Bitcoin, saw a price drop after a sudden reaction to geopolitical news, now trading at a lower level since April 25. Data from TradingView indicates that Bitcoin was trying to establish support at $64,000 before the Wall Street opening, following a decline to around $63,575 due to tensions in the Middle East.

What’s Happening with Bitcoin?

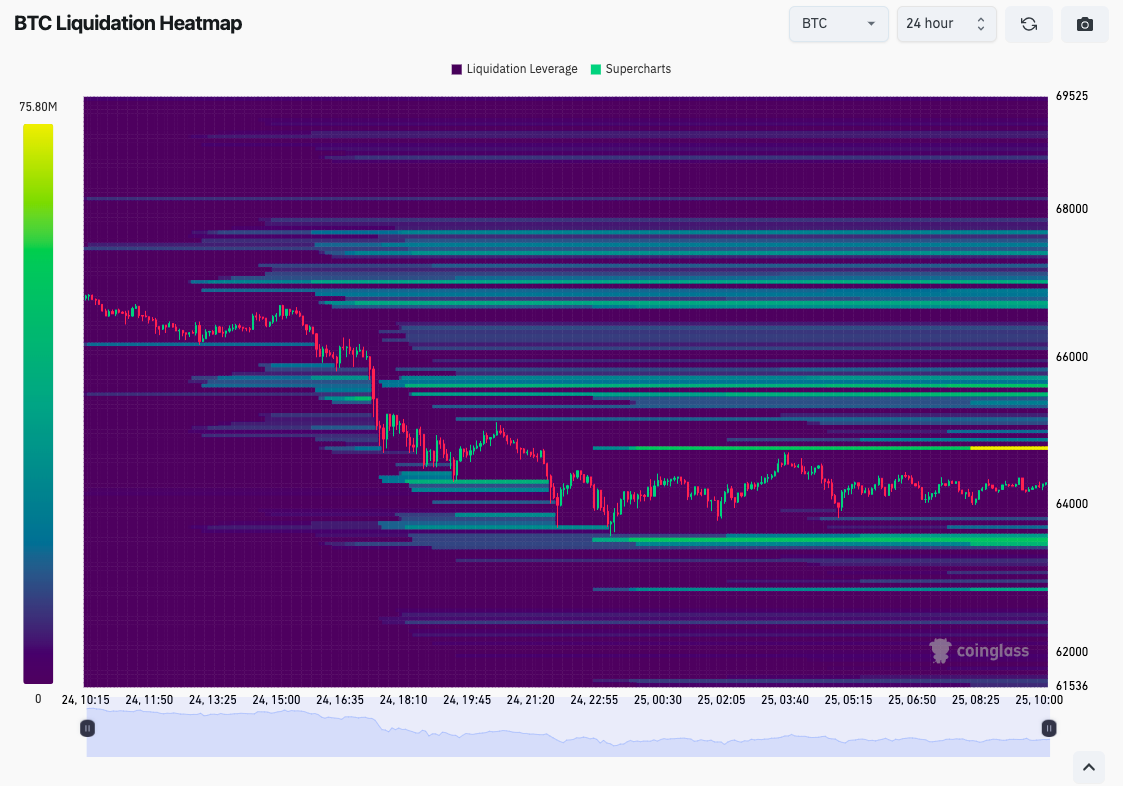

Blockchain data analysis platform CoinGlass reports an increase in liquidity on both sides of the spot price in crypto exchanges today. Notably, there was a liquidation of approximately $75 million between the levels of $64,765 and $67,700. On the downside, there was a relatively modest bid interest focusing on the local low of $63,500.

Bitcoin managed to fill one of the two recent futures gaps created by CME Group with its latest downturn.

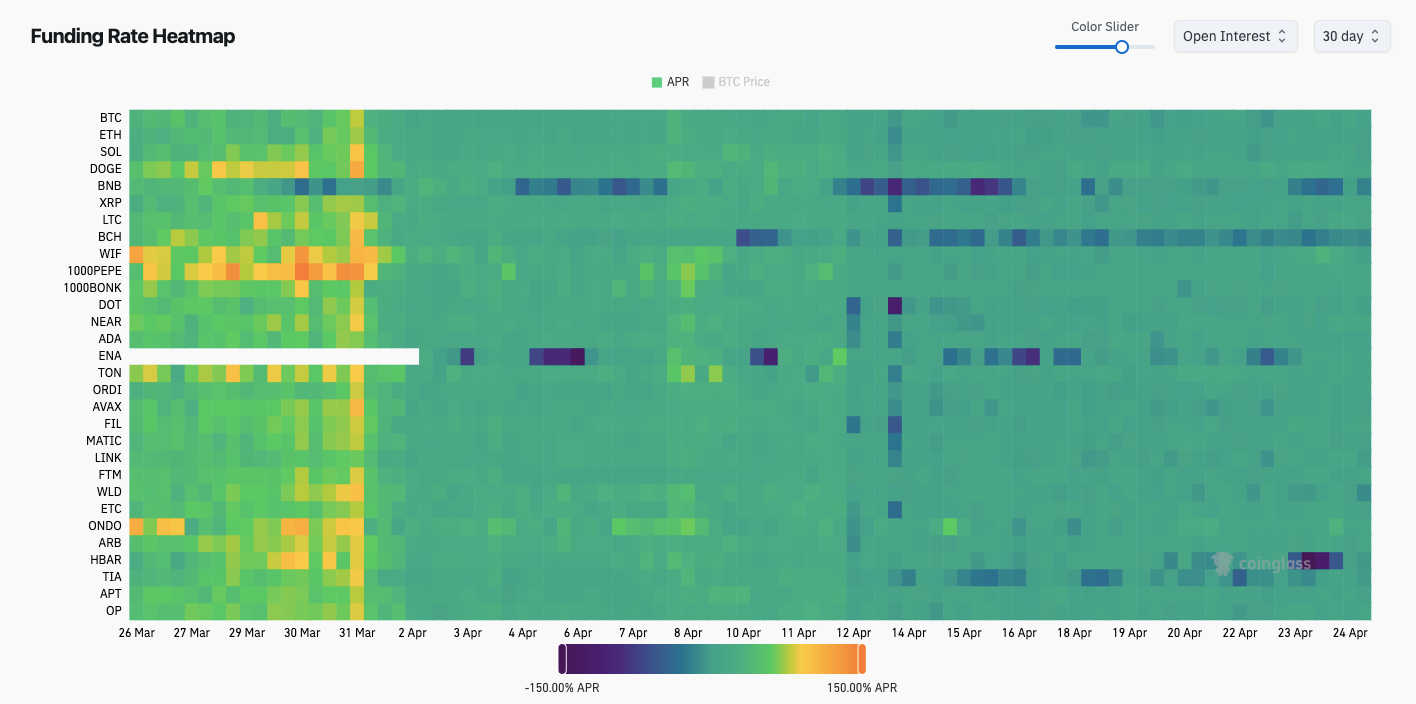

Commenting on the current situation, popular investor and analyst Daan Crypto Trades reiterated the healthy state of funding rates as a foundation for a slow but steady recovery in Bitcoin prices, sharing these words with followers via X alongside Coinglass data:

“Continue this way during the process and we should have a solid foundation to rise higher. I don’t want to see long tails coming back on the next best green candle.”

Key Details About Bitcoin’s Current State

In the latest edition of New York Color market updates sent to Telegram channel subscribers on April 24, trading company QCP Capital revealed a shift in crypto sentiment in lower time frames, stating in the report that the market expects a limitation on the rise and a short-term consolidation of the spot price.

“The market expects the rise to be limited and the spot price to consolidate shortly.”

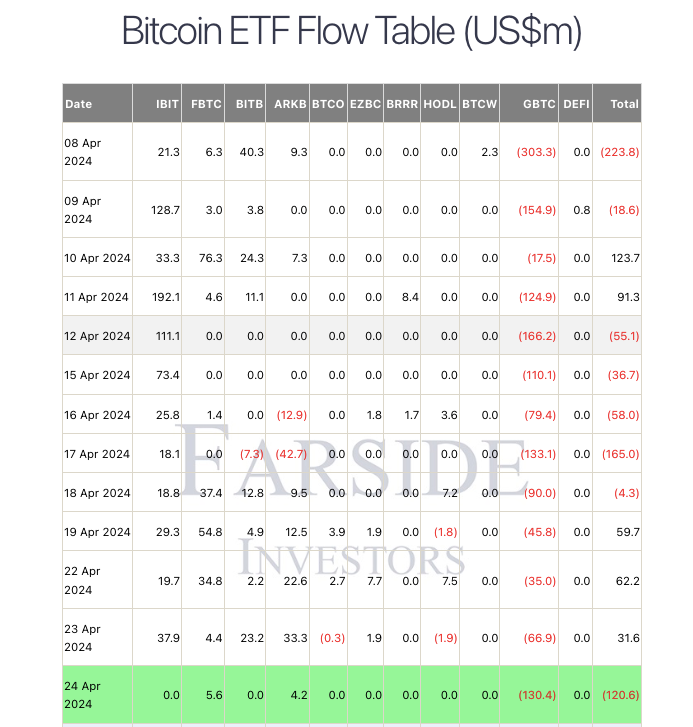

Meanwhile, the U.S.’s spot Bitcoin exchange-traded funds (ETFs) continued to see net outflows on April 24. During this period, the series of fund inflows into BlackRock’s spot Bitcoin ETF fund IBIT was disrupted after 71 days. The selling pressure was mostly due to outflows from Grayscale Bitcoin Trust (GBTC) and data from sources like the UK-based investment firm Farside.

Türkçe

Türkçe Español

Español