Bitcoin price found buyers at $63,800 after dropping to $59,678 about 12 hours ago. After the US market opened, BTC turned its direction upwards, reaching its daily peak. Following comments from Fed member Williams that the data wasn’t as bad as expected, will Bitcoin‘s rapid rise continue?

Has Bitcoin (BTC) Bottomed Out?

Short-term fluctuations are significantly impacting investors, and the losses in Bitcoin price have led to frustrating outcomes for altcoins. News of a postponed attack on Iran came late yesterday, and today, this development is said to have significant implications through the ETF channel. We are now in the midst of a rise, the continuation of which remains uncertain.

So, what scenarios do market experts predict for April, setting aside short-term movements?

Crypto Analysts Offer Predictions

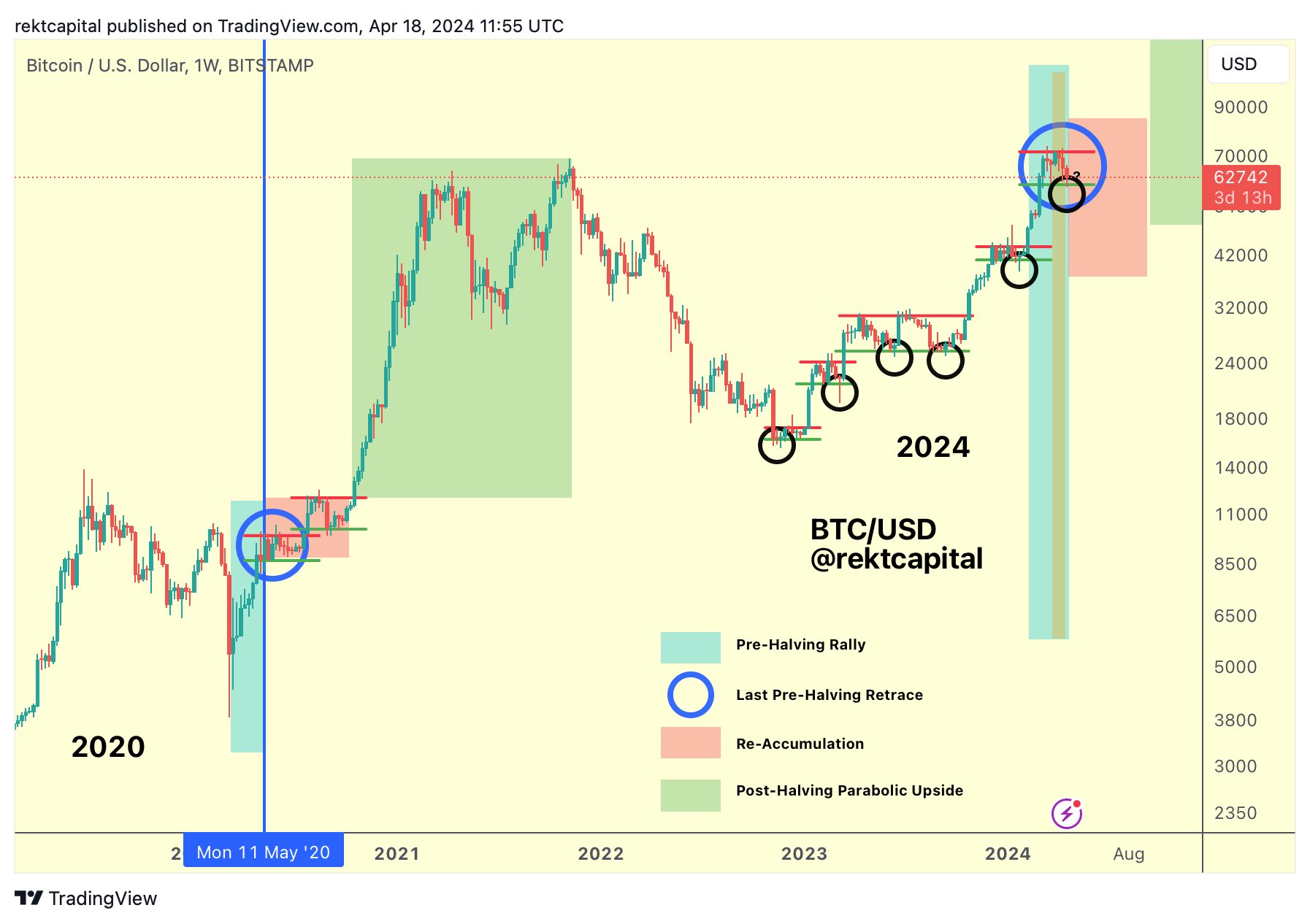

Famous for predicting many major movements, Rekt Capital talks about a “reaccumulation range” that will match the price behavior of BTC/USD. This cycle is different, and the approval of US-based ETFs brought early price peaks. Rekt Capital wrote;

“One of the most important things to note about Bitcoin’s Reaccumulation Ranges during this cycle is this: Downward wicks below the Range Bottoms tend to appear to trick investors into a fake crash (black circles) before continuing the uptrend.”

According to him, there is not much to worry about. Analyst known as Jelle commented;

“Bitcoin simultaneously tested the 3-day RSI 50 level and the 3d 33EMA. This last happened earlier this year at $38,000. I am quite confident the outcome will be similar: prices will rise further.”

Popular crypto commentator Poppe remains optimistic. While many of his predictions have been discarded, considering the trend is upward, his views are significant, and he wrote;

“A boring period for Bitcoin, eager to consolidate here. Overall, I don’t think this will change in the coming months, but I believe we have found the bottom in altcoins.”

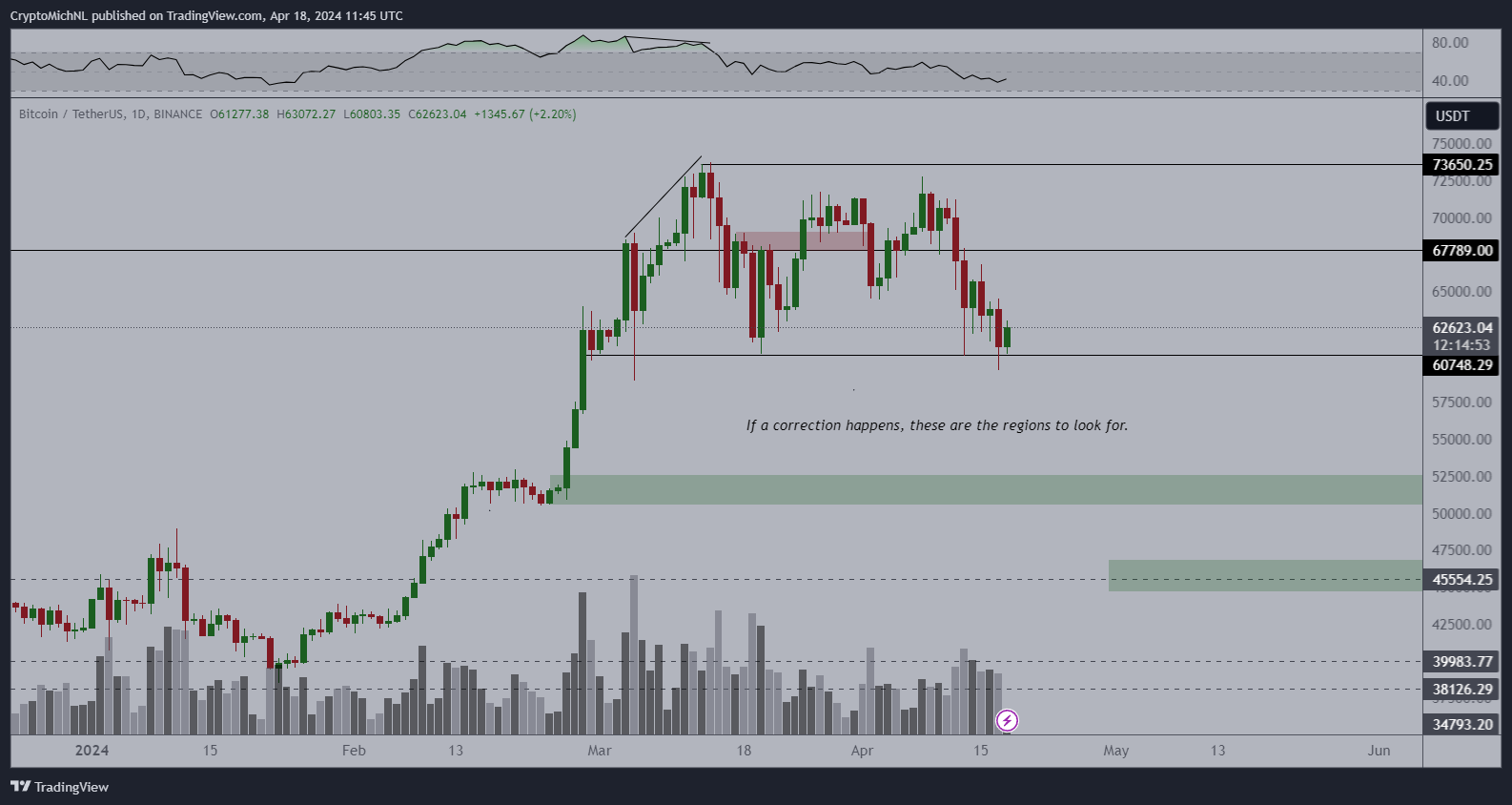

If a downturn occurs, Poppe’s bottom targets are $52,000 and $45,000.

Türkçe

Türkçe Español

Español