Recent comments from Federal Reserve officials have sent shockwaves through the cryptocurrency market. Following announcements on Wednesday, the sharp decline in Bitcoin  $103,850 and altcoins erased significant gains, with some altcoins returning to levels seen before the U.S. election results on November 5. This raises questions about the Fed’s future actions and their implications for crypto investors.

$103,850 and altcoins erased significant gains, with some altcoins returning to levels seen before the U.S. election results on November 5. This raises questions about the Fed’s future actions and their implications for crypto investors.

Powell’s Impactful Statements

On Wednesday, Fed Chair Jerome Powell made remarks that unsettled both cryptocurrency and stock markets. While these statements were discouraging for crypto investors, the recently released Personal Consumption Expenditures (PCE) data suggests that the macroeconomic situation might not be as dire as feared. Inflation approaching 2% and rising unemployment could potentially provide necessary support for macroeconomic policies.

Fed officials Daly and Williams shared crucial insights regarding the current economic landscape. Their assessments are pivotal for cryptocurrency investors. Let’s examine the key points from Daly’s statements.

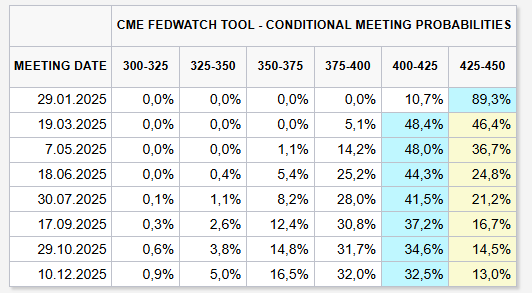

“We do not know what the new administration will do, so the data is crucial. I believe our policy is well-placed and that we are prepared for what lies ahead. Data on inflation shows that we are slowing our desired progress; it has been a bumpy ride. Ultimately, I decided that 100 basis points is the right point, and recalibration is now complete. We can return to a more typical gradual reduction model. We will carefully wait before making further reductions. I am very comfortable with two rate cuts projected for 2025.”

Williams echoed similar sentiments, emphasizing the need for data-driven decisions moving forward. He noted that while there are encouraging signs in the economy, the journey has been uneven. The Fed aims to bring inflation back to 2%, and recent data remains aligned with their economic forecasts.

Türkçe

Türkçe Español

Español