During a recent address, Bitcoin (BTC)  $119,105 reached a critical level of $86,000 but failed to surpass it. The Federal Reserve (Fed) was evaluating three potential scenarios: maintaining a hawkish stance due to inflation risks, concluding quantitative tightening (QT), or adopting a more dovish approach. Ultimately, the decision reflected a balance between these positions, raising questions about the implications for cryptocurrency.

$119,105 reached a critical level of $86,000 but failed to surpass it. The Federal Reserve (Fed) was evaluating three potential scenarios: maintaining a hawkish stance due to inflation risks, concluding quantitative tightening (QT), or adopting a more dovish approach. Ultimately, the decision reflected a balance between these positions, raising questions about the implications for cryptocurrency.

Fed and the Economy

Fed Chairman Powell emphasized the economy’s resilience while signaling that there would be no rush to cut interest rates. He dismissed excessive fears from consumer sentiment data, asserting that tangible economic indicators appear to be much healthier. Despite increasing recession forecasts, Powell pointed towards a stabilization in economic conditions.

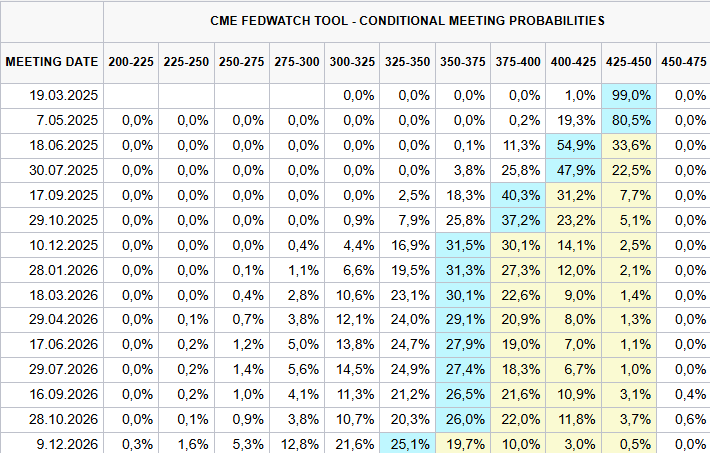

The Fed recently revised growth projections down to 1.7% from December’s 2.1%, along with upward adjustments to unemployment rates. This suggests that in scenarios where job losses escalate, the Fed may act more swiftly regarding interest rate cuts. Expectations indicate a slowdown in inflation by 2026 and 2027, with the Fed expected to significantly reduce its asset reduction strategy following a rise in the federal debt ceiling.

Impact on Cryptocurrencies

The current scenario for cryptocurrency investors is encouraging, as the Fed is easing its tightening measures, indicating a path towards the end of QT. For the cryptocurrency markets to stabilize, a complete cessation of tight monetary policy is essential, and tariffs may compel the Fed to act within this year. The upcoming data before the May meeting will clarify QT expectations.

Anticipation now turns to the customs tariff announcement on April 2, which could mark a significant day, potentially opening new avenues for relaxation in cryptocurrency markets. For now, the outlook appears more optimistic.

Türkçe

Türkçe Español

Español