Bitcoin’s market dominance.

$139, HYPE, and Bitcoin’s market dominance.

Aster, HYPE, and Solana (SOL)

For altcoins, the market environment isn’t exceedingly promising. However, the reduced prices may present buying opportunities, although long-term prospects for cryptocurrencies have never been a short-term bet. Potential investors are currently prefer to stay on the sidelines, observing the developments in numerous altcoins.

On November 1st, retaliatory actions between China and the U.S. will occur, with a Supreme Court hearing on November 5th regarding Trump’s tariff authority.

With more volatility on the horizon, Sherpa shared an updated chart, indicating HYPE remains an outstanding project within the crypto world. However, sales might be attributed to uncertainty over lock releases and possibly increased competition.

In case of further declines, the supports at $28.41 and $20 remain vital. Yet, if $34.3 is maintained, upward momentum might resume. Recent records had many dreaming of acquiring HYPE at these prices.

Sherpa’s analysis anticipates that SOL Coin, now at the dip, will continue its sideways motion for a while.

Aster Coin is a favorite among analysts, bolstered by CZ’s strong support. Sherpa foresees movements around the market average without any significant leaps. It is crucial to maintain the $0.946 support, while the resistance stands at $1.265.

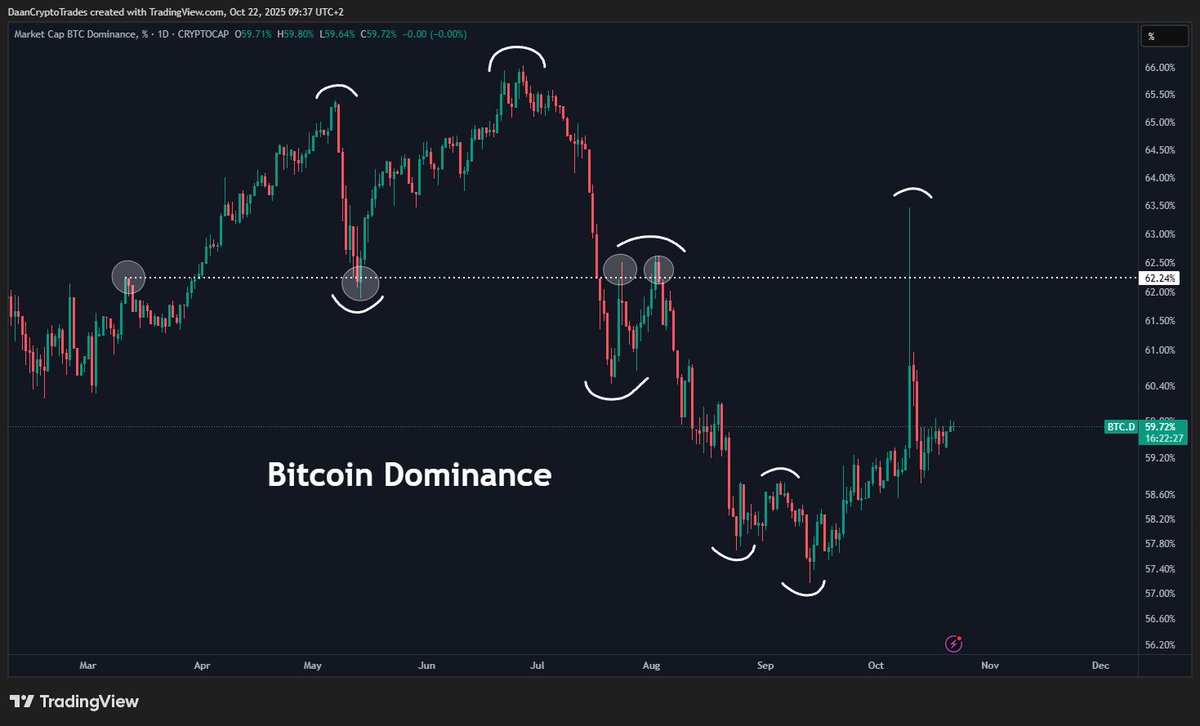

Bitcoin Market Dominance

DaanCrypto examines the Bitcoin market dominance chart, an essential indicator for altcoin bulls. He anticipates that a portion of the wick will fill, strengthening BTC through its integration with gold.

He notes that most altcoin surges, characterized by rapid sales, were more pronounced during downturns. For a sustainable bounce, BTC’s enhanced performance is desired, encouraging others to follow suit.