Cryptocurrency investors eagerly awaited the interest rate decision, and the Fed has now announced it. Investors, confident that rates would remain unchanged, focused on the details of the announcement and the members’ three-year average interest rate forecasts. So, what were the decisions, and where will the market move now?

June 12 Fed Interest Rate Decision

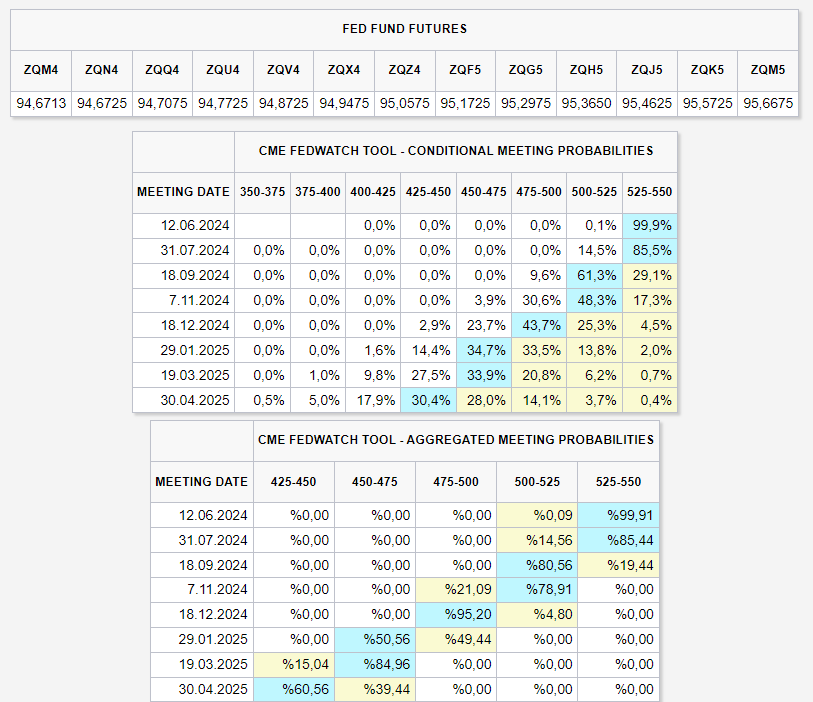

Bitcoin, gold, the dollar, silver, and all markets were keenly awaiting today’s news from the Fed. At the beginning of the year, members who predicted a 75bp cut by year-end opposed the market’s 150bp rate cut scenario. However, poor inflation data in the first quarter and fluctuating signals from the employment front caused these expectations to drop to 50bp levels.

Now, signals about whether the Fed will make its first cut in September or earlier were sought in these statements. Last month, after some members commented that the cut might be delayed or even require a bit more tightening, investors experienced days of emotional turmoil. Meanwhile, the Bank of Canada and the European Central Bank made their first rate cuts by 25bp.

Half an hour later, Powell will make important statements, and here are the key summary points you need to know about today’s interest rate decision:

- Fed kept interest rates unchanged.

- Fed doesn’t find it appropriate to reduce the policy target range until inflation sustainably moves towards 2%.

- Fed members’ median interest rate forecast for the end of 2024 is 5.1% (previously 4.6%).

- Fed: Inflation has decreased but remains high.

- Fed: Risks towards achieving policy goals have moved towards a better balance.

- Fed: The economy continues to grow at a solid pace, employment increases are strong, and the unemployment rate remains low.

- Fed projections foresee a 25 basis point rate cut from the current level in 2024 and a 100 basis point cut in 2025.

- Fed: We will continue to reduce our holdings of Treasury securities and mortgage-backed securities.

- According to Fed projections, 4 out of 19 officials do not foresee a rate cut in 2024, while 7 foresee one cut, and 8 foresee two cuts.

- Fed members revised the 2024 year-end PCE from 2.4% to 2.6% and core inflation from 2.6% to 2.8%.

- The 2025 PCE and core PCE inflation were revised from 2.2% to 2.3% according to March member forecasts.

- Fed members see GDP growth at 2.1% and the unemployment rate at 4% in 2024; both unchanged from March.

- Fed: We don’t find it appropriate to reduce the policy target range until inflation sustainably moves towards 2%.

Türkçe

Türkçe Español

Español