Market observers of the cryptocurrency space anticipate that the long-awaited potential approval of a spot Bitcoin exchange-traded fund (ETF) in the United States could lead to a sudden drop in Bitcoin supply in the market, as funds buy up as much as they can. Leading firms like Ernst & Young are expecting the SEC approval to trigger intense demand from institutions, but will the financial giants behind these ETF products leave any spot Bitcoin for the rest of us?

Famous Analysts Comment on Bitcoin

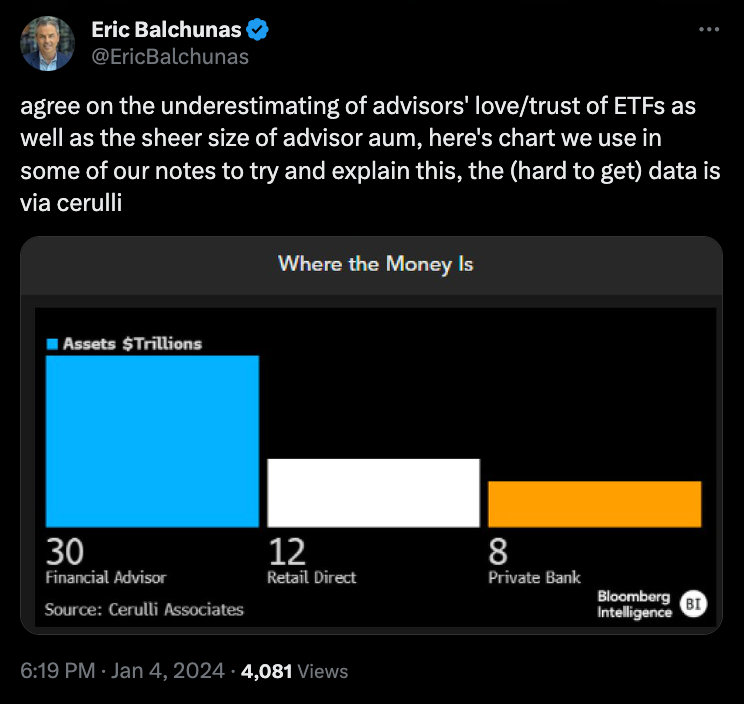

According to a prediction made in September 2023 by crypto entrepreneur and investor Lark Davis, a spot Bitcoin ETF product in the US could bring up to $30 billion in cash to Bitcoin. In such a scenario, Davis estimates that issuers of spot Bitcoin ETFs would need to purchase approximately 50% of all circulating Bitcoin to back their ETF products. However, many industry executives and analysts continue to share their thoughts on the difficulty of purchasing as much Bitcoin as possible for everyone. Valkyrie CEO Leah Wald commented on the issue:

“Theoretically, a company or government could try to buy a significant amount of Bitcoin, but buying up all circulating Bitcoin is not very practical, and we still have a significant amount of Bitcoin supply that has not been released.”

Wald explained that the Bitcoin supply is limited to 21 million, with 1.4 million yet to be mined. She further stated:

“Bitcoin’s decentralized structure and the fact that many owners may refuse to sell at any price create a natural barrier against monopolization.”

The Scarcity Principle and Bitcoin

Matt Hougan, Chief Investment Officer at Bitwise, which also applied for a spot Bitcoin ETF, believes that theoretically, no one can monopolize Bitcoin. He shares his thoughts on the matter:

“A fundamental economic principle, the Scarcity Principle, tells us that the price of a scarce good will rise to meet demand. In other words, if someone tries to corner Bitcoin, they will encounter increasingly reluctant sellers, and the price will continue to rise.”

Despite this belief, Hougan admits that someone could still corner a significant amount of Bitcoin. Samson Mow, CEO of Jan3, echoes Hougan’s stance, asserting that due to the extremely high prices fueled by products like a spot Bitcoin ETF fund, purchasing all circulating Bitcoin would be difficult:

“When there are fewer tokens ready for sale, the price people are willing to sell for goes up.”

Türkçe

Türkçe Español

Español