Bitcoin price is currently at $66,000, having recently dropped to $66,230 in the last 24 hours. Altcoins are generally positive. Could cryptocurrencies initiate a significant rise today? What are the current market conditions and expectations? Here are the details.

Bitcoin (BTC)

As of April 22, S&P 500 futures rose by 0.33% to 5031 points. We discussed yesterday that this week would be very active in terms of earnings reports. If companies like Microsoft, Alphabet, Tesla, and others report positive earnings, it could positively impact both the stock market and cryptocurrencies. Previous quarter data also indicated an increase in the crypto market.

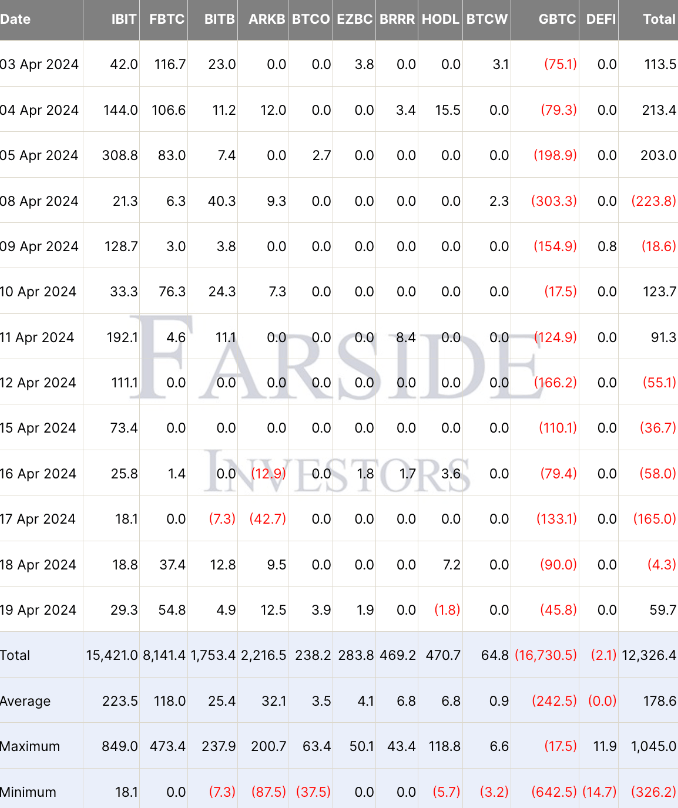

According to Bloomberg’s latest Markets Live Pulse survey, two-thirds of the 409 participants believe that these earnings reports will boost the stock markets. The main reason for today’s recovery is the resumption of net entries into spot Bitcoin ETFs. After seeing a $60 million investment on April 19, the funds showed a recovery signal following a $319 million outflow over seven days.

The acceleration of entries reflects a recovery sentiment among professional investors following recent declines. If things go as expected, Bitcoin could return to $69,000 alongside the earnings reports of major tech companies.

Cryptocurrencies Could Rise

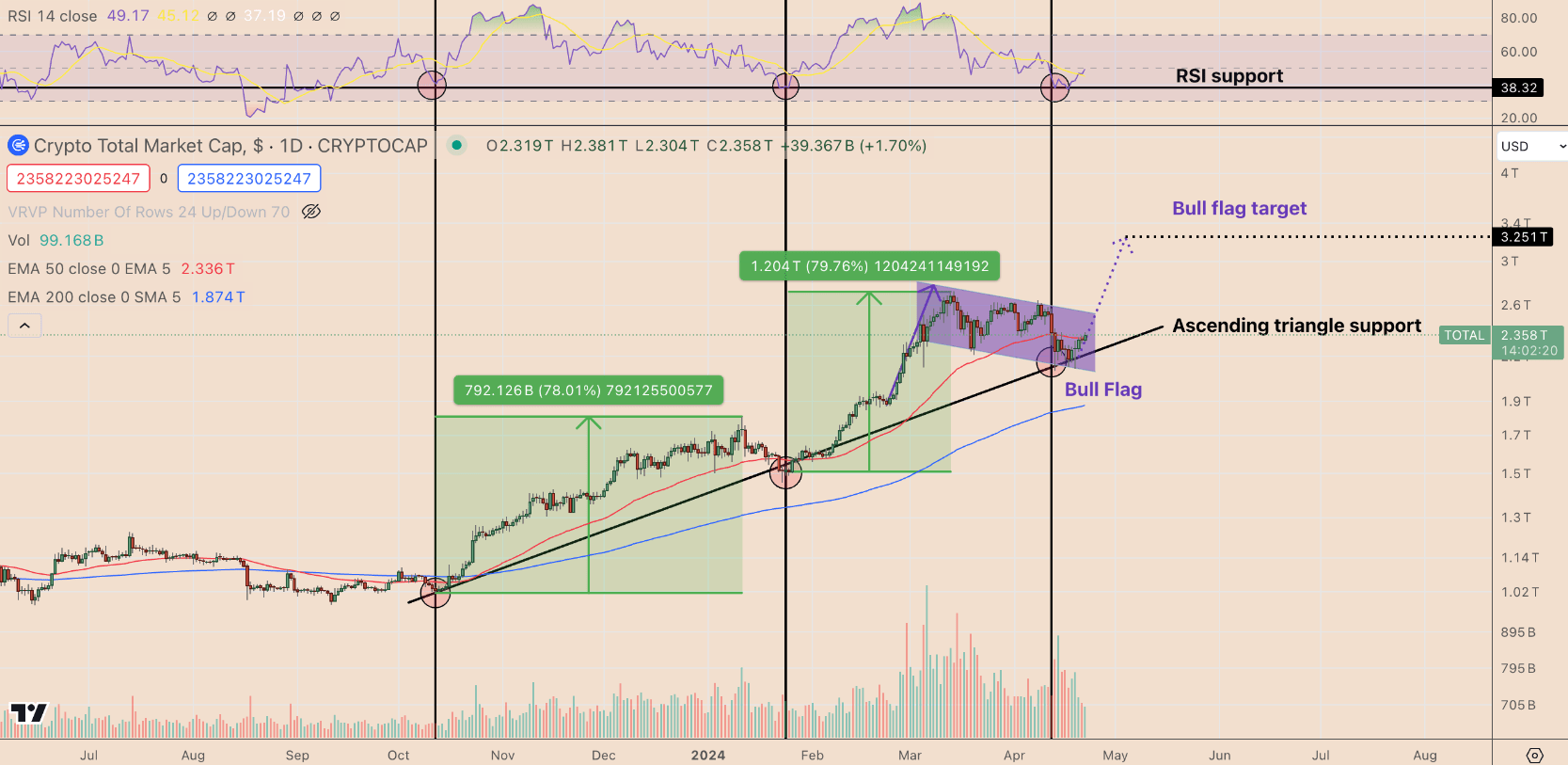

Investors are hopeful about the upcoming PCE data on Friday. This leading indicator for inflation has been steadily decreasing, which could ease macroeconomic pressures if it continues. On the other hand, the cumulative value graph of cryptocurrencies shows a bull flag, indicating a continuation of the rally.

This continuation pattern targets higher peaks when the price crosses above the upper trend line. The technical indicator aims for a new peak at $3.25 trillion. Thus, altcoins could achieve double-digit gains, while some exceptions may see interesting rises of 5-10 times.

The long-term upward trend in the total market value graph also promises accelerated rallies post-halving. Typically, cryptocurrencies reach new historical highs within 12 or 18 months after each halving event. The RSI also confirms growth potential as it is in the oversold region.

Türkçe

Türkçe Español

Español