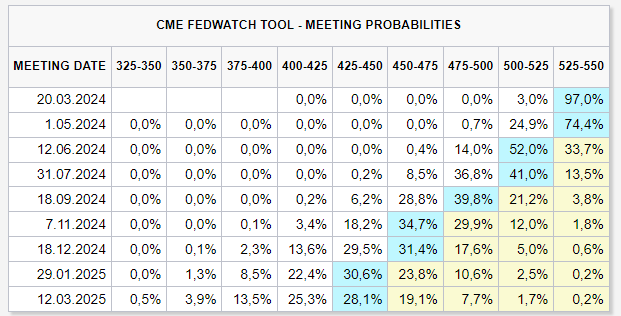

Bitcoin price may have exceeded $62,500, but a return to an aggressive hawkish stance by the Fed could reverse this trend. The rise in cryptocurrency markets is linked not only to inflows from ETFs but also to this year’s interest rate cuts. So, did the Fed’s stance on economic policy change following the recent PCE data?

Fed Monetary Policy

Cryptocurrency investors have had to monitor all macroeconomic developments since the beginning of 2022, from the Fed‘s interest rate decisions to PMI data. This is due to the Fed’s historically rapid pace of interest rate hikes and the resulting turmoil in risk markets. Fed member Barkin made significant statements at the time this article was prepared, and they contain important details following the latest PCE data.

Barkin said the following;

“Interest costs as a percentage of income is a data point I’m concerned with. We will see if there will be an interest rate cut this year. A high inflation report came in yesterday. I still see wage and inflation pressures. However, if monthly figures come in inconsistent with this, we must consider them. I’m not in a hurry to cut interest rates. It’s likely that overall inflation figures will decrease in the coming months. We need to see what else needs to happen for inflation to fall back to 2%. We should be happy that inflation is decreasing. Yesterday’s PCE is consistent with the story I hear about service inflation. When asked about PCE data, I try not to read too much into the economic figures for January. Price increases are being balanced by declines in some sectors. We are in a world where companies are raising prices at levels higher than normal.”

Türkçe

Türkçe Español

Español