Bitcoin has been closing below $69,000 for a while, which is frustrating. After closing at lower levels, the price dropped to $59,600 before rising again to $66,000. Is the current situation in the spot Bitcoin ETF channel supportive for BTC?

Spot Bitcoin ETF

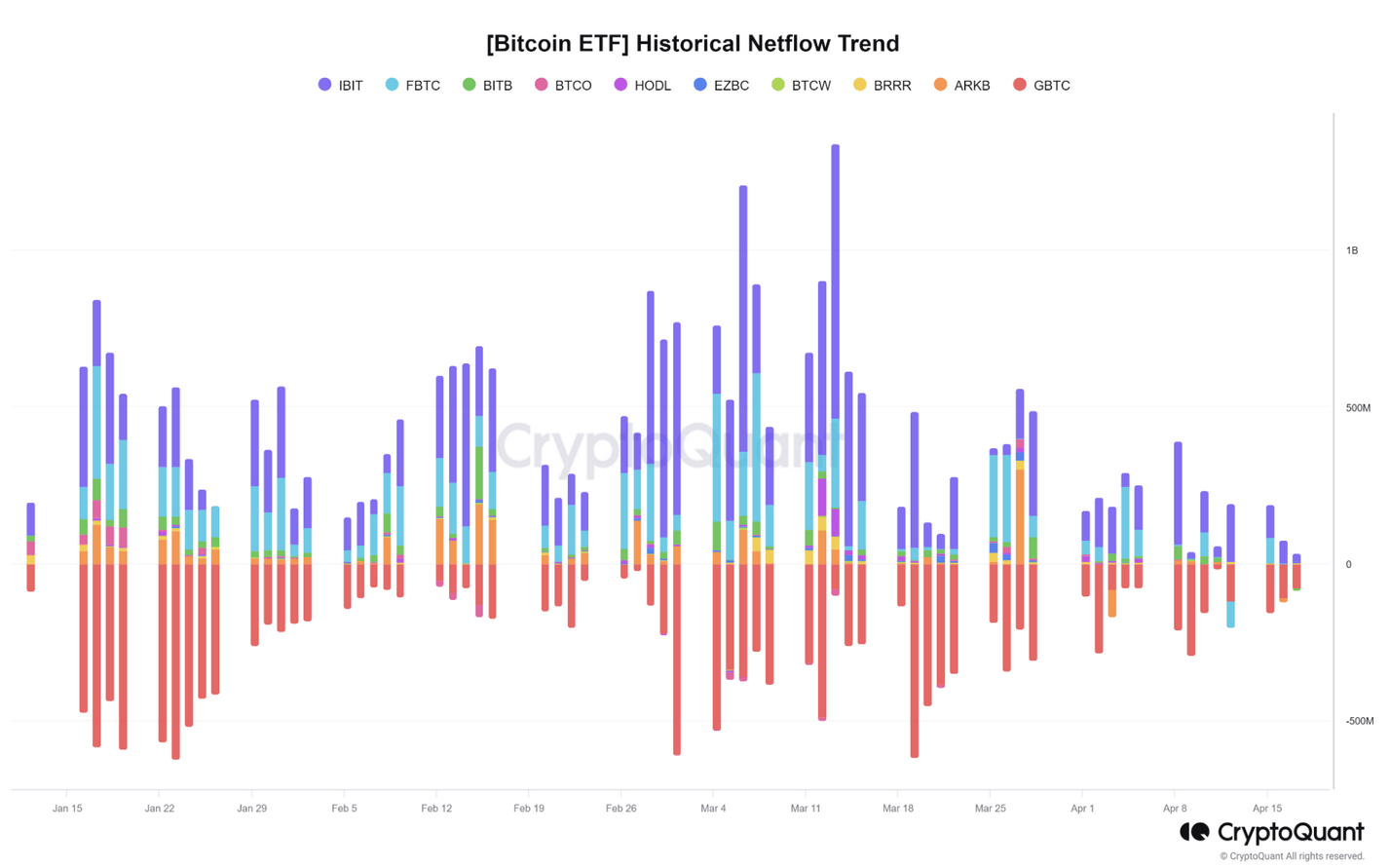

With their launch in January, Spot Bitcoin ETFs have become a closely watched indicator for institutional investors. These ETFs have seen nearly $13 billion in net inflows in a few months, helping to steadily increase market prices. In fact, they reached an all-time high (ATH) level for the first time before a halving event.

Halving and ETF demand, when read together, suggest that experts believe the real supply shock period should now begin. They are both right and wrong in this view. On some days, daily issuance sees demand 40 times higher than today, while recently it has returned to break-even levels.

The latest statement from Grayscale indicates that institutional GBTC sales have ended and exits will calm down. The only problem is that this needs to inject optimism to increase entries during a period when geopolitical tensions are gripping risk markets.

When Will Bitcoin Hit a New Peak?

Bitfinex’s derivatives director Jag Kooner says recent slowdowns in entries are not so significant because they will soon increase. Today, we have the opportunity to see the validity of this prediction. This week, the macro outlook is positive and geopolitical tension has weakened. If today’s ETF entry is as positive as last Friday’s, the first signal will have arrived. Kooner stated;

“The decrease in entries and significant exits are not related to the halving event, but rather to the current SPX and Nasdaq downturn and geopolitical tensions. Bitcoin ETFs are ‘an alternative investment’ or a smaller part of large TradFi [traditional finance] investment portfolios. The current situation is likely a result of rebalancing these portfolios and reducing exposure to high-risk assets.”

CryptoQuant’s CEO Ki Young Ju also says that after a temporary weakness, demand should strengthen within 6 months. If it goes as expected, we should start seeing hundreds of millions of dollars re-entering the ETF channel and BTC could reach $80,000.