As the crypto market continues to experience significant drops ahead of the Bitcoin halving, the approval of spot Bitcoin ETFs and Ethereum ETFs in Hong Kong has created a positive sentiment among Bitcoin (BTC) investors.

Spot Bitcoin ETF Predictions

Following the approval, the forecasts were notable. It is thought that Bitcoin ETFs could generate up to $25 billion in inflows in their first year on the market.

Despite this optimistic sentiment, Peter Schiff highlighted uncertainties about the growth of Bitcoin ETFs in his latest X (formerly Twitter) post and added:

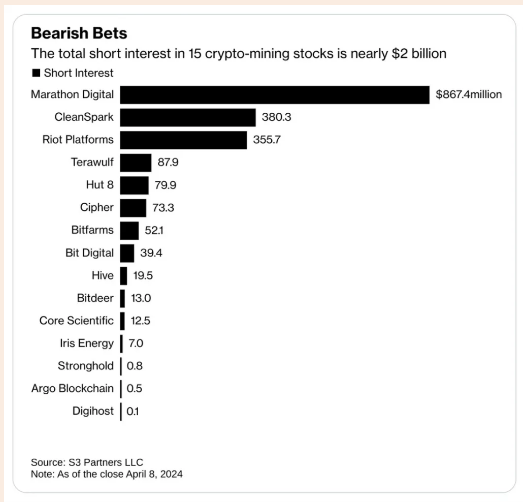

If Bitcoin ETFs really lift Bitcoin to $100,000 or more, why are all related stocks in a bear market? For example, $COIN down 21%, $GLXY down 26%, $MSTR down 33%…

The Future of Bitcoin

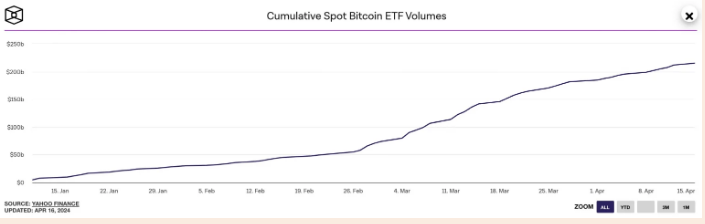

According to data provided by CoinMarketCap, BTC’s price chart has brought many breakdowns. Despite these, data from The Block shows that the total spot Bitcoin ETF volume chart continues to move upwards.

These reviews raise several questions. Whether the upcoming BTC halving is the real reason behind the recent price movements is a matter of curiosity. In an interview with LizClaman, Anthony Pompliano stated:

Bitcoin is a global alarm system. It leads all assets in a crash and accelerates during upswings.

This situation once again highlights the difference in opinion between bullish and cautious investors.

Optimists expect a price increase due to the upcoming scarcity, while skeptics fear a decline due to miners being rewarded less.

The emotional conflict seems to be further confirmed by the current market facing high volatility.

On the other hand, opinions are rapidly growing that BTC miners could face significant losses after the halving, and according to Barchart, the downtrend could be further fueled.

BTC Price Movements

In an interview with Bloomberg, Cryptocom CEO Kris Marszalek commented on the upcoming Bitcoin halving.

Bitcoin sales may become clearer as the so-called halving date approaches, but the event is set to support the price of the largest digital asset in the longer term.

Commenting on the ongoing process, Ash Crypto summarized how BTC has seen significant price increases after each halving event:

Bitcoin pumps intensely after each halving.

- 2012 halving: 9900%

- 2016 halving: 2900%

- 2020 halving: 700%

But this time, something interesting will happen.

Türkçe

Türkçe Español

Español