Fed’s latest data shows that US consumers are borrowing at a slower pace, with total outstanding credit increasing by $8.9 billion in June, falling short of the expected $10 billion. According to Markus Thielen, founder of 10x Research, this slow borrowing rate, combined with rising credit card defaults, poses significant issues for the cryptocurrency market.

Slowdown in Consumer Debt Growth

In June, revolving debt, primarily involving credit cards, decreased by $1.7 billion, marking the largest drop since early 2021. In contrast, non-revolving debt, including student and auto loans, increased by $10.6 billion, the most significant rise in the past year. The combination of reduced credit card borrowing and increased other debt types indicates a notable shift in consumer financial behavior.

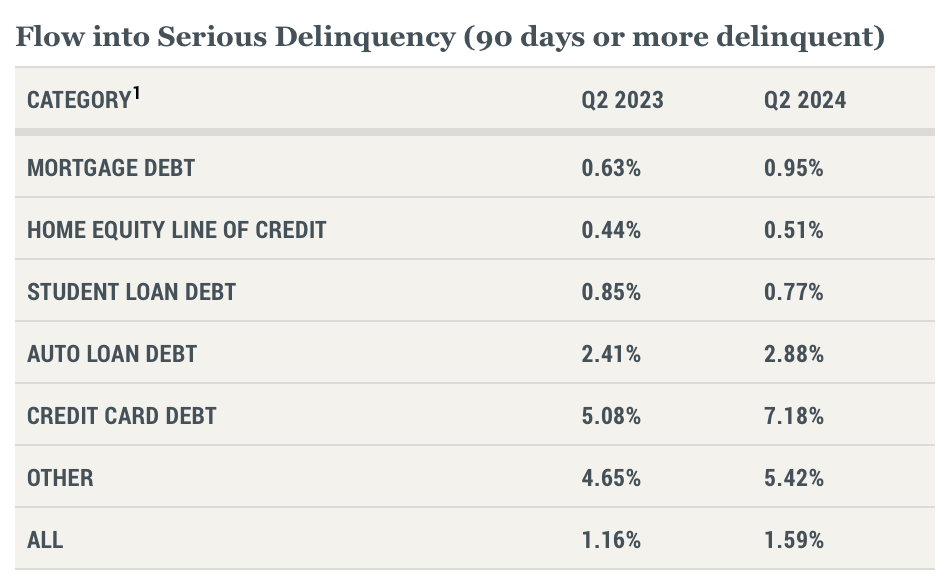

The rising delinquency rates in debts are particularly concerning. In the second quarter of 2023, the rate of credit card payments delayed by more than 90 days reached 10.93%, the highest since 2012. Auto loan defaults also rose to 4.43%, the highest since 2021. These increases indicate that many US consumers have reached their borrowing limits, posing a challenge to the bullish narratives in the cryptocurrency market, according to Thielen.

Impact of Debt Delinquencies on the Cryptocurrency Market

The limited borrowing capacity of US consumers points to a restricted fiat-crypto ramp, crucial for new investments in the cryptocurrency market. Thielen emphasized that the decline in consumer credit data, especially due to negative credit card debt and high default rates, signals a collapsing personal savings rate. This development restricts potential investments in cryptocurrencies.

Thielen also highlighted other risks to the cryptocurrency market, such as uncertainties surrounding the upcoming US Presidential elections, a slowing economy, and waning enthusiasm for artificial intelligence technologies. The performance of Bitcoin (BTC) and Nvidia (NVDA) reflects these broader market trends. Both assets have significantly dropped since peaking earlier in the year, mirroring broader market sentiments.

At the time of writing, Bitcoin was trading around $57,000, having dropped 10% in the past seven days. Similarly, Nvidia shares reached approximately $140 in June but fell to $98, indicating the broader economic slowdown and the decline in AI hype.

Türkçe

Türkçe Español

Español