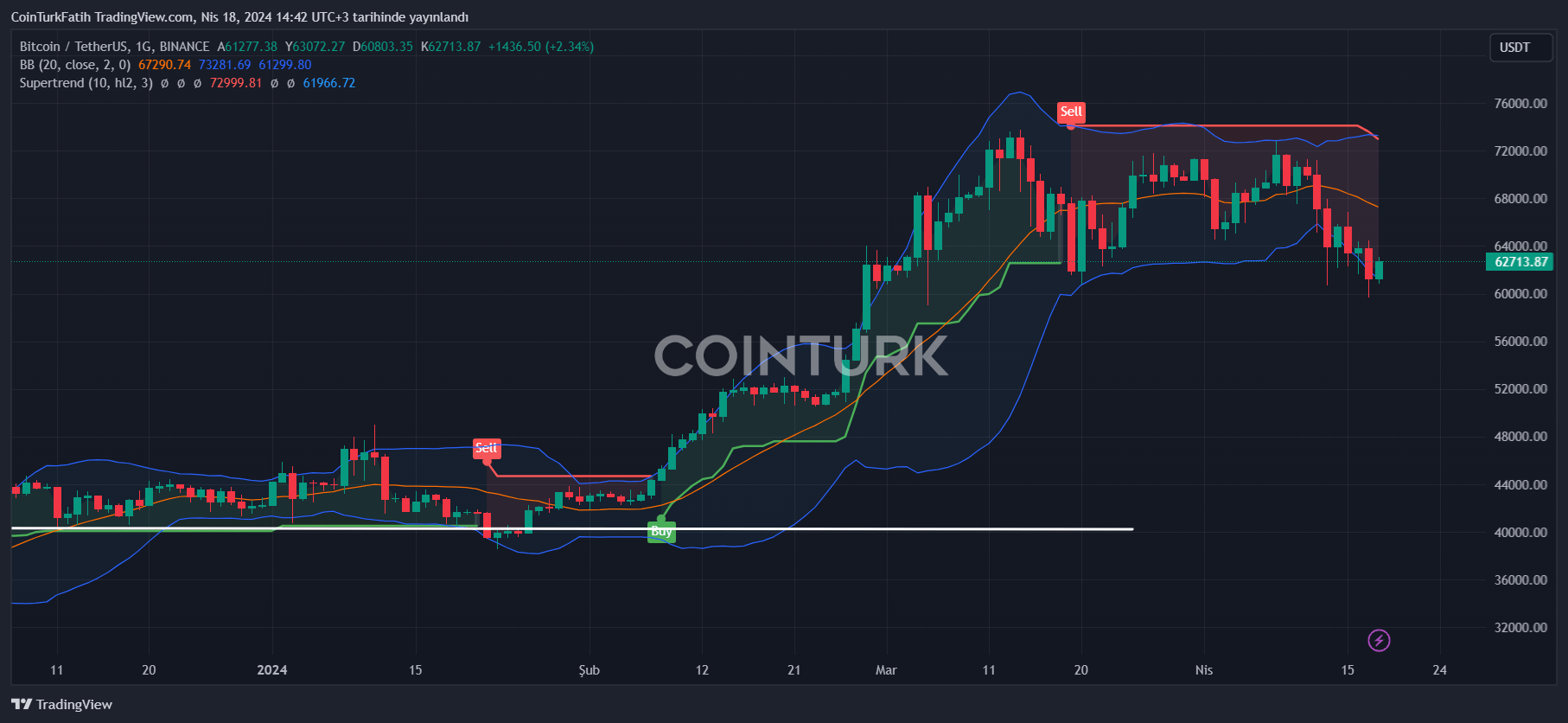

Bitcoin price is currently finding buyers at $63,000, having dropped to as low as $59,678 in the last 24 hours. As this article is being prepared, BTC has climbed back to $63,000, facing several challenges this week. What is the current market situation with roughly 2 days to go until the halving?

Why Aren’t Cryptocurrencies Rising?

Bitcoin‘s price is being suppressed due to diminishing optimism over interest rate cuts, a strengthening US dollar, and geopolitical tensions. Recent statements by Powell suggested that interest rates could be kept at their peak for a longer period. On Tuesday, Powell spoke at a forum in Washington, stating that the US central bank may not reach its 2% inflation target as soon as anticipated.

“Currently, considering the strength of the labor market and the progress made in inflation so far, it would be appropriate to allow more time for restrictive policy to work and let the data and evolving outlook guide us.”

The scenario expected at the beginning of 2024 pointed to a rate cut in the March meeting. However, no rate cut is expected before the September meeting now. The markets have been talking about dampening excessive optimism for months, and this situation is not much of a surprise.

Cryptocurrency Predictions

According to Rennick Palley, co-founder of Stratos, the current period makes the fluctuating course of BTC prices meaningful. Historically, BTC prices have shown significant volatility before the halving. Moreover, there is another detail that makes the 2024 cycle different. BTC broke all-time records much earlier than expected due to several positive developments.

Since the ATH came surprisingly early, price corrections could be considered normal. Palley worries about “stubborn inflation and fewer interest rate cuts this year causing challenging winds in crypto and other risk markets for some time.”

Still, he expects the current trend of central banks to have long-term consequences for Bitcoin.

“Longer-term higher inflation, due to strict monetary policies from the Fed and other central banks around the world continuing to print money, positions Bitcoin well.”

Historically, Bitcoin prices reach the real cycle peak 12-18 months after the halving. Thus, investors might have more time to adjust their strategies accordingly.

Türkçe

Türkçe Español

Español