As this article is being prepared, Fed member Bowman is making important statements, and the latest data make them significant. On the other hand, we will learn about the new Fed interest rate decision in about 22 days. The stance that Powell will adopt at the upcoming meeting and how the Fed interprets the incoming data are very important. So, what did Bowman say?

Fed Statements

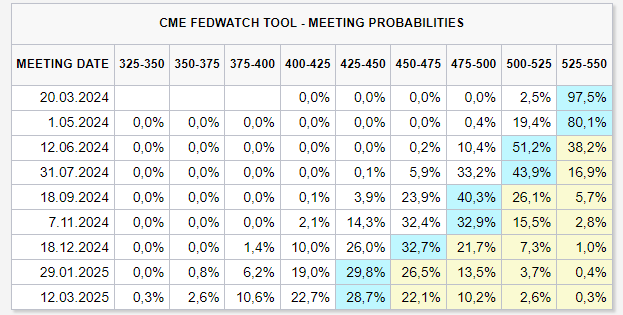

At the March meeting, the expectation for the Fed‘s interest rate decision was to keep it steady. While a reduction was 80% likely at the beginning of January, the current situation has shifted to no change. Moreover, the expectation for the first rate cut has moved to the July 31 meeting. Even for the June meeting, there is a 61% probability of a cut.

Bowman said the following while the article was being prepared; Crypto Traders Are Rushing to This App – Here’s Why You Should Too

“I expect inflation to fall further with the policy rate being held steady, but I see upward inflation risks. The latest inflation data indicates a slower progression in inflation. Economic activity and consumer spending are strong, the labor market is tight. The Fed’s monetary policy stance is restrictive and appropriately calibrated. If inflation moves sustainably towards the 2% target, it will eventually be appropriate to lower interest rates; we are not at that point yet.

If the progress in inflation stalls or reverses, I continue to be willing to raise the policy rate. Lowering the policy rate too early could lead to the need for future rate hikes. I will continue to be cautious regarding monetary policy.”

The CEO of Goldman warned against excessive confidence in the United States’ ‘soft landing’. For cryptocurrencies, this skepticism does not present a very good outlook. The expected 150bp rate cut for this year is increasingly aligning with the Fed’s 75bp cut scenario as days pass.

Türkçe

Türkçe Español

Español