The potential decision of the US Federal Reserve to maintain current interest rates significantly impacts the cryptocurrency market, especially Bitcoin. Following the release of the May Consumer Price Index (CPI) and Producer Price Index (PPI) data, analysts closely monitor the situation as the Fed prepares to announce its final interest rate decision. Currently, Bitcoin is trading around $69,500 after failing to maintain a position above $71,000 the previous week.

Expectations Focused on September

Many market analysts, including those at CME Group, predict that the Federal Reserve will maintain the effective fed funds rate at the 23-year high of 5.25-5.50% set last July to control inflation.

Traders have adjusted their expectations, influenced by a stronger-than-expected employment market report from the Bureau of Labor Statistics, and are now betting on a possible rate cut in September 2024. This report indicated that wage and employment growth could exert upward pressure on inflation, leading investors to reduce their bets on an imminent rate cut.

Expectation of $89,200 for Bitcoin

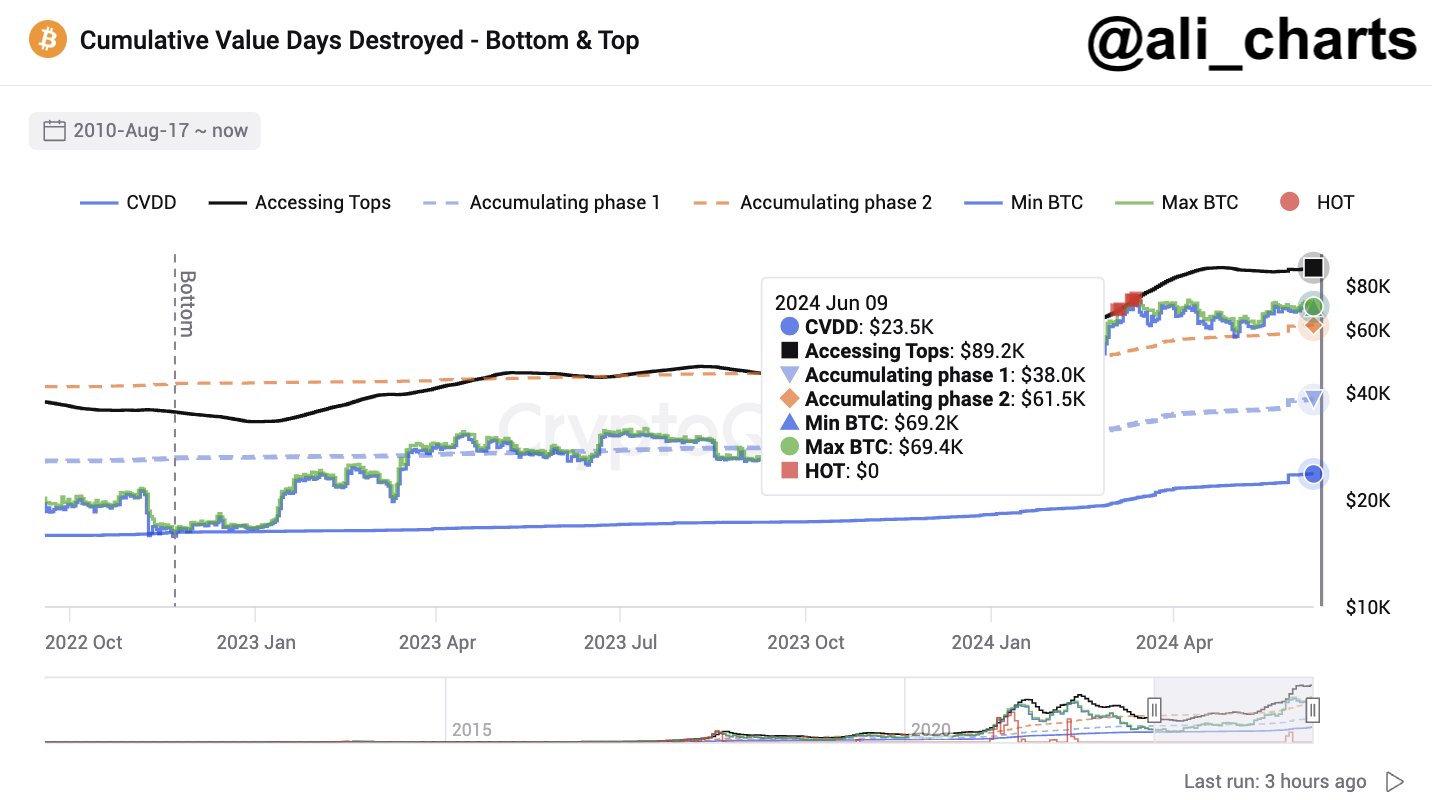

Cryptocurrency analyst Ali Martinez presents a positive outlook for Bitcoin, forecasting a potential local peak of $89,200. Martinez bases this prediction on significant buying pressure observed in the Bitcoin Buyer Buy-Sell Ratio, which has risen to 730 at HTX Global, indicating strong bullish sentiment. This ratio suggests that Bitcoin’s price could see a significant upward movement shortly.

Martinez also notes a significant increase in Bitcoin network activity. The number of daily active Bitcoin addresses broke the downtrend that began in early March, with 765,480 active addresses recorded in the last 24 hours. This increase in network activity is seen as a positive indicator of the ongoing upward momentum in Bitcoin’s price.

Growth in BTC

Despite the overall market’s uncertainty regarding the Federal Reserve’s actions, the cryptocurrency market, particularly Bitcoin, shows signs of resilience and potential growth. The interest rate decisions expected this week will be crucial in shaping market sentiment and price movements.

Bitcoin’s ability to maintain its current levels and possibly reach new peaks will largely depend on the Fed’s stance on interest rates and broader economic indicators.