The anticipated significant shift in the Federal Reserve’s (Fed) monetary policy may drive Bitcoin’s price to $250,000 by year-end. According to renowned economist and co-founder of cryptocurrency exchange BitMEX, Arthur Hayes, Bitcoin’s price is directly linked to market expectations regarding future dollar supply. Recent signals from Fed Chairman Jerome Powell indicating a potential transition from monetary tightening to easing have heightened excitement around Bitcoin  $107,289.

$107,289.

Powell’s Must-Do Move Will Benefit Bitcoin

Arthur Hayes suggested that political pressures will force Fed Chairman Powell to halt monetary tightening. Powell’s recent statements about reducing the pace of balance sheet contraction and possibly resuming bond purchases have increased expectations of a return to monetary easing. Hayes believes these developments will lead to a sudden spike in Bitcoin’s price.

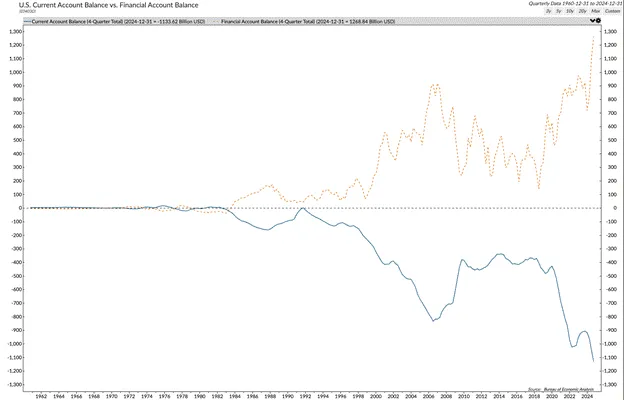

Additionally, Hayes highlighted that U.S. Treasury Secretary Scott Bessent’s plans to lift restrictions on bank purchases of Treasury bonds could positively impact Bitcoin. Bessent aims to facilitate government borrowing by enhancing banks’ capacity to purchase bonds. Experts argue that the Fed’s and banks’ actions could significantly boost Bitcoin by increasing the supply of dollars in the market.

Bitcoin and Altcoins Aim to Respond to Future Money Supply

One of the fundamental factors determining Bitcoin’s value is expectations regarding the future supply of fiat money. The Fed’s shift back to monetary easing policies is creating a favorable environment for investors in the largest cryptocurrency. Hayes emphasized that as long as there are no major changes in Bitcoin’s technological foundations, its price will be directly influenced by expectations surrounding money supply.

Particularly, the economic growth and manufacturing policies of the Trump administration are increasing public spending and, consequently, government borrowing. It is argued that the Fed has no option but to increase the money supply to manage this rising debt burden. Hayes posited that these factors could propel Bitcoin’s price to an impressive $250,000 by the end of the year.

Indeed, after a pullback to around $78,000, Bitcoin has begun to recover on expectations of a return to the Fed’s monetary easing policy. Leading experts like Hayes believe that Powell will continue to ease monetary policy under pressure, significantly boosting not just Bitcoin but also altcoins.

Türkçe

Türkçe Español

Español