Fidelity Digital Assets has published a comprehensive short-term and long-term outlook report for Bitcoin (BTC) and Ethereum (ETH), providing investors with increased confidence in investing in Fidelity Wise Origin Bitcoin ETFs (FBTC).

Liquidity Influx in Bitcoin ETFs

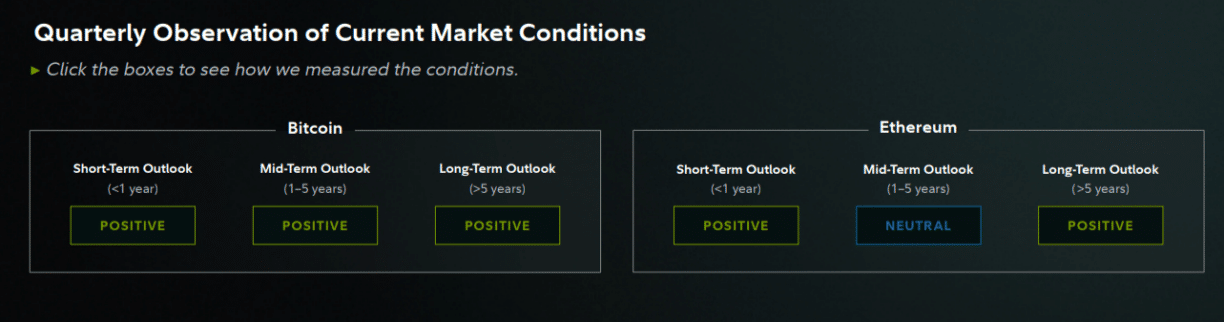

FBTC saw an inflow of $130 million on February 7th, among 10 spot Bitcoin ETFs with a total inflow of $145 million. Fidelity Digital Assets analyzes key market metrics in a 22-page report that affect Bitcoin (BTC) and Ethereum (ETH) prices and investor sentiment. According to the performance of the leading cryptocurrencies up to the fourth quarter of 2023, on-chain metrics and other signal indicators maintain positive forecasts for Bitcoin for 2024, the next five years, and beyond.

For the short-term Bitcoin forecast, Fidelity used factors such as the 200-day moving average and the golden cross, as well as the current price being higher than the realized price. Moreover, Fidelity’s bullish market forecast for 2024 depends on three key factors: interest rates, the Bitcoin halving, and the success of the spot Bitcoin ETF. For the mid-term outlook up to 2028, metrics such as the NUPL ratio, MVRV Z-Score, Reserve Risk, Stock-to-Flow, Puell Multiple, holders’ net position change, addresses in profit, and the Bitcoin benchmark were analyzed. Most measurements are positive for the Bitcoin price.

ETH Price Analysis

In the long term, conditions such as price above 200 weeks, monthly address metrics, new address momentum, illiquid supply, and balances over 0.1 BTC have been met for a positive outlook. For the short-term ETH price forecast, similar factors like the 200-day moving average and the current price being higher than the realized price were considered. For the mid-term outlook up to 2028, Fidelity analyzed metrics such as the NUPL ratio, MVRV Z-Score, and the percentage of addresses in profit. Monthly address metrics, new address momentum, addresses holding over $1,000, and metrics such as staking numbers, net issuance, and burn rate were analyzed for the long-term ETH price forecast.

Türkçe

Türkçe Español

Español