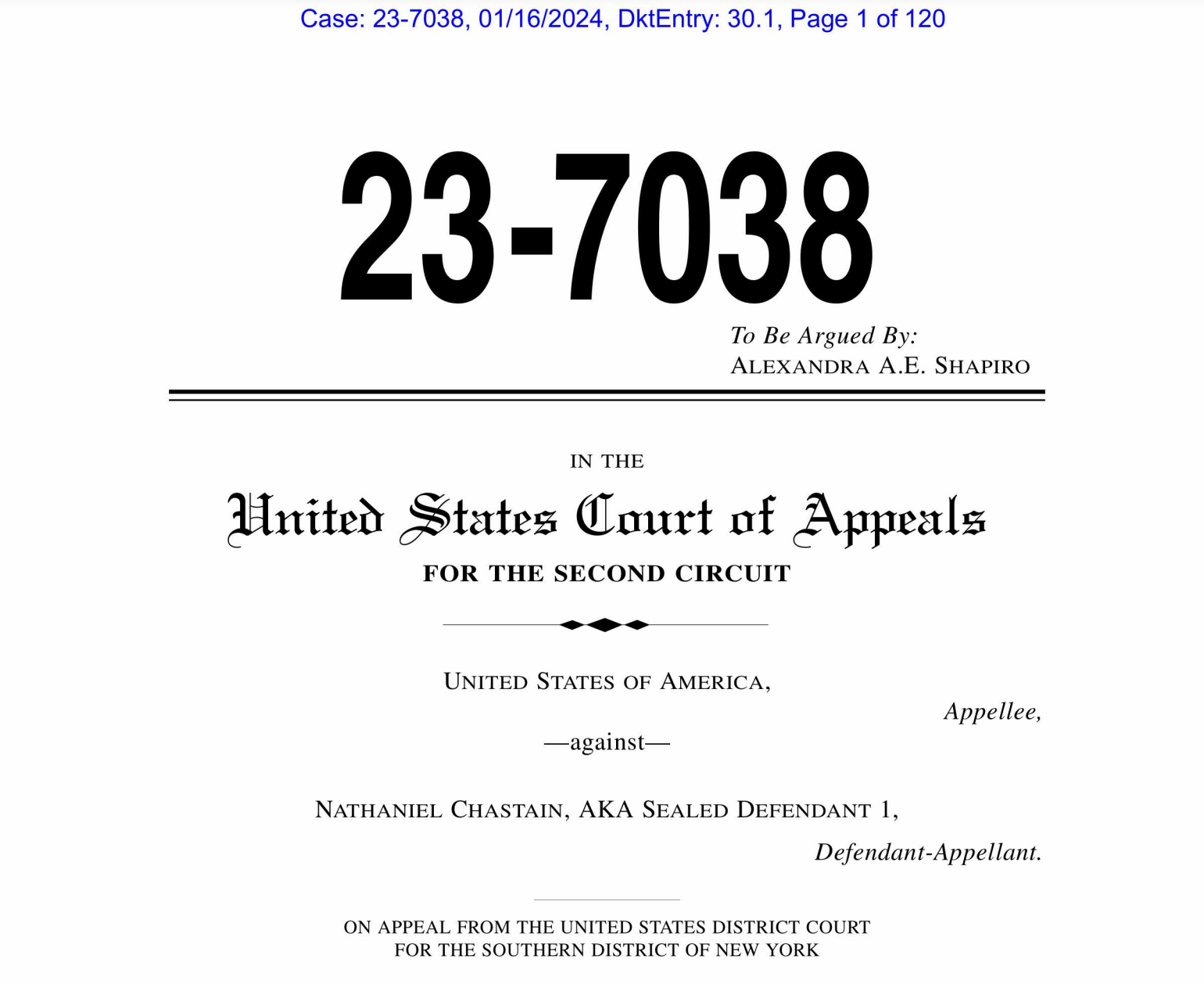

Nathaniel Chastain, former product manager of the popular NFT marketplace Ethereum ecosystem’s OpenSea, has appealed his conviction for wire fraud and money laundering related to insider trading charges. Chastain’s legal team presented their defense regarding the allegations to the United States Court of Appeals for the Second Circuit on January 16th.

Defense Lawyers’ Argument Attracts Attention

The legal team argued that the former product manager should be acquitted because the U.S. government failed to prove that information about NFTs listed on OpenSea constituted property. According to the lawyers, the information Chastain used to profit from NFTs on the marketplace had no trade value for the platform and was not considered protected property.

The appeal summary stated that not all confidential information is property and that the information did not have commercial value for its owner. The company’s business model was not to make money from Chastain’s ideas on which NFTs to feature, but to earn commissions from NFT transactions conducted in the marketplace. The filing also included the following statements:

“OpenSea made money from Chastain’s trades because Chastain used the platform to buy and sell featured NFTs, earning a commission.”

What Happened on OpenSea’s Side?

During the trial held in 2023 at the United States District Court for the Southern District of New York, prosecutors presented evidence that Chastain had the authority to choose which NFTs would be featured on the OpenSea marketplace. Chastain purchased 45 NFTs before they were featured and later resold them for Ethereum.

In May 2023, Chastain was convicted of bank fraud and money laundering. He was subsequently sentenced to three months in prison and a fine of $50,000, and a judge allowed him to wait until November 2nd to surrender to authorities. In the appeal, Chastain requested that his conviction be overturned or alternatively dismissed without a new trial.

While these developments were taking place, OpenSea lost its leadership in the NFT space, particularly after the launch of Blur, leading to significant financial losses for the company. Expectations of Web3 users regarding the airdrop event contributed to OpenSea’s losses.

Türkçe

Türkçe Español

Español