Bitcoin (BTC)  $118,701 hovers above $68,000, maintaining a key support level, which is currently a positive sign. As we approach the end of October, the upcoming U.S. elections are anticipated to further increase market volatility. This raises the question: what are today’s predictions regarding the cryptocurrency market? What can crypto stakeholders expect in the near future?

$118,701 hovers above $68,000, maintaining a key support level, which is currently a positive sign. As we approach the end of October, the upcoming U.S. elections are anticipated to further increase market volatility. This raises the question: what are today’s predictions regarding the cryptocurrency market? What can crypto stakeholders expect in the near future?

Cryptocurrency Market Insights

Mikybull’s analysis suggests that the total value of cryptocurrencies could reach up to $9 trillion. By comparing this figure to previous market cycles, analysts expect upward movements similar to past breaks. If this scenario unfolds, we could witness significant increases in altcoin values, potentially exceeding tenfold.

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

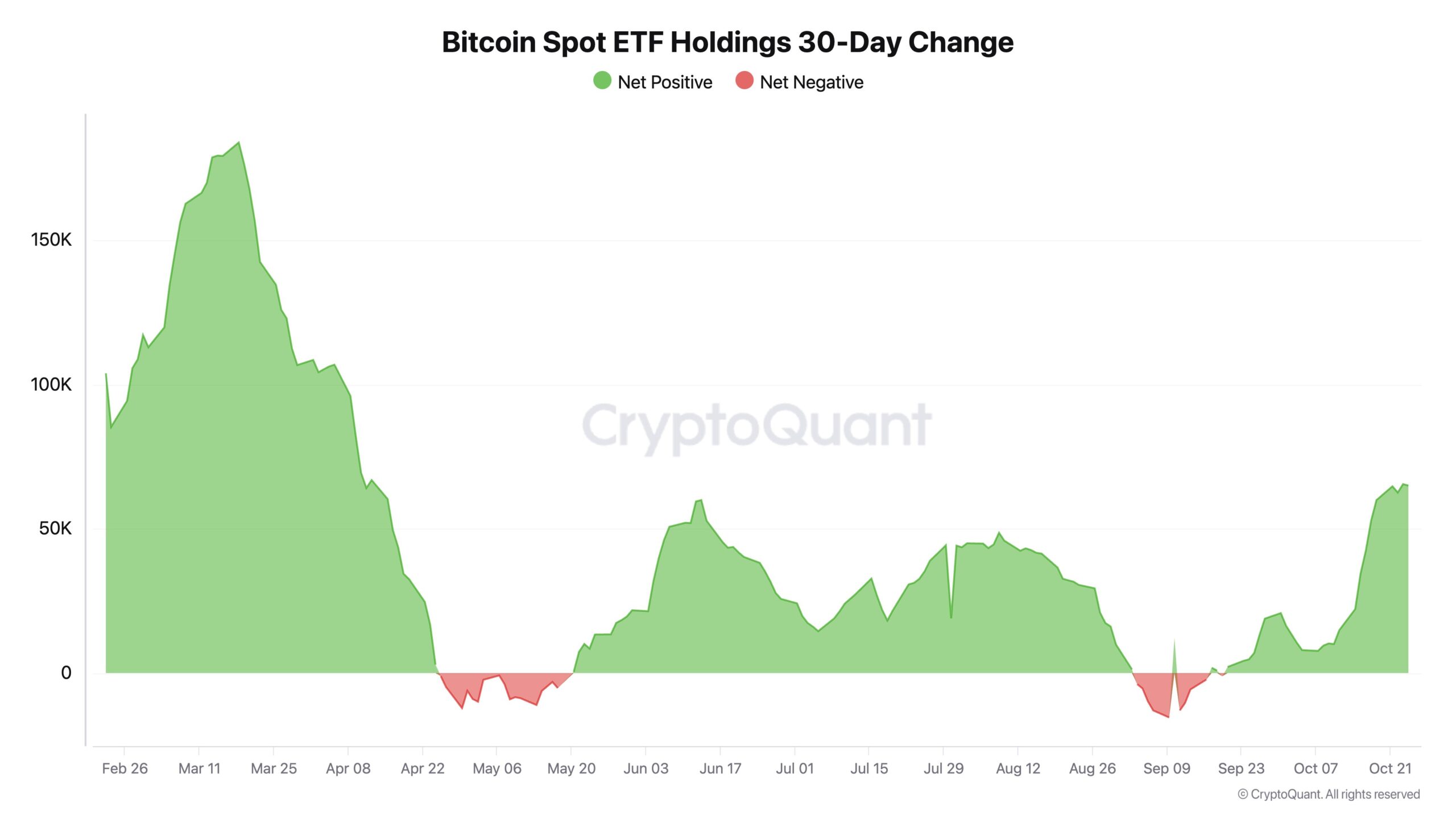

While BTC was above $68,000, it retreated to the $67,900 region as U.S. markets opened. However, the demand for U.S.-based spot Bitcoin ETFs has surged to 64,962 BTC in the last 30 days, indicating a strong interest beyond what the German government is selling. Furthermore, net flows have reached their highest level in six months.

The growing institutional demand confirms a strong bullish sentiment while contributing to a reduction in supply on exchanges. Approximately 2,000 companies currently hold BTC ETFs, marking a historical achievement for an ETF that hasn’t yet completed its first year.

Bitcoin and FLOKI Analysis

Jelle’s market analysis indicates that Bitcoin’s path has opened up following the breakout of two resistance levels. Although these resistances may be tested as supports, the analyst expects upward momentum to strengthen from here.

FLOKI Coin is also showing a strong bullish sentiment, having formed higher lows recently.

“FLOKI continues to make higher lows and has now turned the 200-day EMA into support. Patience is advised as Bitcoin is expected to make its significant move, ready to rally once it does.”

The daily chart indicates a target of $0.00033, above which new all-time highs should be achieved. The ongoing formation of higher lows confirms the bullish sentiment among investors, paving the way for new peaks.

Türkçe

Türkçe Español

Español