Fidelity’s spot Bitcoin exchange-traded fund (ETF) experienced a daily inflow of $208 million on January 29, surpassing Grayscale Bitcoin Trust’s outflows for the first time since its launch day, excluding the launch day itself. According to preliminary data from Farside Investors, Fidelity’s FBTC product saw an inflow of $208 million on January 29, while GBTC experienced an outflow of $192 million.

What’s Happening in the ETF Space?

The most recent outflows from GBTC represent a drop of about 25% from the $255 million on January 26 and a 70% decrease from the highest daily outflow of $641 million on January 22. This also marks the second-lowest outflow day since January 11, when $95 million was withdrawn from the fund on the day it was converted into a spot Bitcoin ETF.

Crypto investors are keenly observing signs of a slowdown in GBTC outflows, which may be due to the fund’s investors having the opportunity to cash out positions that were once at a loss. JPMorgan analysts had noted on January 25 that GBTC outflows were putting downward pressure on Bitcoin prices, but suggested that this should largely be behind us now.

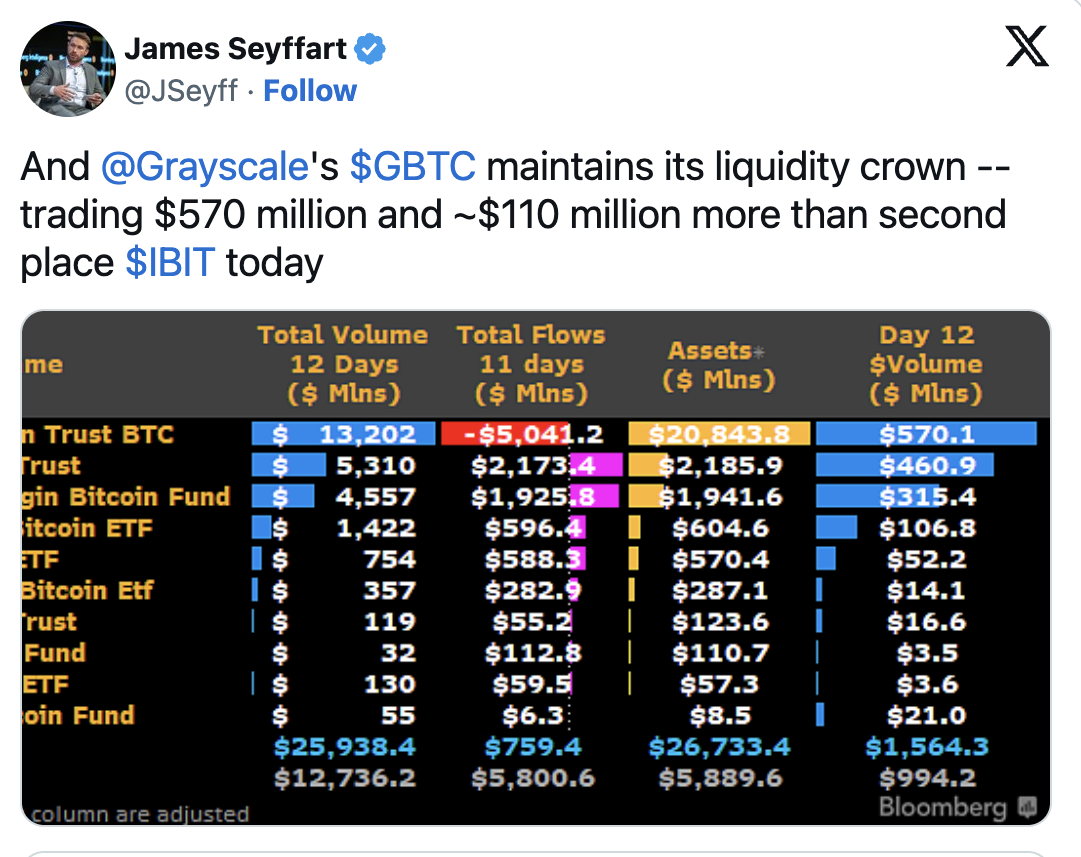

Meanwhile, according to data shared by Bloomberg ETF analyst James Seyffart, the figures for January 29 show that nine new US spot Bitcoin ETF products reached a total volume of $994.1 million, nearly double the $570 million volume of GBTC.

BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity Wise Origin Bitcoin Fund (FBTC) followed GBTC in terms of the largest volume share, with daily volumes of $460.9 million and $315.4 million, respectively, making up 78% of the total volume of the nine new ETFs.

Competition Continues Over Transaction Fees

It has been previously reported that issuers of spot Bitcoin ETF products in the market have been lowering commission fees to attract investors both in the US and abroad. Invesco and Galaxy Asset Management announced on January 29 that the final commission rate for their joint ETF product (Invesco Galaxy Bitcoin ETF (BTCO)) would drop from 0.39% to 0.25%, making them the latest company to reduce fees.

This fee reduction brings it in line with BlackRock, Fidelity, Valkyrie, and VanEck. BTCO will have zero fees for the first six months or until it reaches $5 billion in assets, after which the new lower fee will come into effect.

According to research from blockchain data analysis platform CoinShares, speculation that investors are fleeing European-based products for the US, along with the US fee war, could have also impacted European ETFs.

Last week, on January 23, Invesco also reduced the fees for its Europe-based Bitcoin ETF from 0.99% to 0.39%, and WisdomTree lowered its fees from 0.95% to 0.35%. CoinShares followed suit on January 25 by reducing the fees for its flagship Bitcoin ETF from 0.98% to 0.35%.

Türkçe

Türkçe Español

Español