The eagerly awaited Federal Reserve minutes were released, and this event topped today’s key agenda items. We talk about the important developments of the week every Sunday, and in the last one, we discussed how critical today was. The expected increase in volatility was not in vain, and Bitcoin fell from the $52,500 level to $50,625 in the last 24 hours.

Federal Reserve Minutes and Cryptocurrencies

As expected, the Federal Reserve Minutes caused fluctuations in the cryptocurrency markets. Especially altcoins experienced a drop of around 7%, while some saw double-digit losses. BTC itself suffered a loss of about $2,000. In the last Federal Reserve meeting, Powell stated they would not rush interest rate cuts and that it is highly unlikely there will be a reduction in the March meeting.

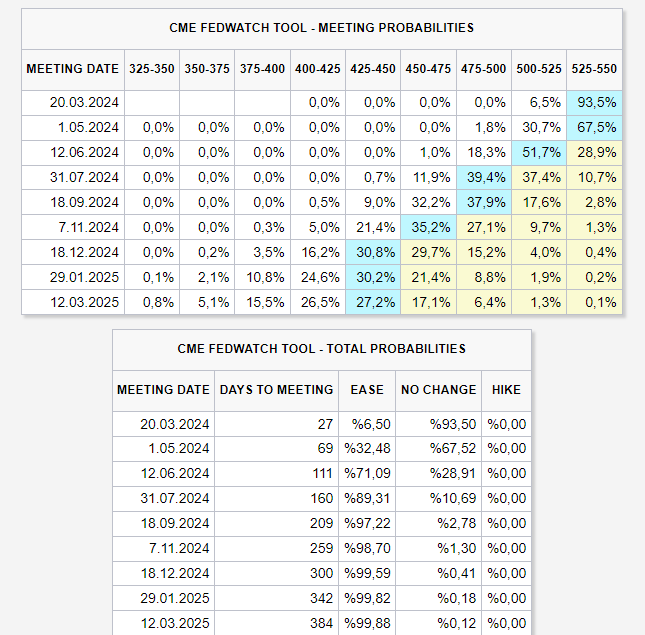

Above, you see the interest rate outlook after the minutes were released. The markets had been significantly shaken by the latest employment and inflation data but had recovered with ETF entries. Now, they will price in the Federal Reserve Minutes. The details of the minutes are as follows;

- Federal Reserve Minutes Released

- Federal Reserve Minutes: A few policymakers pointed to the downside risks of maintaining an overly restrictive stance for too long.

- Federal Reserve Minutes: Federal Reserve officials believe the policy interest rate is likely at its peak for this cycle.

- Federal Reserve Minutes: Most Fed policymakers highlighted the risks of easing too quickly, emphasizing the importance of incoming data to decide whether inflation is sustainably moving towards 2%.

- Some officials noted that progress on inflation could stall.

- Policymakers generally did not find it appropriate to lower interest rates until gaining more confidence that inflation is sustainably moving towards 2%.

- Many policymakers emphasized the importance of clear communication about a data-dependent approach.

- Several officials mentioned that balance sheet reduction could continue after interest rate cuts begin.

- The overall economic outlook was slightly stronger than the December projection.

- Officials highlighted the uncertainty about how long the restrictive policy stance would last. Federal Reserve officials think risks to economic forecasts are to the downside.

- Federal Reserve officials weighed the possibility that more progress in reducing inflation could take longer than expected.

- Some policymakers said slowing the pace of balance sheet reduction could help a smooth transition to an adequate level of reserves and allow balance sheet reduction to continue longer.

Türkçe

Türkçe Español

Español