The king of cryptocurrencies, Bitcoin, is currently priced at $63,600 and continues the day with a 2% increase. Following weeks of negativity, BTC has managed to hold above the $60,000 mark despite setting lower resistance levels. Is a $95,000 target feasible given the current outlook?

Will Bitcoin (BTC) Price Increase?

Even during the exciting days of bull markets, Bitcoin’s price can experience significant drops. After a great first quarter, BTC is now undergoing one of these declines. The price, which fell below $60,000, managed to maintain a crucial support level. For now, bulls are preventing larger losses as the $65,000 resistance keeps new peaks at bay.

What do the indicators say? The Reserve Risk indicator is close to exiting the ideal green zone. Measuring the appetite and confidence of long-term investors, Reserve Risk suggests the price is at an attractive point, supporting a likely upcoming price increase.

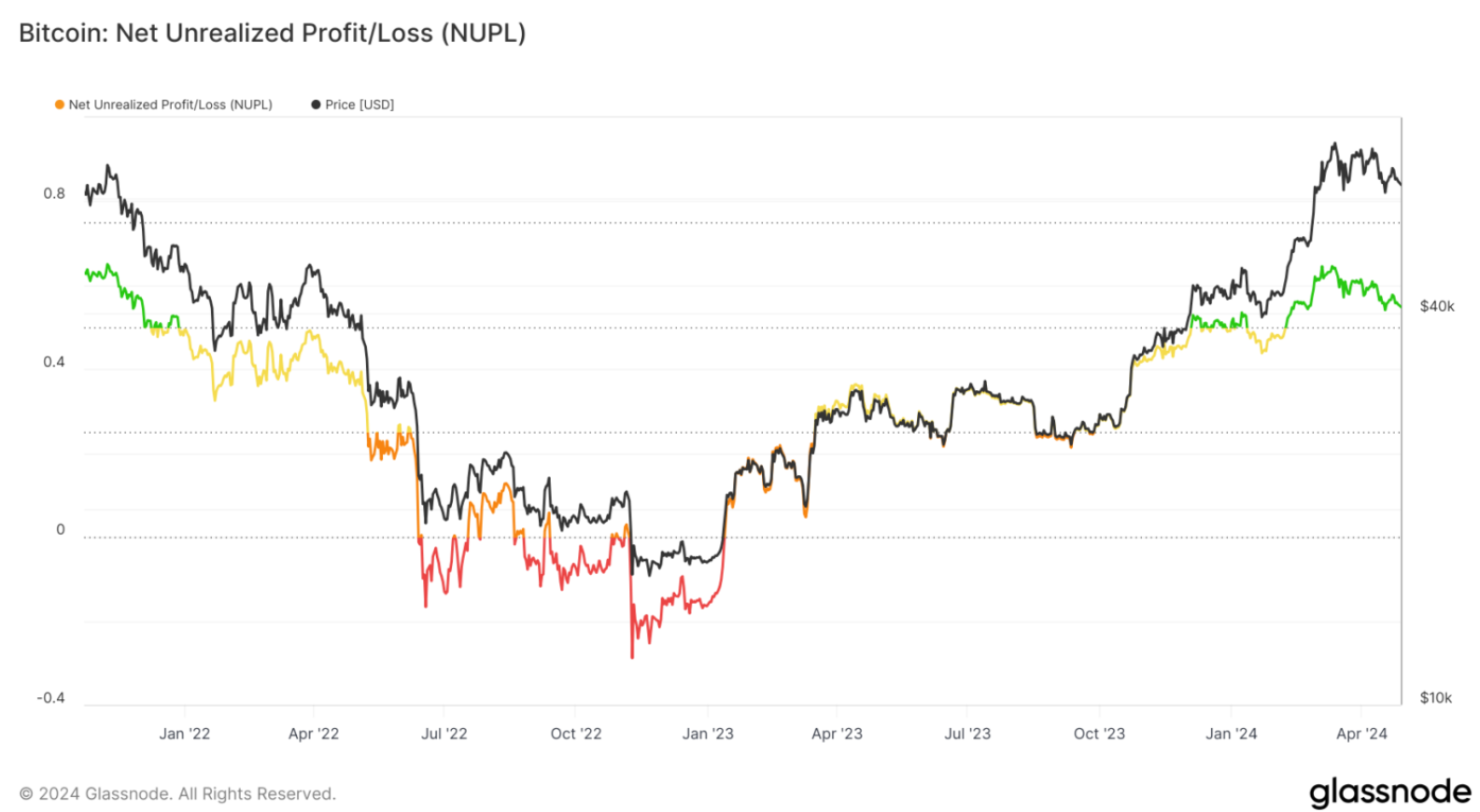

The Net Unrealized Profit/Loss (NUPL) indicator is also lingering in a zone that historically begins rallies. This indicates that if the Fed gives positive signals regarding easing, investors might be willing to bet on a rise.

What Will Bitcoin (BTC) Be Worth?

Following the last rally, the ongoing consolidation process has caused a flag formation on the chart, pointing to a significant target. The post-halving negativity and consolidation process might make for dull days, but as with previous cycles, this disheartening period will likely be forgotten with new highs. At least, that’s what historical data suggests.

The formation’s target indicates an increase of over 42% to $95,000. However, for this to occur, the BTC price needs to permanently surpass the $71,800 resistance and break free from this narrow range. If it fails to do so, closures below $63,000 could lead to weaknesses down to $61,000 and $58,000. Even if the uptrend continues, closures below $58,000 could signal longer dull days for Bitcoin.