Satoshi Nakamoto Bitcoin was created with the future in mind, taking significant steps. This still unidentified individual had implemented several measures to counter Bitcoin inflation, one of the most crucial being the Bitcoin halving. With each halving, miner rewards are cut in half every four years, consequently reducing the amount of BTC obtained.

How Long Until the Next Bitcoin Halving?

The entire world seems to be watching when the next Bitcoin halving will occur. According to sources, there are less than 20 hours left until the halving. Also, looking at the remaining blocks, there are 128 blocks left before the halving.

While all this is happening, the price of Bitcoin also started to decline following news of new tensions between Israel and Iran. BTC, which was at the level of 63,000 dollars, dropped below 60,000 dollars within minutes but later recovered slightly to a level of 61,700 dollars.

During this period, Bitcoin’s market cap experienced a 0.5% decrease and is trying to hold above 1.2 trillion dollars. On the other hand, there was a slight increase in the 24-hour trading volume. After a 0.64% increase, BTC’s 24-hour trading volume was at 42.6 billion dollars.

What Could Happen in Bitcoin?

The Bitcoin halving has occurred three times in history so far. Each time, significant market movements were observed. Particularly, these halvings had effects on altcoins as well. The first three occurrences had the following impact on prices:

- 2012 halving: +9900%

- 2016 halving: +2900%

- 2020 halving: +700%

It’s beneficial for investors to remember that these price movements occurred within just one year after the halving. Given past rises, the upcoming halving is also expected to be of great significance.

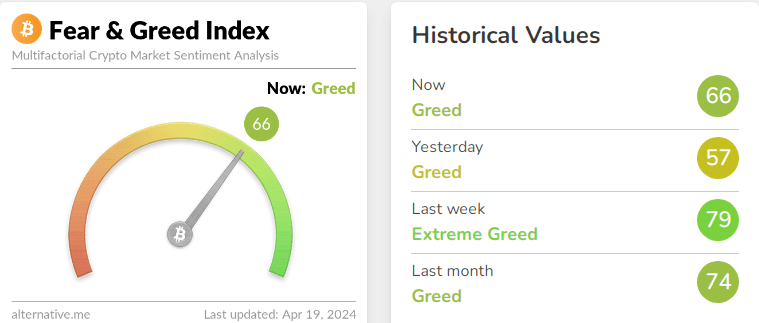

On the other hand, eyes are now turned to the Fear & Greed index. The index, which had dropped to 57 yesterday, has risen back to 66 today, suggesting that investors are becoming more eager to re-enter the market.

Considering the three halvings that have occurred, it is anticipated that prices could reach new highs by 2025. However, due to ongoing geopolitical events and policies worldwide, the future price remains uncertain.

Türkçe

Türkçe Español

Español