Crypto currency world is experiencing the excitement of halving today. Only hours are left. Bitcoin miners’ rewards will decrease from 6.25 BTC to 3.125 BTC. Reports have started coming in prior to this development. CoinShares aims to update and inform investors about the risks and opportunities facing the Bitcoin mining sector in its report. Let’s take a closer look at the details of the report.

CoinShares Releases Bitcoin Mining Report

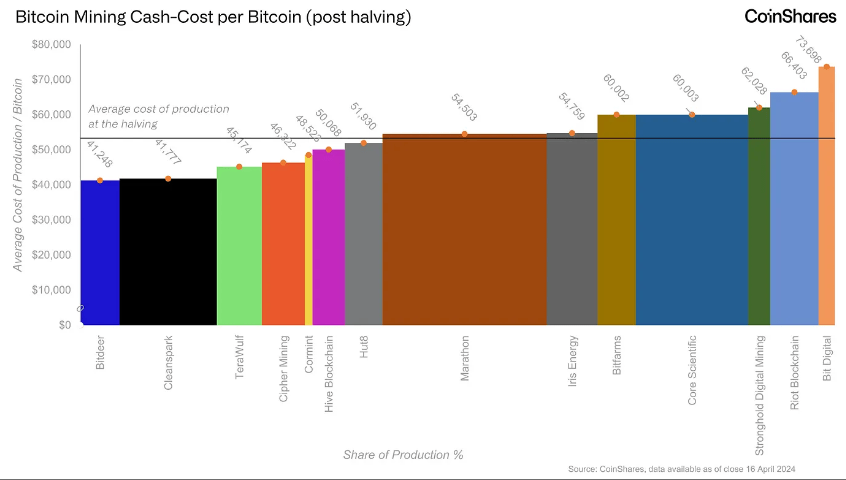

CoinShares stated that its data was primarily updated based on figures reported in the fourth quarter of 2023. It was emphasized that the average production cost per Bitcoin among listed mining companies is currently about 53,000 US dollars.

Companies like BitDigital, Hive, and Hut 8, which are already generating revenue from artificial intelligence, expect a shift towards AI in energy-secure locations due to higher revenue potential, as highlighted in the report.

According to the report, this trend shows that while investment in AI is increasing in more stable locations, Bitcoin mining could increasingly move to grounded energy fields. Companies like TeraWulf, BitDigital, and Core Scientific have current AI operations or plans for AI growth.

Emphasis on Hash Power and Prices

CoinShares predicts that their models’ hash power will rise to 700 Exahash by 2025, but could drop by up to 10% after the halving as miners shut down unprofitable ASICs.

Hash prices are expected to halve after 2024 to $53/Ph/day.

Electricity Costs to Double

The report indicated that due to the halving, electricity and overall production costs are expected to nearly double, leading to significant cost increases. Key mitigation strategies include optimizing energy costs, enhancing mining efficiency, and securing favorable hardware supply conditions.

According to the report, miners are actively managing their financial obligations, and some are using substantial cash to significantly reduce their debts.

Bitcoin Price Rises Before Halving

The price of Bitcoin saw a level of $59,600 during the night hours before quickly recovering. We see the BTC price surpassing the $65,000 level as of writing this article. This situation can be considered a reflection of the recent volatility experienced in the Bitcoin price.

Post-halving, a report published by JPMorgan analysts predicted that the BTC price could drop after the halving.

Türkçe

Türkçe Español

Español