Doesn’t that sound terrible? Experts at Apollo Academy think exactly that. Diverse opinions, especially in the field of economics, are highly valuable. As long as they are not foolish, every idea can contribute something to your investment strategy. So why won’t the Fed enter into interest rate cuts this year?

Fed’s 2024 Interest Rate Forecast

This year’s market expectation was a 150bp cut, but this has been reduced to 100-125bp. The Fed, on the other hand, is planning a 75bp rate cut. I say planning because the last few meetings have discussed when this should start, and members clearly state that cuts will begin this year. The only issue is that while the market gave a 90% probability of a cut in March, this month, about 2 months ago, this probability nearly zeroed out. The expectation for June has also been postponed, and now a cut is expected in July.

However, statements that “we could even raise interest rates if necessary” are not completely over. Sometimes Powell and sometimes members of the hawkish wing voice this and talk about the risks of sticky inflation. This unwanted possibility could greatly shake crypto markets and other risk markets.

Fed Will Not Cut Interest Rates in 2024

This dreadful idea recently came from experts at Apollo Academy. They listed 10 points supporting their view and believe in them. The market entered 2023 with a recession expectation. There was no recession. Now markets have entered this year with an expectation of interest rate cuts. However, Apollo Academy experts say;

“The truth is, the US economy is not slowing down, and the Fed’s pivot since December has provided strong support for growth. As a result, the Fed will not lower interest rates this year, and interest rates will remain high for a longer period.”

So, how do they substantiate this? Their 10-point rationale is as follows;

- The economy is not slowing down, it’s accelerating. Growth expectations for 2024 have surged following the December Fed decision and the subsequent easing of financial conditions.

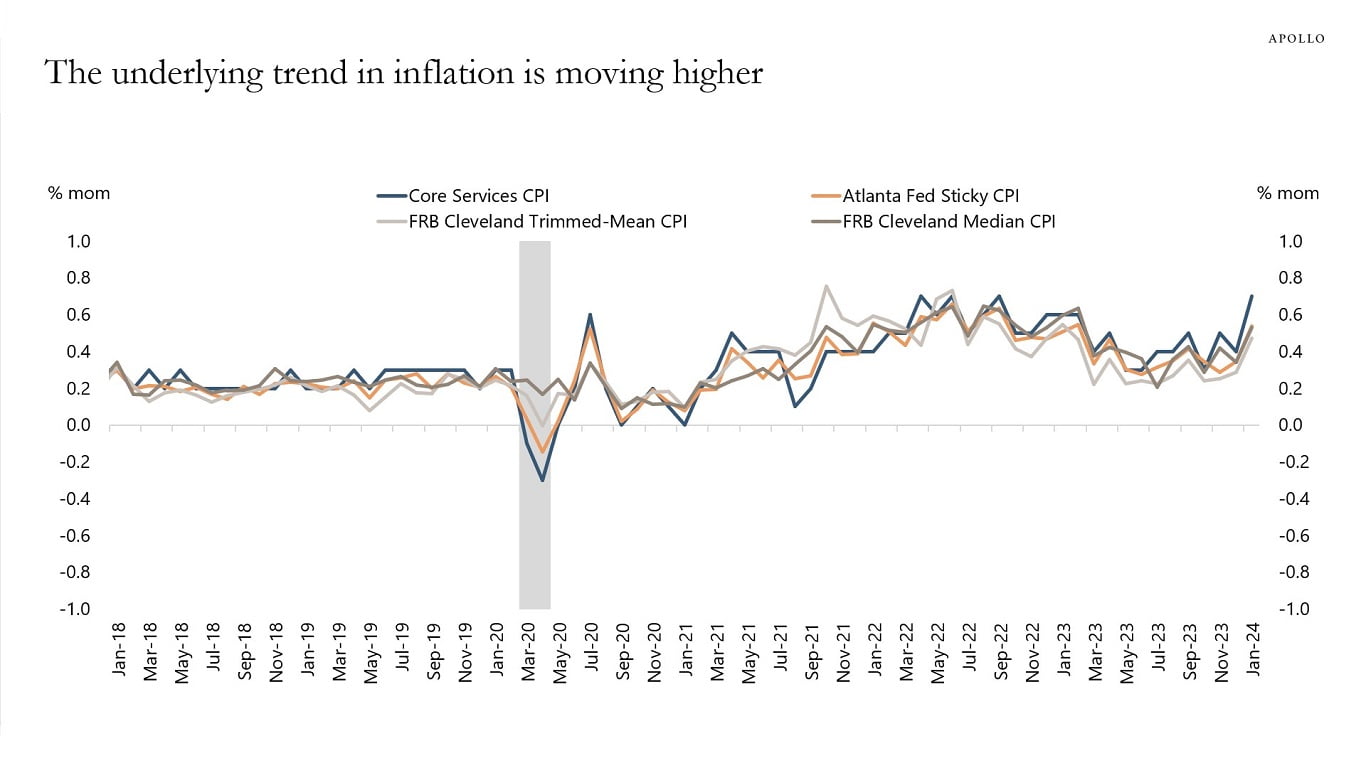

- Core inflation measures are rising.

- Supercore inflation, monitored by Powell, is trending upwards.

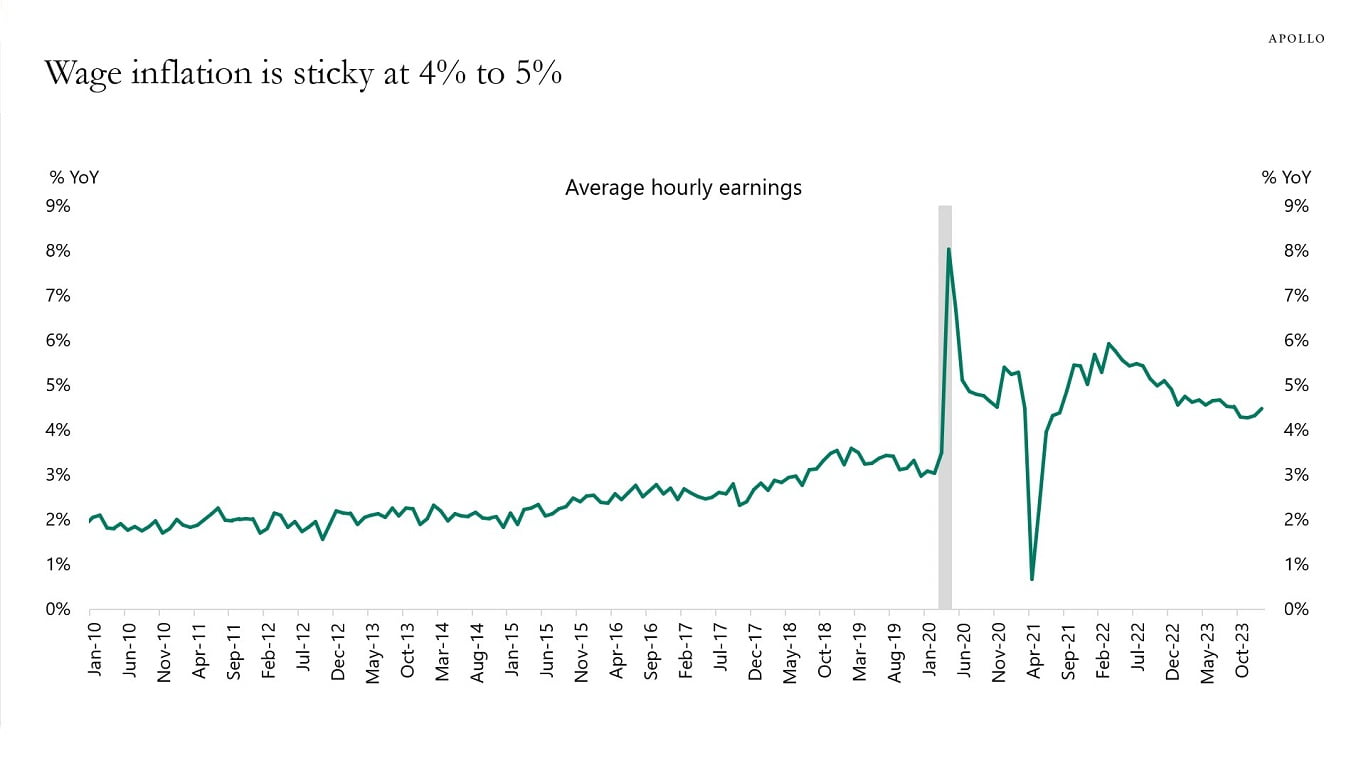

- Since the December Fed decision, the labor market is tight, unemployment claims are low, and wage inflation is fluctuating between 4% and 5%.

- Surveys with small businesses show more plan to increase their selling prices.

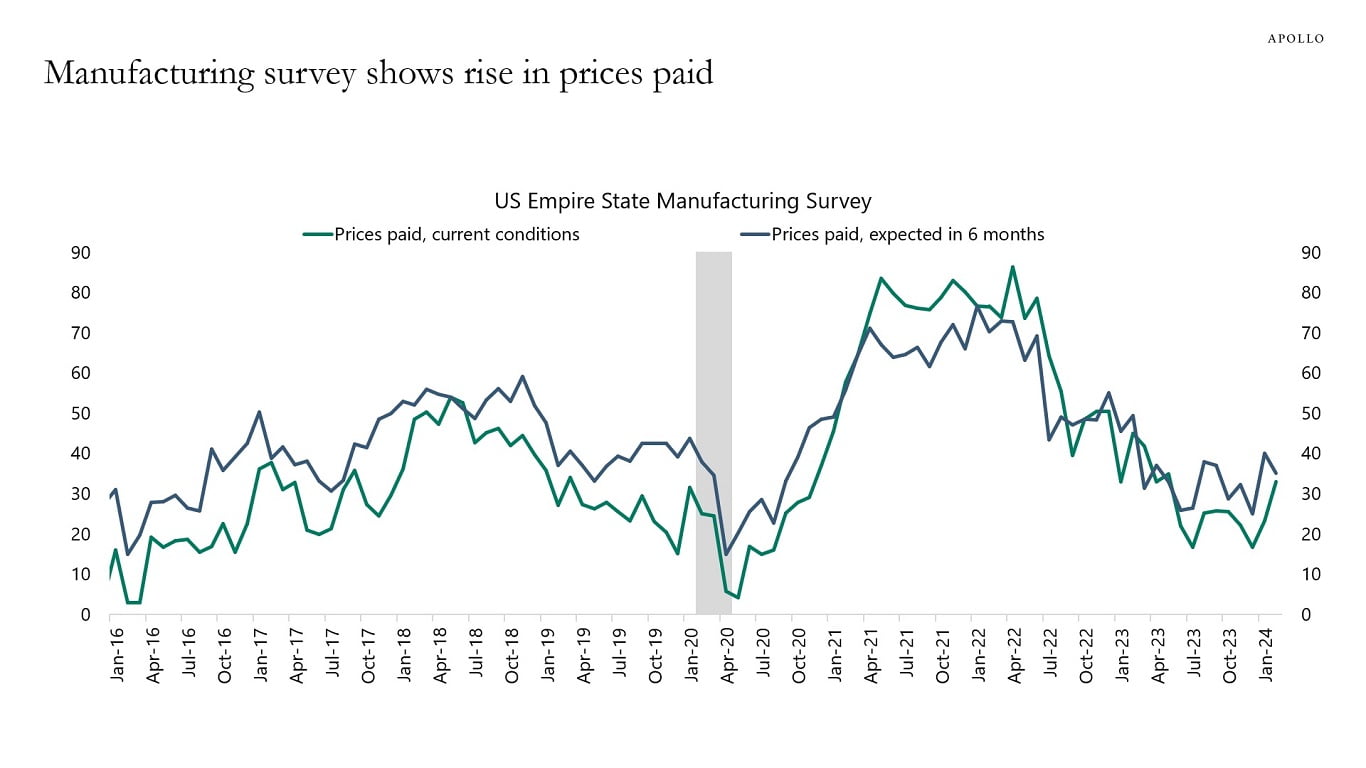

- Manufacturing surveys indicate a higher trend in prices paid, another leading indicator of inflation.

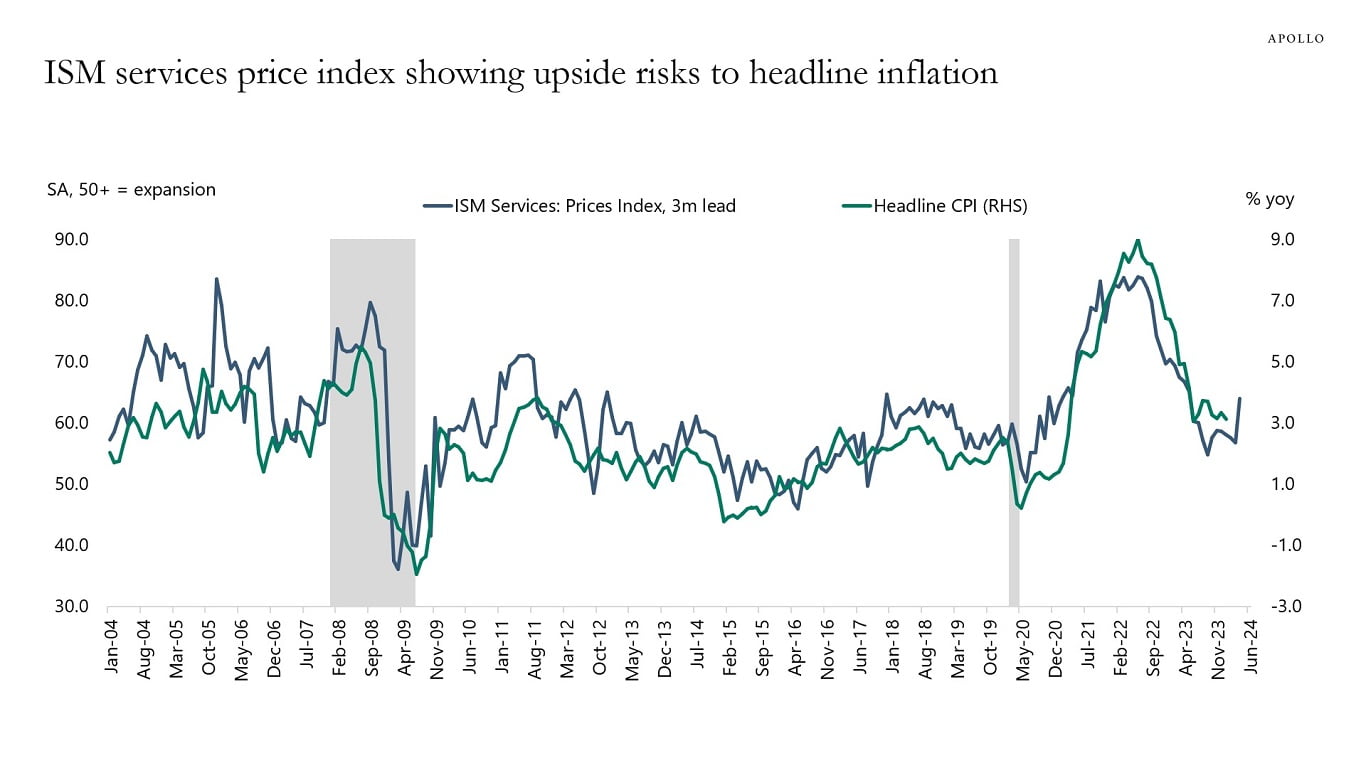

- ISM service prices are also on the rise.

- Surveys with small businesses show more plan to increase worker wages.

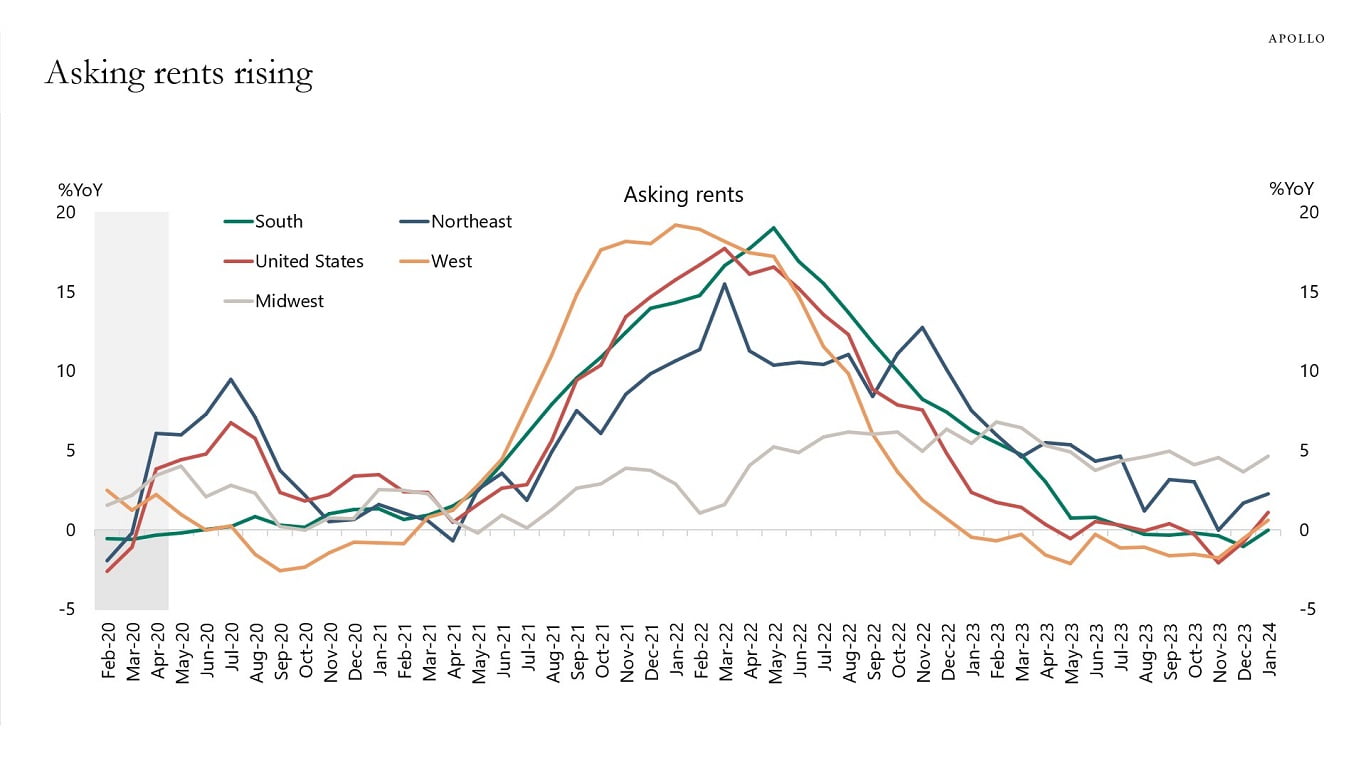

- Rents are rising, and home prices are increasing.

Finally, the experts say the following;

“Financial conditions continue to ease with record foreign currency issuance, high HY issuance, increased IPO activities, rising mergers and acquisitions, tight credit spreads, and the stock market reaching all-time highs following the December Fed pivot. With significant easing of financial conditions, seeing strong non-farm employment and inflation in January is not surprising, and we should expect this strength to continue.

The Fed will spend much of 2024 fighting inflation. As a result, interest rate levels in fixed income will remain high.”