The cryptocurrency market‘s king, Bitcoin, conducted its first halving event 11 years ago today. As the community commemorates the anniversary of Bitcoin’s first halving event, they did not forget to revisit some of the historical turning points on the Bitcoin front before the next halving expected in April 2024. The first Bitcoin transaction took place approximately 15 years ago, just a few months after Bitcoin’s creator Satoshi Nakamoto published the Bitcoin white paper in October 2008, on January 3, 2009.

Halving and the Bitcoin Cycle

On November 28, 2012, three years and ten months after the mining of Bitcoin’s first block, the first halving event took place. According to data from StatMuse, Bitcoin was trading at $12 on November 28, 2012. Although the halving events and the cryptocurrency’s 21 million supply limit were not directly explained in Nakamoto’s published white paper, the document pointed to some mechanisms to control the new supply of Bitcoin. The following statements are in the white paper: “To compensate for increasing hardware speed and varying interest in running nodes over time, the proof-of-work difficulty is determined by a moving average targeting an average number of blocks per hour. If blocks are generated too quickly, the difficulty increases.”

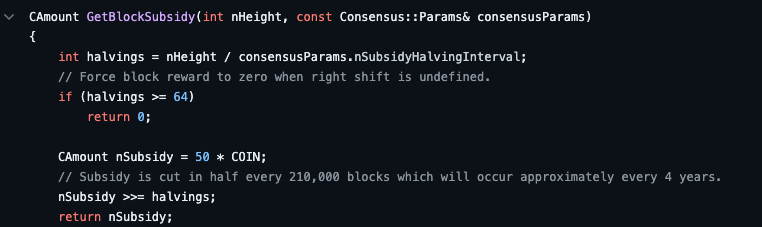

Unlike some of the basic information in the Bitcoin white paper, the source code of Bitcoin mentions the halving event. Especially the validation.cpp file found in the Bitcoin Core GitHub repository explains that the miner’s block subsidy will halve every 210,000 blocks, which will occur approximately every four years. The Bitcoin halving mechanism is programmed into the Bitcoin mining algorithm to take precautions against inflation by maintaining supply and demand.

The Impact of Halving on Bitcoin’s Price

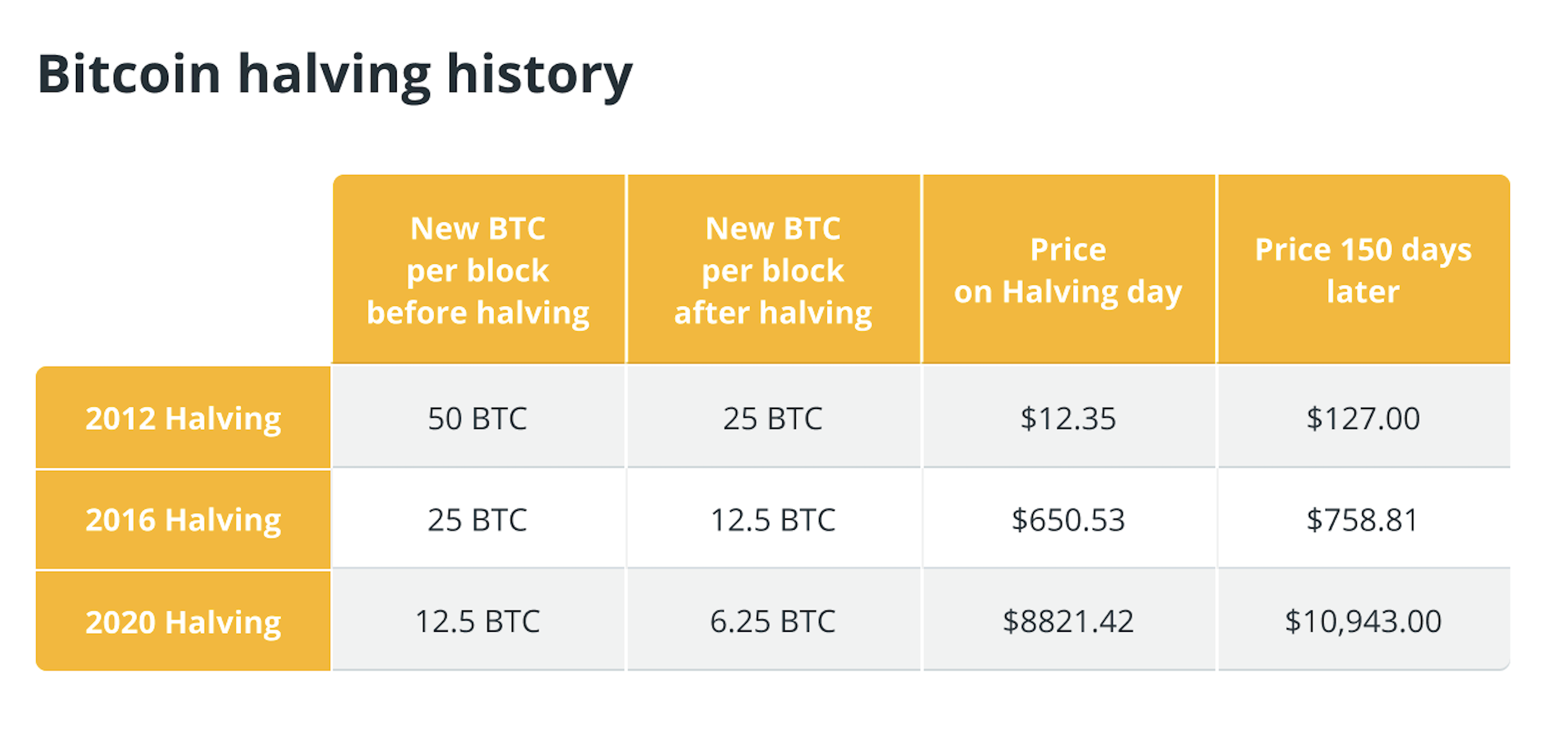

Before the first halving event, miners were paid up to 50 Bitcoins per block. After the first halving event in 2012, the reward was reduced to 25 Bitcoins. Then, with the second halving in 2016, the reward was reduced to 12.5 Bitcoins. The most recent Bitcoin halving event took place in 2020, and the block reward was reduced from 12.5 Bitcoins to 6.25 Bitcoins.

Because Bitcoin halving events significantly reduce the amount of cryptocurrency in circulation, the Bitcoin price cycle has historically been influenced by halving events. Just one year after the first halving event, Bitcoin rose to around $1,000, and following the second halving, a 350% increase was triggered over the year, with Bitcoin reaching its all-time high of approximately $20,000 in December 2017. After the third Bitcoin halving event, Bitcoin rose to $69,000 in November 2021, reaching its latest ATH level.

- Bitcoin’s halving events reshape its economics.

- Historical patterns show price surges post-halving.

- Halving impacts Bitcoin’s supply-demand balance.

Türkçe

Türkçe Español

Español