The world’s largest cryptocurrency, Bitcoin (BTC), showed little movement last week and its volatility reached a new low. On-chain data indicates that Bitcoin’s volatility is at its lowest level since July 2022, and past data suggests that this decrease in volatility may be a precursor to a major rally.

8 out of 9 Decreases in Volatility Were Followed by a Big Rally

Looking at the price trend that emerges during periods of low volatility in the past, it is evident that a strong rally follows each decrease in Bitcoin’s volatility. Crypto analyst CrediBuLL Crypto commented on this price trend, saying, “Out of the 9 times that volatility has been this low, 8 of them resulted in an upward movement. The only time this didn’t happen was after the peak of the parabolic explosion in 2017, followed by a 6-month consolidation.”

With a market capitalization of $562.7 million, Bitcoin, the largest cryptocurrency, is currently trading at $28,940 with a 1.57% decrease in the last 24 hours. If history repeats itself, the ongoing consolidation is expected to fuel the next price rally. Additionally, new investors continue to join the Bitcoin ecosystem with the creation of 5 million new wallet addresses last year.

Renowned crypto analyst Ali Martinez expressed his excitement about the newly created Bitcoin wallet addresses, stating, “Over 5 million wallet addresses holding Bitcoin were created last year. This means that the entire population of Costa Rica, Palestine, or Singapore bought BTC within just 12 months.”

Could Bitcoin be on the Verge of a Decline?

In addition to the attack on the leading DeFi protocol Curve Finance (CRV), which caused negative sentiment and selling pressure throughout the cryptocurrency market, many altcoins, including Bitcoin, experienced a decrease of over 5% in the last 24 hours. Particularly, Bitcoin falling below $29,000 suggests that it may face selling pressure towards the next support level of $27,500.

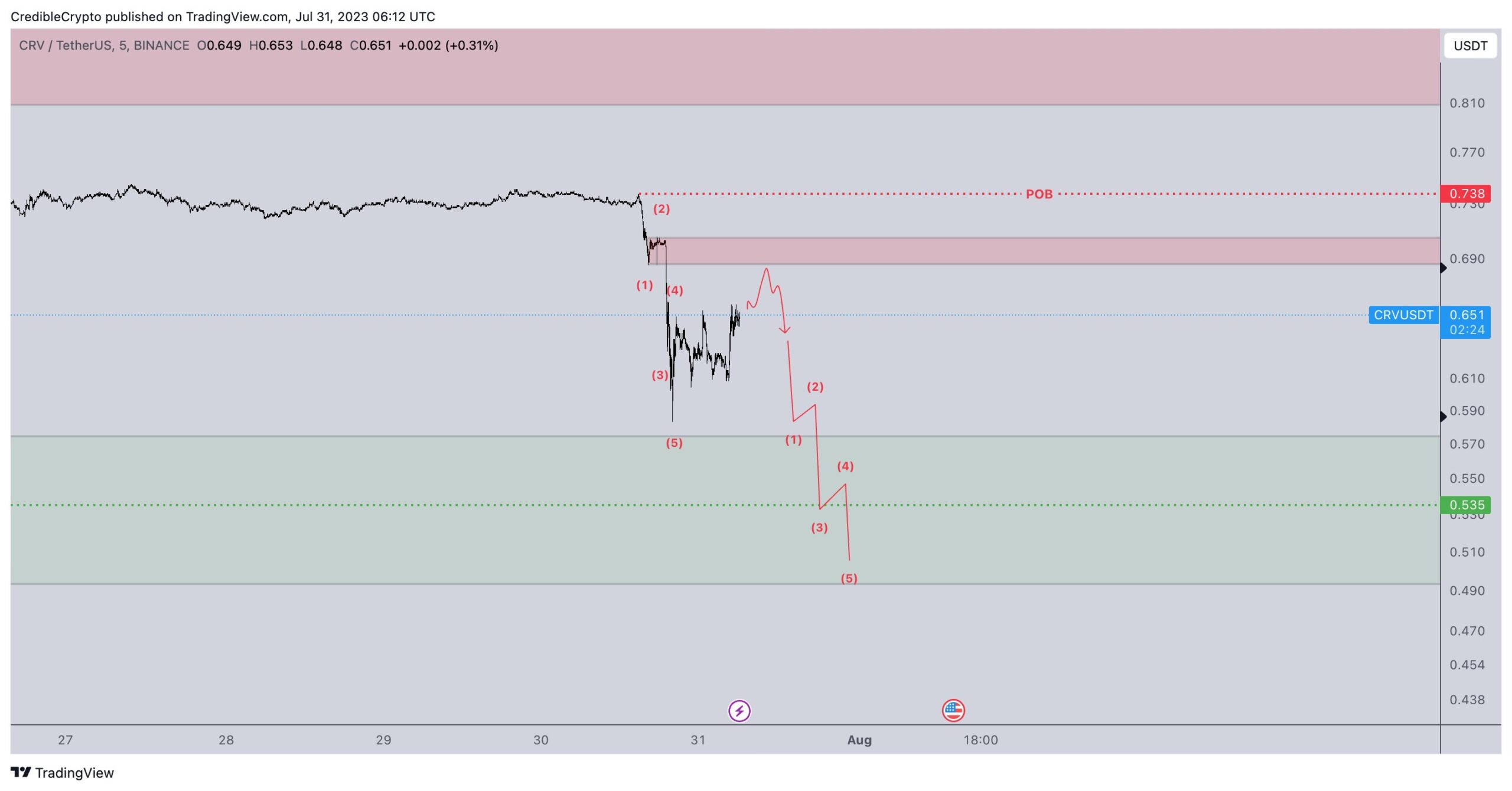

CrediBuLL Crypto expressed his expectation regarding this selling pressure through his analysis of CRV, stating, “At the moment, the situation with CRV seems to be calming down, but there are a few wildcard factors that need to be addressed within the next 48-72 hours before focusing solely on the charts. From a purely technical perspective, the decline has not yet occurred.”

The price chart for CRV shared by CrediBuLL Crypto indicates that if the price manages to break through the red zone and the point of breakout (POB), the decline is considered complete. However, the analyst’s main expectation is for the price to drop to the green zone, around $0.49.