The first spot Bitcoin exchange-traded fund (ETF) to be processed in the United States began pre-market trading a day after being approved by the Securities and Exchange Commission (SEC). BlackRock’s iShares Bitcoin fund, with the ticker IBIT, started pre-market trading and was traded at $26.81, marking a 22.25% increase before the market opened. The iShares fund met with investors through the Nasdaq exchange.

ETFs Start the Day with Gains

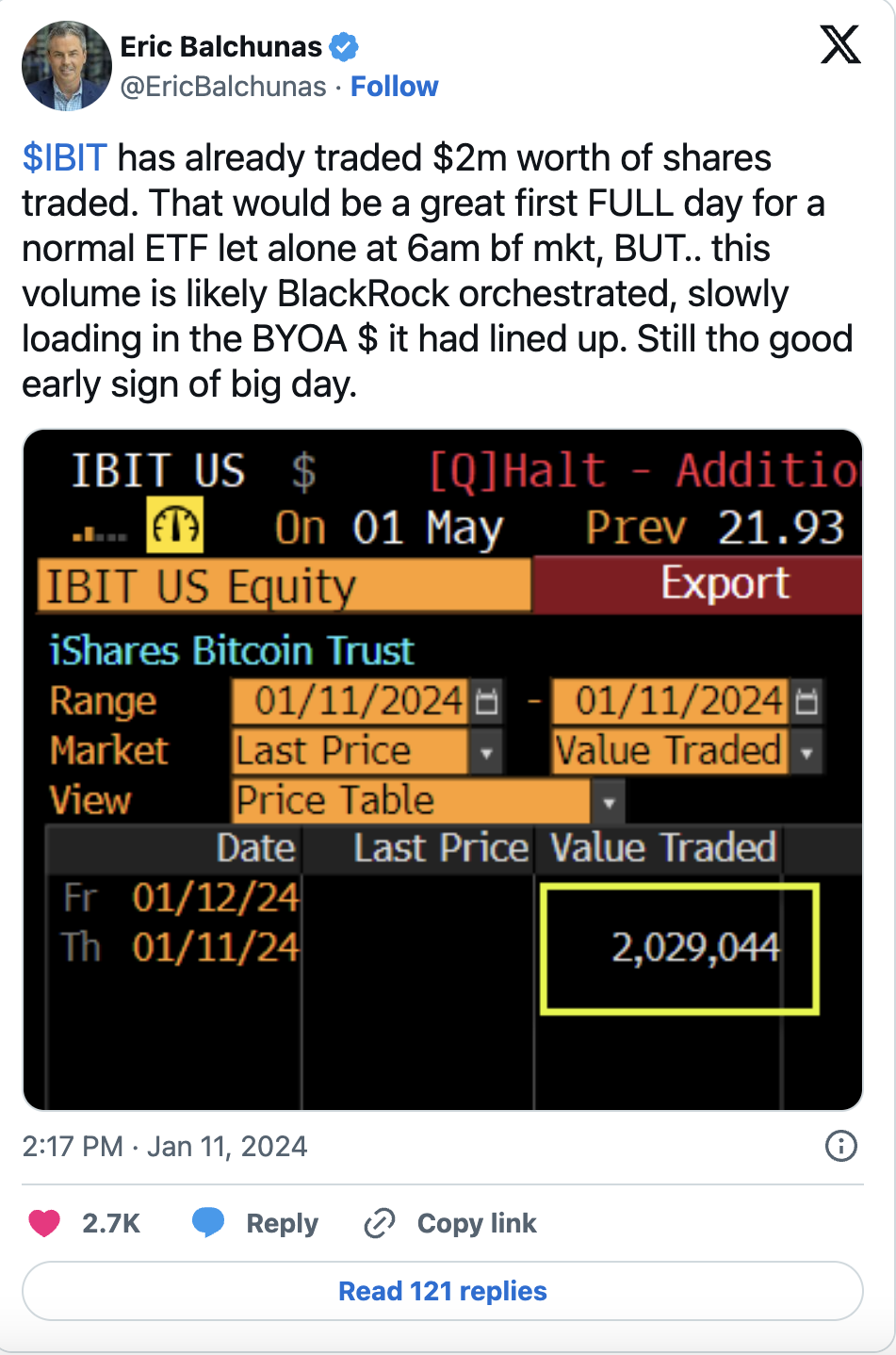

Bloomberg senior ETF analyst Eric Balchunas revealed that the IBIT fund traded a notable volume of $2 million in pre-market transactions. The famous analyst added that such a high volume would be a great first day for an average ETF, but he did not fail to warn investors that this initial volume might be sourced from BlackRock.

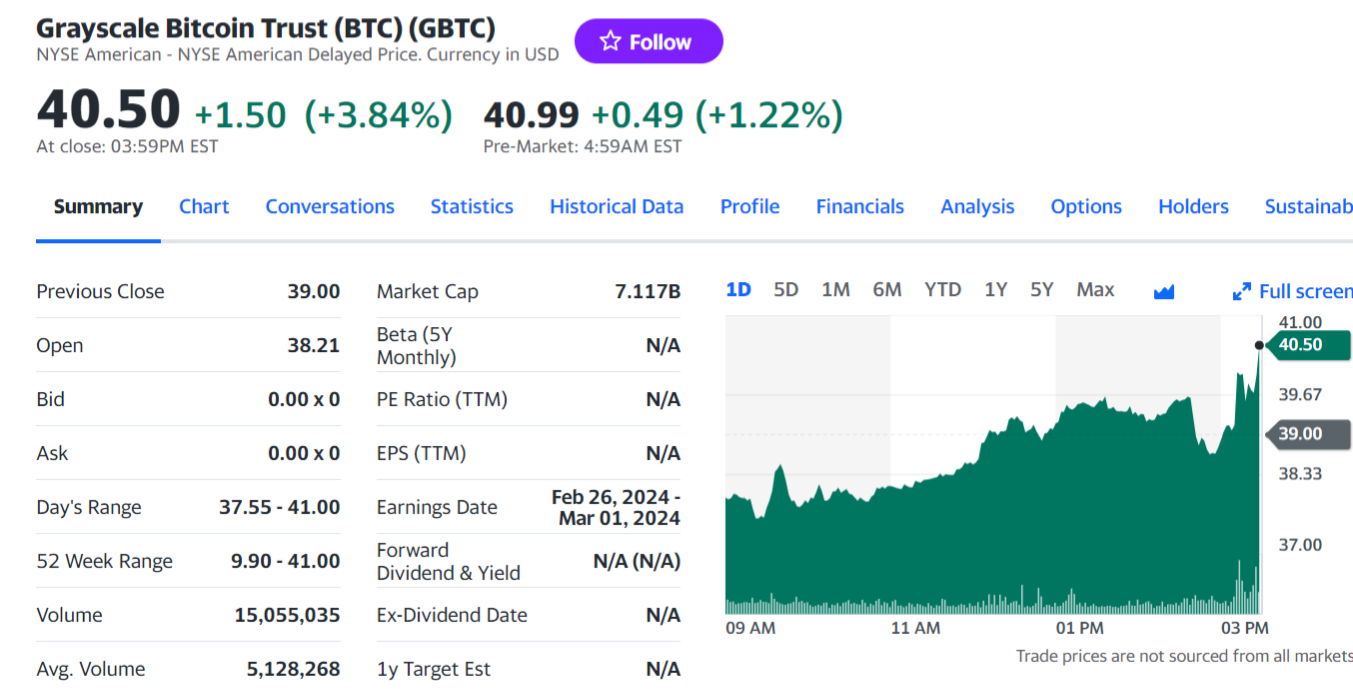

In addition to BlackRock, Grayscale’s Bitcoin Trust (GBTC) fund also began pre-market trading. GBTC shares experienced a 2% rise during pre-market trading hours. The GBTC fund will meet with investors through the New York Stock Exchange.

Pre-market trading transactions consist of the process of buying and selling assets before the markets open, or simply, the area where trading is done before normal market trading hours begin. Pre-market trading usually occurs between 8:00 AM and 9:30 AM Eastern Time. Investors follow pre-market movements to monitor how the markets may perform after opening.

Historic Day in the ETF Process

With the historic decision, the SEC approved the 19b-4 applications of ARK 21 Shares, Invesco Galaxy, VanEck, WisdomTree, Fidelity, Valkyrie, BlackRock, Grayscale, Bitwise, Hashdex, and Franklin Templeton, allowing various spot Bitcoin ETF products to be listed and traded on public exchanges.

All 11 approved spot Bitcoin ETF products officially began trading when the markets opened on January 11. According to pre-market trading data, the investment products offered to investors are starting the day with gains.

The Bitcoin price did not react much to the official approval of the first spot Bitcoin ETF applications and traded around the $46,000 level before and after the approval. Many crypto enthusiasts noted that the Bitcoin price had a more significant reaction to the false ETF approval news on January 9, rising to the $48,000 level.